Answered step by step

Verified Expert Solution

Question

1 Approved Answer

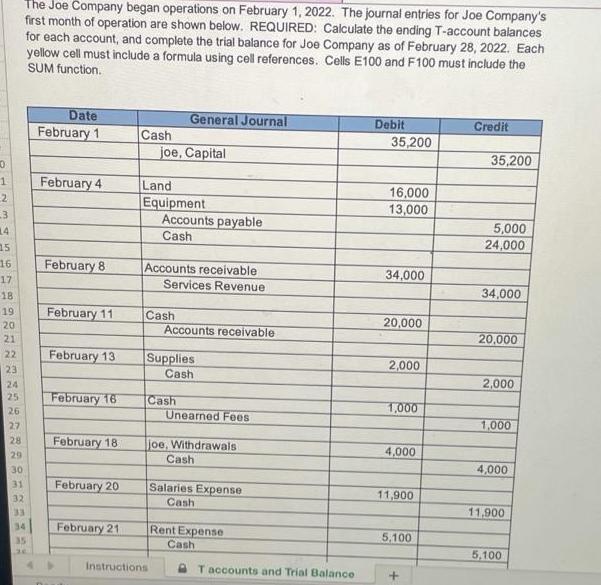

The Joe Company began operations on February 1, 2022. The journal entries for Joe Company's first month of operation are shown below. REQUIRED: Calculate

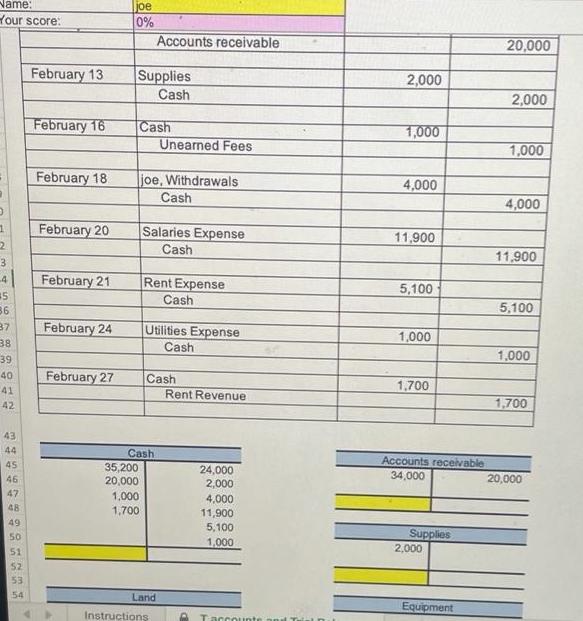

The Joe Company began operations on February 1, 2022. The journal entries for Joe Company's first month of operation are shown below. REQUIRED: Calculate the ending T-account balances for each account, and complete the trial balance for Joe Company as of February 28, 2022. Each yellow cell must include a formula using cell references. Cells E100 and F100 must include the SUM function. Date General Journal Debit 35,200 Credit February 1 Cash joe, Capital 35,200 February 4 2 Land Equipment Accounts payable 16,000 13,000 5,000 24,000 14 Cash 15 16 February 8 Accounts receivable 17 34.000 Services Revenue 18 34,000 19 February 11 Cash Accounts receivable 20 20,000 21 20,000 February 13 22 Supplies Cash 2,000 23 24 2,000 25 February 16 Cash Unearned Fees 26 1,000 27 1,000 28 February 18 joe, Withdrawals Cash 4,000 29 30 4,000 February 20 Salaries Expense Cash 31 11,900 32 33 11,900 February 21 Rent Expense Cash 34 35 5.100 5,100 Instructions T accounts and Trial Balance Name: Your score: joe 0% Accounts receivable 20,000 February 13 Supplies 2,000 Cash 2,000 February 16 Cash Unearned Fees 1,000 1,000 February 18 ljoe, Withdrawals 4,000 Cash 4,000 February 20 Salaries Expense 11,900 Cash 11.900 3 February 21 Rent Expense 4 5,100 Cash 86 5,100 37 February 24 Utilities Expense Cash 1,000 38 39 1,000 February 27 40 Cash 1,700 41 Rent Revenue 42 1,700 43 44 Cash 35,200 20,000 1,000 Accounts receivable 45 24,000 2,000 46 34,000 20,000 47 4,000 11,900 48 1,700 49 5,100 Supplies 50 1,000 51 2,000 52 53 54 Land Equipment Instructions Taccounte

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 T Accounts Dr Cash account Cr Particulars Amount Particulars Amount To Joes capital 35200 By Supplies 2000 To Accounts Receivable 20000 By Joes acco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started