Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The job costing system at Sarah's Custom Framing has five indirect cost pools (purchasing, material handling, machine maintenance, product inspection, and packaging). The company is

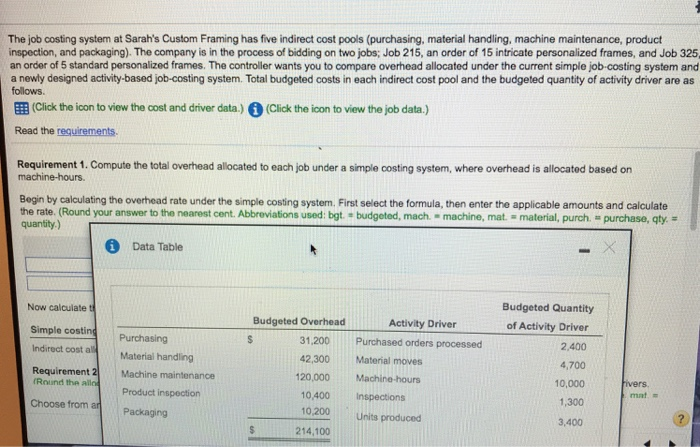

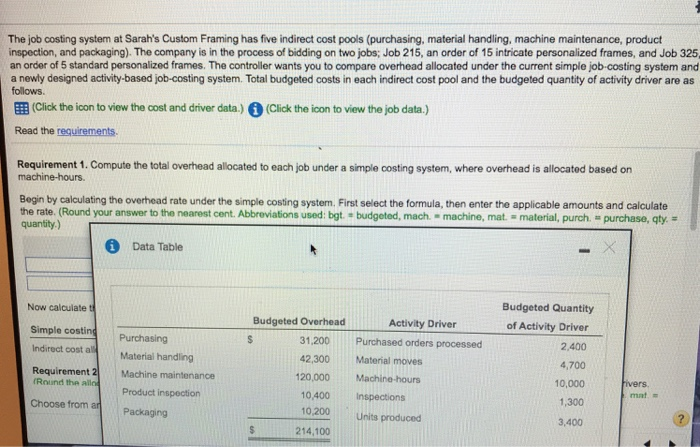

The job costing system at Sarah's Custom Framing has five indirect cost pools (purchasing, material handling, machine maintenance, product inspection, and packaging). The company is in the process of bidding on two jobs; Job 215, an order of 15 intricate personalized frames, and Job 325 an order of 5 standard personalized frames. The controller wants you to compare overhead allocated under the current simple job-costing system and a newly designed activity-based job-costing system. Total budgeted costs in each indirect cost pool and the budgeted quantity of activity driver are as follows EB (Click the icon to view the cost and driver data.)(Click the icon to view the job data.) Read the requirements Requirement 1. Compute the total overhead allocated to each job under a simple costing system, where overhead is allocated based on Begin by calculating the overhead rate under the simple costing system. First select the formula, then enter the applicable amounts and calculate quantity.) your answer to the nearest cent. Abbreviations used: bgt. + budgeted, mach machine, mat. material, purch purchase, qty. Data Table Budgeted Quantity Now calculate t of Activity Driver 2,400 4,700 10,000 1,300 3,400 Budgeted Overhead Activity Driver Simple costing Indirect cost Material handling 31,200 Purchased orders processed 42,300Material moves 20,000Machine-hours 10,400 Inspections 10,200 Units produced 214.100 Purchasing Requirement 2 Round the allo Machine maintenance Product inspection ivers. mat. Choose from an Packaging The job costing system at Sarah's Custom Framing has five indirect cost pools (purchasing, material handling, machine maintenance, product inspection, and packaging). The company is in the process of bidding on two jobs; Job 215, an order of 15 intricate personalized frames, and Job 325 an order of 5 standard personalized frames. The controller wants you to compare overhead allocated under the current simple job-costing system and a newly designed activity-based job-costing system. Total budgeted costs in each indirect cost pool and the budgeted quantity of activity driver are as follows EB (Click the icon to view the cost and driver data.)(Click the icon to view the job data.) Read the requirements Requirement 1. Compute the total overhead allocated to each job under a simple costing system, where overhead is allocated based on Begin by calculating the overhead rate under the simple costing system. First select the formula, then enter the applicable amounts and calculate quantity.) your answer to the nearest cent. Abbreviations used: bgt. + budgeted, mach machine, mat. material, purch purchase, qty. Data Table Budgeted Quantity Now calculate t of Activity Driver 2,400 4,700 10,000 1,300 3,400 Budgeted Overhead Activity Driver Simple costing Indirect cost Material handling 31,200 Purchased orders processed 42,300Material moves 20,000Machine-hours 10,400 Inspections 10,200 Units produced 214.100 Purchasing Requirement 2 Round the allo Machine maintenance Product inspection ivers. mat. Choose from an Packaging

The job costing system at Sarah's Custom Framing has five indirect cost pools (purchasing, material handling, machine maintenance, product inspection, and packaging). The company is in the process of bidding on two jobs; Job 215, an order of 15 intricate personalized frames, and Job 325 an order of 5 standard personalized frames. The controller wants you to compare overhead allocated under the current simple job-costing system and a newly designed activity-based job-costing system. Total budgeted costs in each indirect cost pool and the budgeted quantity of activity driver are as follows EB (Click the icon to view the cost and driver data.)(Click the icon to view the job data.) Read the requirements Requirement 1. Compute the total overhead allocated to each job under a simple costing system, where overhead is allocated based on Begin by calculating the overhead rate under the simple costing system. First select the formula, then enter the applicable amounts and calculate quantity.) your answer to the nearest cent. Abbreviations used: bgt. + budgeted, mach machine, mat. material, purch purchase, qty. Data Table Budgeted Quantity Now calculate t of Activity Driver 2,400 4,700 10,000 1,300 3,400 Budgeted Overhead Activity Driver Simple costing Indirect cost Material handling 31,200 Purchased orders processed 42,300Material moves 20,000Machine-hours 10,400 Inspections 10,200 Units produced 214.100 Purchasing Requirement 2 Round the allo Machine maintenance Product inspection ivers. mat. Choose from an Packaging The job costing system at Sarah's Custom Framing has five indirect cost pools (purchasing, material handling, machine maintenance, product inspection, and packaging). The company is in the process of bidding on two jobs; Job 215, an order of 15 intricate personalized frames, and Job 325 an order of 5 standard personalized frames. The controller wants you to compare overhead allocated under the current simple job-costing system and a newly designed activity-based job-costing system. Total budgeted costs in each indirect cost pool and the budgeted quantity of activity driver are as follows EB (Click the icon to view the cost and driver data.)(Click the icon to view the job data.) Read the requirements Requirement 1. Compute the total overhead allocated to each job under a simple costing system, where overhead is allocated based on Begin by calculating the overhead rate under the simple costing system. First select the formula, then enter the applicable amounts and calculate quantity.) your answer to the nearest cent. Abbreviations used: bgt. + budgeted, mach machine, mat. material, purch purchase, qty. Data Table Budgeted Quantity Now calculate t of Activity Driver 2,400 4,700 10,000 1,300 3,400 Budgeted Overhead Activity Driver Simple costing Indirect cost Material handling 31,200 Purchased orders processed 42,300Material moves 20,000Machine-hours 10,400 Inspections 10,200 Units produced 214.100 Purchasing Requirement 2 Round the allo Machine maintenance Product inspection ivers. mat. Choose from an Packaging

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started