Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Isaacson 2021 income statement and balance sheet follows. (Click the icon to view the assets section of the balance sheet.) (Click the icon to

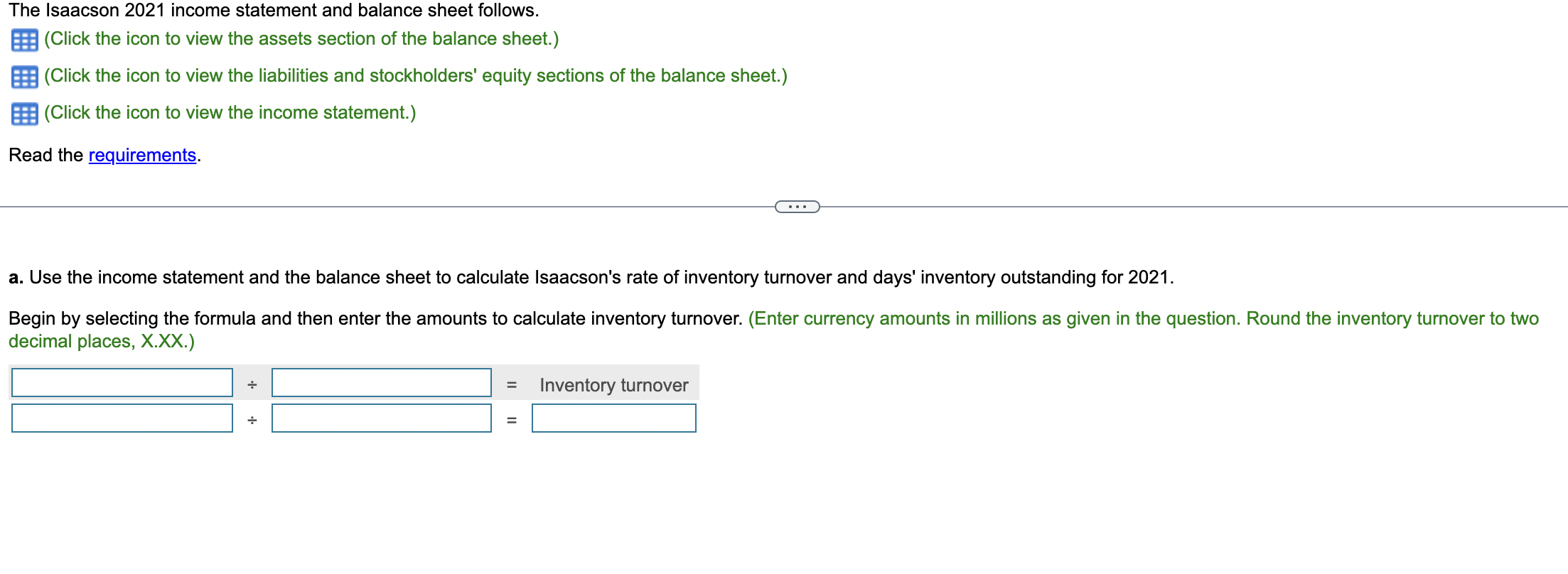

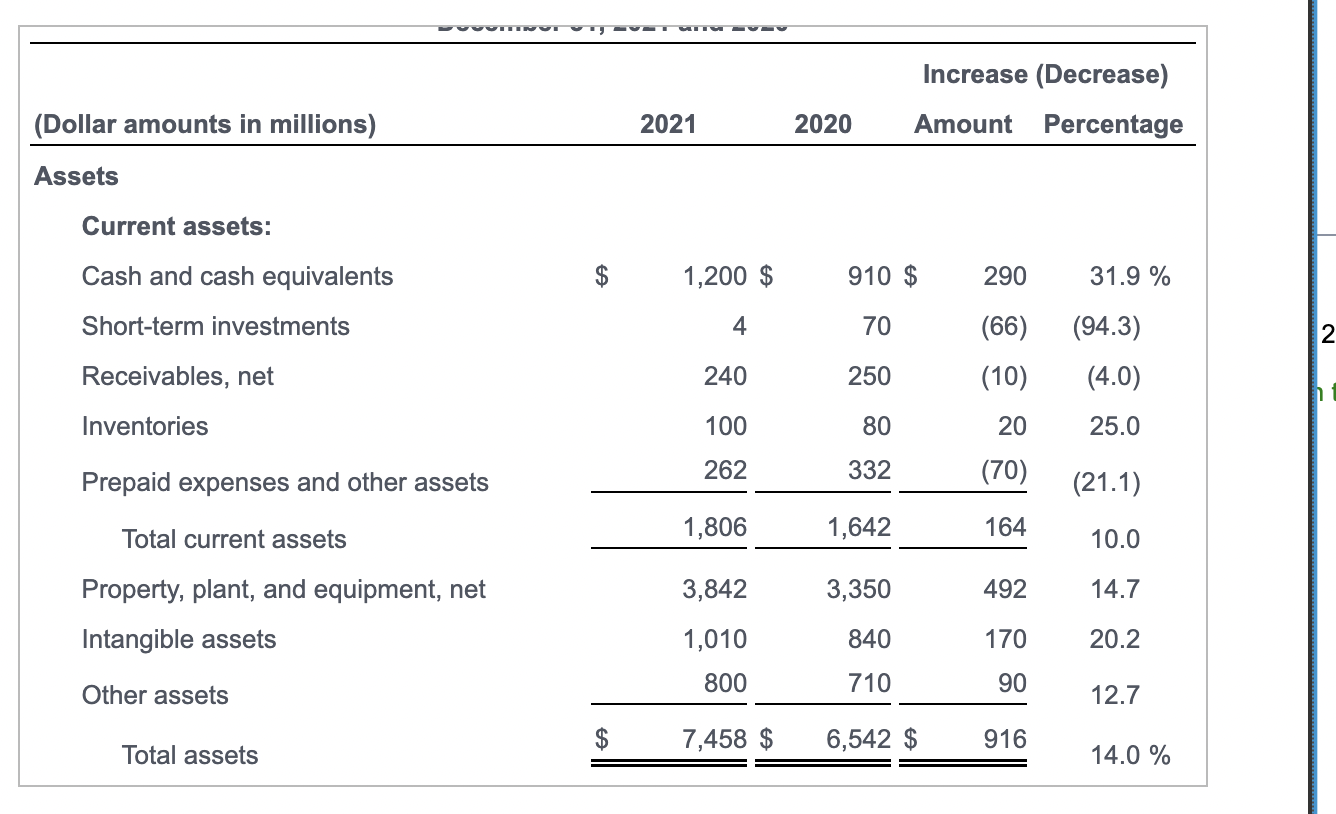

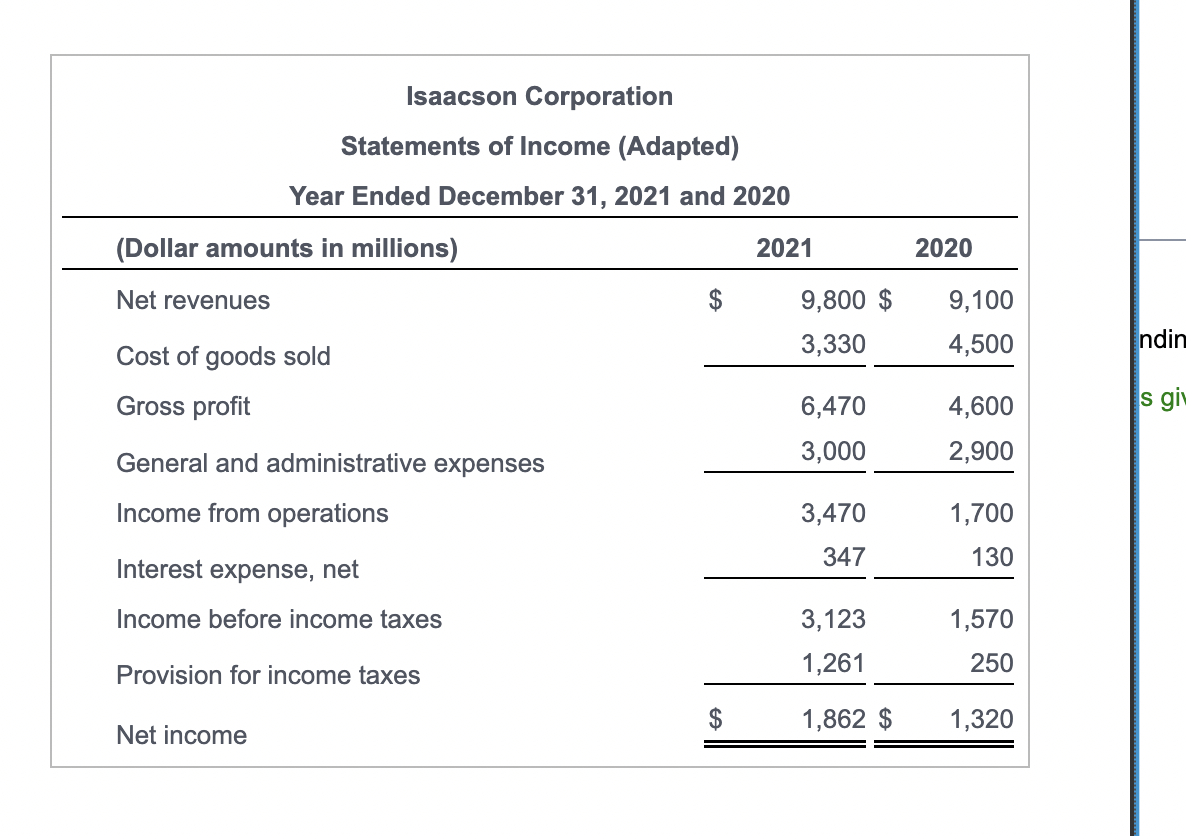

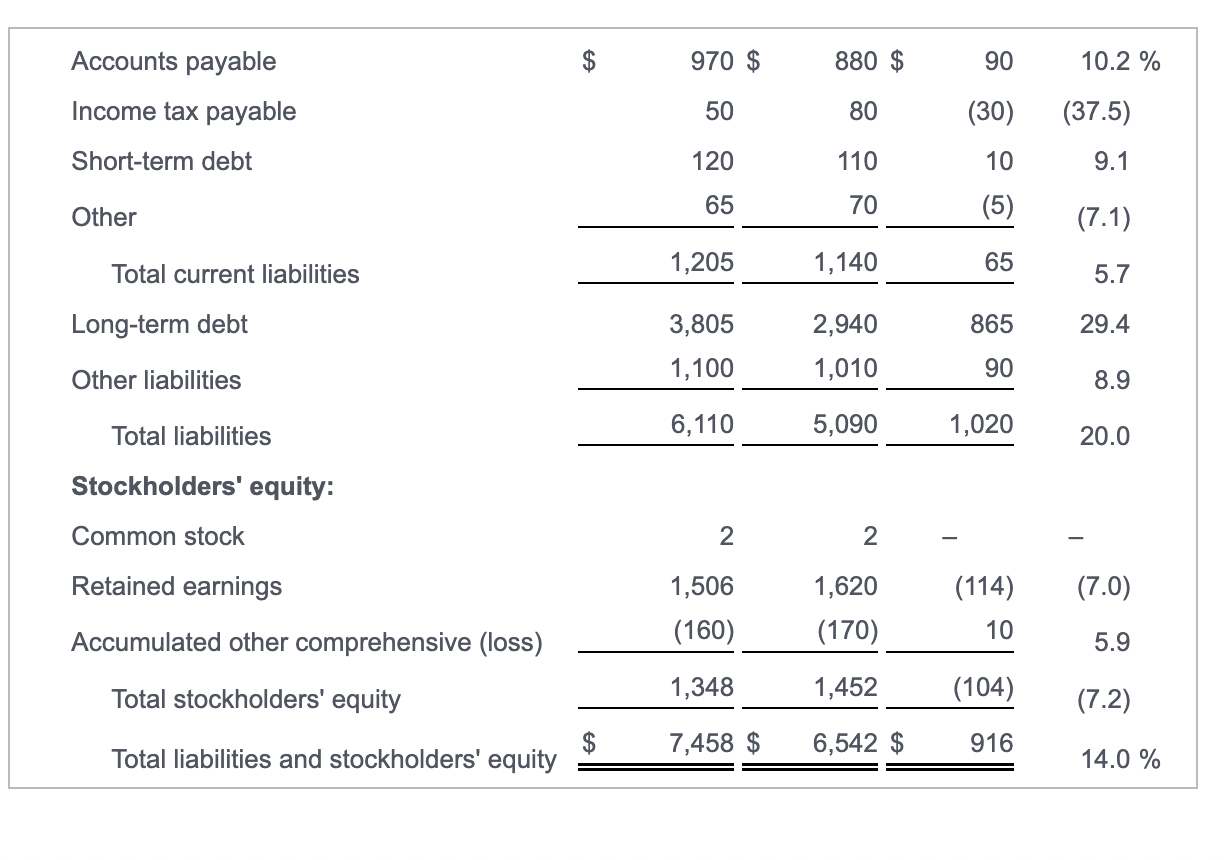

The Isaacson 2021 income statement and balance sheet follows. (Click the icon to view the assets section of the balance sheet.) (Click the icon to view the liabilities and stockholders' equity sections of the balance sheet.) (Click the icon to view the income statement.) Read the requirements. a. Use the income statement and the balance sheet to calculate Isaacson's rate of inventory turnover and days' inventory outstanding for 2021. Begin by selecting the formula and then enter the amounts to calculate inventory turnover. (Enter currency amounts in millions as given in the question. Round the inventory turnover to two decimal places, X.XX.) \begin{tabular}{ll} & = Inventory turnover \\ & = \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ (Dollar amounts in millions) } & & \multirow[b]{2}{*}{2021} & \multirow[b]{2}{*}{2020} & \multicolumn{2}{|c|}{ Increase (Decrease) } \\ \hline & & & & Amount & Percentage \\ \hline \multicolumn{6}{|l|}{ Assets } \\ \hline \multicolumn{6}{|l|}{ Current assets: } \\ \hline Cash and cash equivalents & $ & 1,200$ & 910 & 290 & 31.9% \\ \hline Short-term investments & & 4 & 70 & (66) & (94.3) \\ \hline Receivables, net & & 240 & 250 & (10) & (4.0) \\ \hline Inventories & & 100 & 80 & 20 & 25.0 \\ \hline Prepaid expenses and other assets & & 262. & 332 & (70) & (21.1) \\ \hline Total current assets & & 1,806 & 1,642 & 164 & 10.0 \\ \hline Property, plant, and equipment, net & & 3,842 & 3,350 & 492 & 14.7 \\ \hline Intangible assets & & 1,010 & 840 & 170 & 20.2 \\ \hline Other assets & & 800 & 710 & 90 & 12.7 \\ \hline Total assets & $ & 7,458$ & 6,542 & 916 & 14.0% \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{\begin{tabular}{l} Isaacson Corporation \\ Statements of Income (Adapted) \\ Year Ended December 31, 2021 and 2020 \end{tabular}} \\ \hline (Dollar amounts in millions) & & & 2020 \\ \hline Net revenues & $ & 9,800$ & 9,100 \\ \hline Cost of goods sold & & 3,330 & 4,500 \\ \hline Gross profit & & 6,470 & 4,600 \\ \hline General and administrative expenses & & 3,000 & 2,900 \\ \hline Income from operations & & 3,470 & 1,700 \\ \hline Interest expense, net & & 347 & 130 \\ \hline Income before income taxes & & 3,123 & 1,570 \\ \hline Provision for income taxes & & 1,261 & 250 \\ \hline Net income & $ & 1,862=$ & 1,320 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline Accounts payable & $ & 970$ & 880$ & 90 & 10.2% \\ \hline Income tax payable & & 50 & 80 & (30) & (37.5) \\ \hline Short-term debt & & 120 & 110 & 10 & 9.1 \\ \hline Other & & 65 & 70 & (5) & (7.1) \\ \hline Total current liabilities & & 1,205 & 1,140 & 65 & 5.7 \\ \hline Long-term debt & & 3,805 & 2,940 & 865 & 29.4 \\ \hline Other liabilities & & 1,100 & 1,010 & 90 & 8.9 \\ \hline Total liabilities & & 6,110 & 5,090 & 1,020 & 20.0 \\ \hline \multicolumn{6}{|l|}{ Stockholders' equity: } \\ \hline Common stock & & 2 & 2 & - & - \\ \hline Retained earnings & & 1,506 & 1,620 & (114) & (7.0) \\ \hline Accumulated other comprehensive (loss) & & (160) & (170) & 10 & 5.9 \\ \hline Total stockholders' equity & & 1,348 & 1,452 & (104) & (7.2) \\ \hline Total liabilities and stockholders' equity & $ & 7,458=$ & 6,542=$ & 916 & 14.0% \\ \hline \end{tabular}

The Isaacson 2021 income statement and balance sheet follows. (Click the icon to view the assets section of the balance sheet.) (Click the icon to view the liabilities and stockholders' equity sections of the balance sheet.) (Click the icon to view the income statement.) Read the requirements. a. Use the income statement and the balance sheet to calculate Isaacson's rate of inventory turnover and days' inventory outstanding for 2021. Begin by selecting the formula and then enter the amounts to calculate inventory turnover. (Enter currency amounts in millions as given in the question. Round the inventory turnover to two decimal places, X.XX.) \begin{tabular}{ll} & = Inventory turnover \\ & = \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ (Dollar amounts in millions) } & & \multirow[b]{2}{*}{2021} & \multirow[b]{2}{*}{2020} & \multicolumn{2}{|c|}{ Increase (Decrease) } \\ \hline & & & & Amount & Percentage \\ \hline \multicolumn{6}{|l|}{ Assets } \\ \hline \multicolumn{6}{|l|}{ Current assets: } \\ \hline Cash and cash equivalents & $ & 1,200$ & 910 & 290 & 31.9% \\ \hline Short-term investments & & 4 & 70 & (66) & (94.3) \\ \hline Receivables, net & & 240 & 250 & (10) & (4.0) \\ \hline Inventories & & 100 & 80 & 20 & 25.0 \\ \hline Prepaid expenses and other assets & & 262. & 332 & (70) & (21.1) \\ \hline Total current assets & & 1,806 & 1,642 & 164 & 10.0 \\ \hline Property, plant, and equipment, net & & 3,842 & 3,350 & 492 & 14.7 \\ \hline Intangible assets & & 1,010 & 840 & 170 & 20.2 \\ \hline Other assets & & 800 & 710 & 90 & 12.7 \\ \hline Total assets & $ & 7,458$ & 6,542 & 916 & 14.0% \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{\begin{tabular}{l} Isaacson Corporation \\ Statements of Income (Adapted) \\ Year Ended December 31, 2021 and 2020 \end{tabular}} \\ \hline (Dollar amounts in millions) & & & 2020 \\ \hline Net revenues & $ & 9,800$ & 9,100 \\ \hline Cost of goods sold & & 3,330 & 4,500 \\ \hline Gross profit & & 6,470 & 4,600 \\ \hline General and administrative expenses & & 3,000 & 2,900 \\ \hline Income from operations & & 3,470 & 1,700 \\ \hline Interest expense, net & & 347 & 130 \\ \hline Income before income taxes & & 3,123 & 1,570 \\ \hline Provision for income taxes & & 1,261 & 250 \\ \hline Net income & $ & 1,862=$ & 1,320 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline Accounts payable & $ & 970$ & 880$ & 90 & 10.2% \\ \hline Income tax payable & & 50 & 80 & (30) & (37.5) \\ \hline Short-term debt & & 120 & 110 & 10 & 9.1 \\ \hline Other & & 65 & 70 & (5) & (7.1) \\ \hline Total current liabilities & & 1,205 & 1,140 & 65 & 5.7 \\ \hline Long-term debt & & 3,805 & 2,940 & 865 & 29.4 \\ \hline Other liabilities & & 1,100 & 1,010 & 90 & 8.9 \\ \hline Total liabilities & & 6,110 & 5,090 & 1,020 & 20.0 \\ \hline \multicolumn{6}{|l|}{ Stockholders' equity: } \\ \hline Common stock & & 2 & 2 & - & - \\ \hline Retained earnings & & 1,506 & 1,620 & (114) & (7.0) \\ \hline Accumulated other comprehensive (loss) & & (160) & (170) & 10 & 5.9 \\ \hline Total stockholders' equity & & 1,348 & 1,452 & (104) & (7.2) \\ \hline Total liabilities and stockholders' equity & $ & 7,458=$ & 6,542=$ & 916 & 14.0% \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started