Answered step by step

Verified Expert Solution

Question

1 Approved Answer

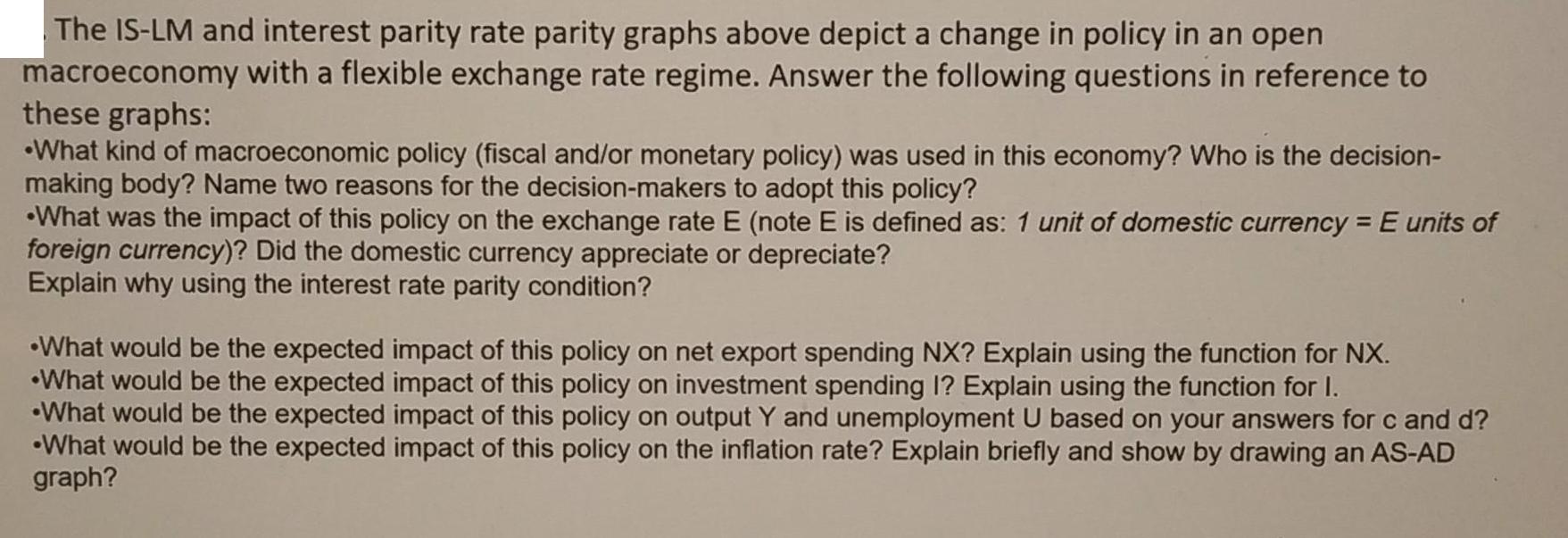

The IS-LM and interest parity rate parity graphs above depict a change in policy in an open macroeconomy with a flexible exchange rate regime.

The IS-LM and interest parity rate parity graphs above depict a change in policy in an open macroeconomy with a flexible exchange rate regime. Answer the following questions in reference to these graphs: What kind of macroeconomic policy (fiscal and/or monetary policy) was used in this economy? Who is the decision- making body? Name two reasons for the decision-makers to adopt this policy? What was the impact of this policy on the exchange rate E (note E is defined as: 1 unit of domestic currency = E units of foreign currency)? Did the domestic currency appreciate or depreciate? Explain why using the interest rate parity condition? What would be the expected impact of this policy on net export spending NX? Explain using the function for NX. What would be the expected impact of this policy on investment spending I? Explain using the function for I. What would be the expected impact of this policy on output Y and unemployment U based on your answers for c and d? What would be the expected impact of this policy on the inflation rate? Explain briefly and show by drawing an AS-AD graph? i i Y Y Income, output LM LM E' Exchange rate. E E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started