Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Spirit Bakery usually has a good return on investment (ROI). Last year the profits fell, and the managing director thinks the entity should restructure

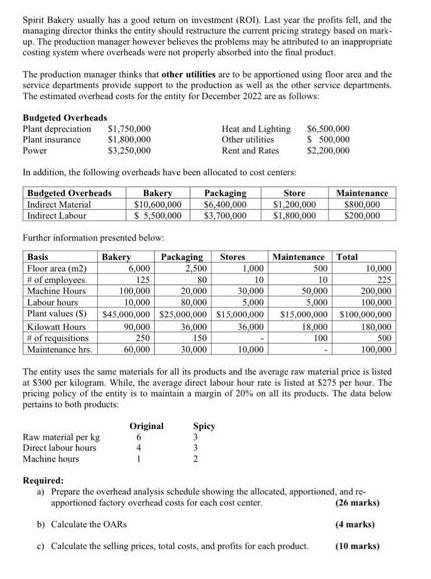

Spirit Bakery usually has a good return on investment (ROI). Last year the profits fell, and the managing director thinks the entity should restructure the current pricing strategy based on mark- up. The production manager however believes the problems may be attributed to an inappropriate costing system where overheads were not properly absorbed into the final product. The production manager thinks that other utilities are to be apportioned using floor area and the service departments provide support to the production as well as the other service departments. The estimated overhead costs for the entity for December 2022 are as follows: Budgeted Overheads Plant depreciation Plant insurance Power $1,750,000 $1,800,000 $3,250,000 In addition, the following overheads have been allocated to cost centers: Budgeted Overheads Indirect Material Indirect Labour Bakery $10,600,000 $ 5,500,000 Further information presented below: Basis Bakery Floor area (m2) # of employees Machine Hours Labour hours Plant values (S) Kilowatt Hours #of requisitions Maintenance hrs. Raw material per kg Direct labour hours Machine hours 6,000 125 100,000 10,000 $45,000,000 90,000 250 60,000 Packaging 2,500 80 20,000 80,000 $25,000,000 36,000 150 30,000 Heat and Lighting Other utilities Rent and Rates Packaging $6,400,000 $3,700,000 Original 6 4 Stores Spicy 3 1,000 10 30,000 5,000 $15,000,000 36,000 $6,500,000 $ 500,000 $2,200,000 Store $1,200,000 $1,800,000 Maintenance 500 10 50,000 5,000 $15,000,000 18,000 100 Maintenance $800,000 $200,000 Total 10,000 The entity uses the same materials for all its products and the average raw material price is listed at $300 per kilogram. While, the average direct labour hour rate is listed at $275 per hour. The pricing policy of the entity is to maintain a margin of 20% on all its products. The data below pertains to both products: 10,000 225 200,000 100,000 $100,000,000 180,000 500 100,000 Required: a) Prepare the overhead analysis schedule showing the allocated, apportioned, and re- apportioned factory overhead costs for each cost center. (26 marks) b) Calculate the OARS (4 marks) c) Calculate the selling prices, total costs, and profits for each product. (10 marks)

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Overhead analysis schedule Allocated overhead Plant depreciation 1750000 Plant insurance 1800000 P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started