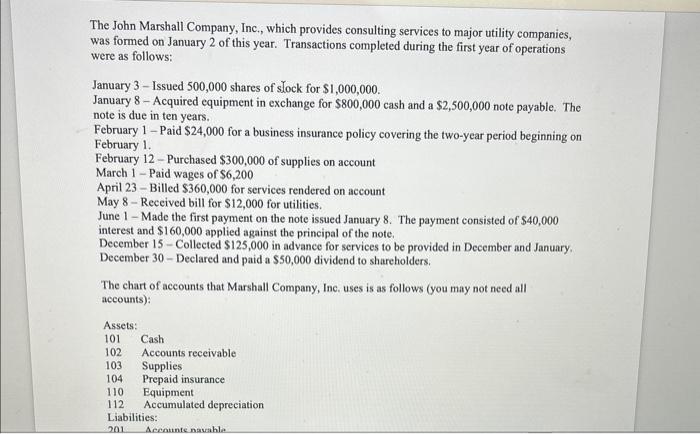

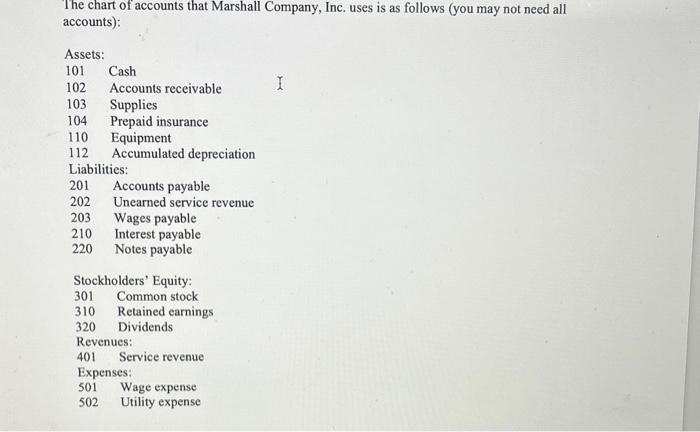

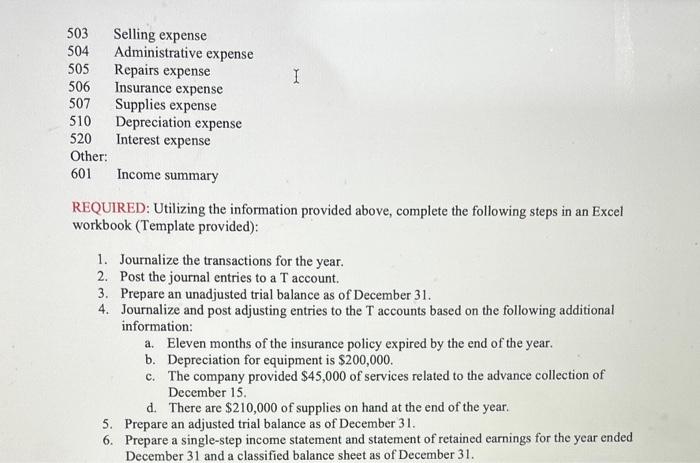

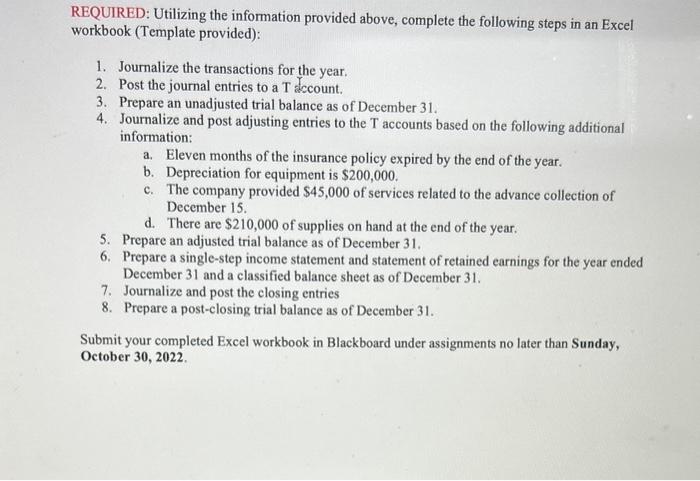

The John Marshall Company, Inc., which provides consulting services to major utility companies, was formed on January 2 of this year. Transactions completed during the first year of operations were as follows: January 3 - Issued 500,000 shares of ock for $1,000,000. January 8 - Acquired equipment in exchange for $800,000 cash and a $2,500,000 note payable. The note is due in ten years. February 1 - Paid $24,000 for a business insurance policy covering the two-year period beginning on February 1. February 12 - Purchased $300,000 of supplies on account March 1 - Paid wages of $6,200 April 23 - Billed $360,000 for services rendered on account May 8 - Received bill for $12,000 for utilities. June 1 - Made the first payment on the note issued January 8 . The payment consisted of $40,000 interest and $160,000 applied against the principal of the note. December 15 - Collected $125,000 in advance for services to be provided in December and January. December 30 - Declared and paid a $50,000 dividend to shareholders. The chart of accounts that Marshall Company, Inc. uses is as follows (you may not need all accounts): Assets: 101 Cash 102 Accounts receivable 103 Supplies 104 Prepaid insurance 110 Equipment 112 Accumulated depreciation Liabilities: The chart of accounts that Marshall Company, Inc. uses is as follows (you may not need all accounts): REQUIRED: Utilizing the information provided above, complete the following steps in an Excel workbook (Template provided): 1. Journalize the transactions for the year. 2. Post the journal entries to a T account. 3. Prepare an unadjusted trial balance as of December 31. 4. Journalize and post adjusting entries to the T accounts based on the following additional information: a. Eleven months of the insurance policy expired by the end of the year. b. Depreciation for equipment is $200,000. c. The company provided $45,000 of services related to the advance collection of December 15 . d. There are $210,000 of supplies on hand at the end of the year. 5. Prepare an adjusted trial balance as of December 31. 6. Prepare a single-step income statement and statement of retained earnings for the year ended December 31 and a classified balance sheet as of December 31 . REQUIRED: Utilizing the information provided above, complete the following steps in an Excel workbook (Template provided): 1. Journalize the transactions for the year. 2. Post the journal entries to a T sccount. 3. Prepare an unadjusted trial balance as of December 31 . 4. Journalize and post adjusting entries to the T accounts based on the following additional information: a. Eleven months of the insurance policy expired by the end of the year. b. Depreciation for equipment is $200,000. c. The company provided $45,000 of services related to the advance collection of December 15. d. There are $210,000 of supplies on hand at the end of the year. 5. Prepare an adjusted trial balance as of December 31 . 6. Prepare a single-step income statement and statement of retained earnings for the year ended December 31 and a classified balance sheet as of December 31 . 7. Journalize and post the closing entries 8. Prepare a post-closing trial balance as of December 31 . Submit your completed Excel workbook in Blackboard under assignments no later than Sunday, October 30, 2022