Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Jacksonville Medical Corporation financial statements follow: (Click the icon to view the consolidated balance sheets.) consolidated income statements.) Jacksonville Medical's current ratio at

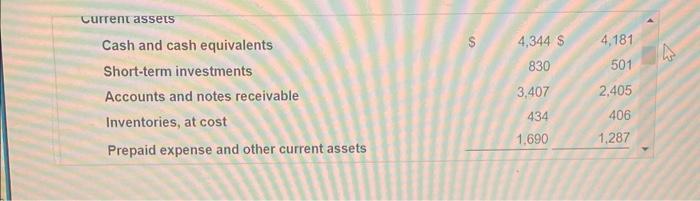

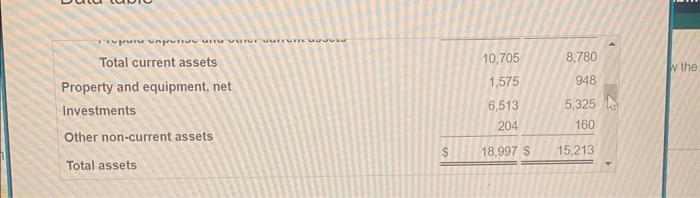

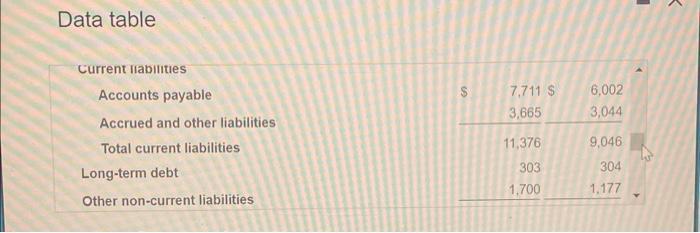

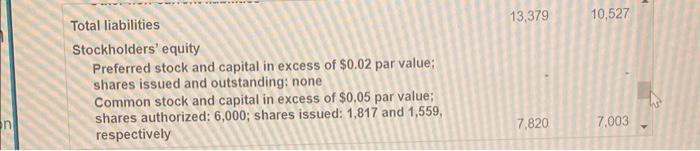

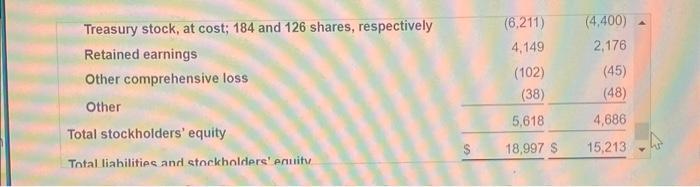

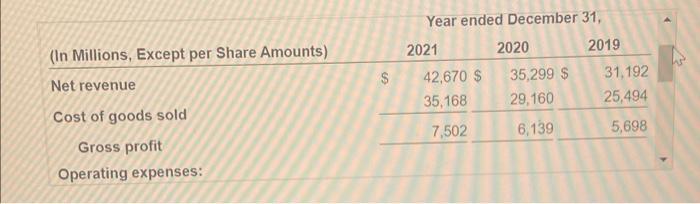

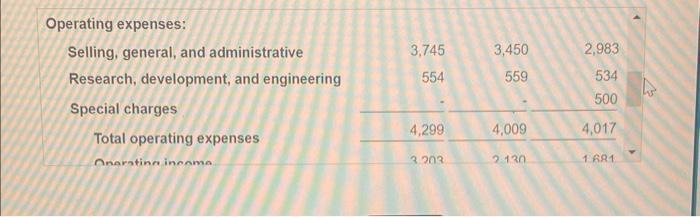

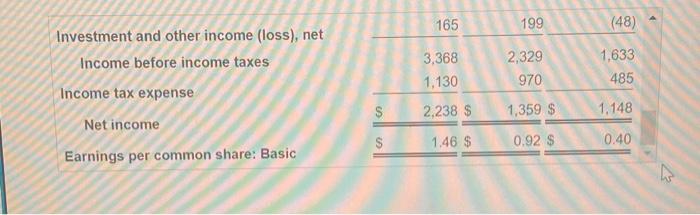

The Jacksonville Medical Corporation financial statements follow: (Click the icon to view the consolidated balance sheets.) consolidated income statements.) Jacksonville Medical's current ratio at year-end 2021 is closest to (Click the icon to view the Current assets Cash and cash equivalents $ 4,344 $ 4,181 830 501 Short-term investments Accounts and notes receivable 3,407 2,405 Inventories, at cost 434 406 1,690 1,287 Prepaid expense and other current assets paper curricu Total current assets 10,705 8,780 w the Property and equipment, net 1,575 948 Investments 6,513 5,325 204 160 Other non-current assets 18,997 $ 15,213 Total assets Data table Current liabilities Accounts payable 7,711 $ 6,002 3,665 3,044 Accrued and other liabilities Total current liabilities 11,376 9,046 Long-term debt 303 304 1,700 1,177 Other non-current liabilities C Total liabilities Stockholders' equity Preferred stock and capital in excess of $0.02 par value; shares issued and outstanding: none Common stock and capital in excess of $0.05 par value; shares authorized: 6,000; shares issued: 1,817 and 1,559, respectively 13,379 10,527 7,820 7.003 Treasury stock, at cost; 184 and 126 shares, respectively (6,211) (4,400) Retained earnings 4,149 2,176 Other comprehensive loss (102) (45) (38) (48) Other Total stockholders' equity 5,618 4,686 $ 18,997 $ 15,213 Total liabilities and stockholders' equity (In Millions, Except per Share Amounts) Net revenue Cost of goods sold Gross profit Operating expenses: $ SA Year ended December 31, 2021 2020 2019 42,670 $ 35,299 $ 31,192 35,168 29,160 25,494 7,502 6,139 5,698 Operating expenses: Selling, general, and administrative 3,745 3,450 2,983 Research, development, and engineering 554 559 534 500 Special charges Total operating expenses 4,299 4,009 4,017 Onerating income 3.203 2.130 1 681 Operating income 3,203 2,130 1,681 Investment and other income (loss), net 165 199 (48) Income before income taxes 3,368 2,329 1,633 Income tax expense 1,130 970 485 Net income S 1 2,238 $ 1,359 $ 1,148 1.46 S 0.92 $ 0.40 Investment and other income (loss), net 165 199 (48) Income before income taxes 3,368 2,329 1,633 1,130 970 485 Income tax expense $ 2,238 $ 1,359 $ 1,148 Net income $ 1.46 $ 0.92 $ 0.40 Earnings per common share: Basic

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started