Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Johnson Research Organization, a nonprofit organization that does not pay taxes, is considering buying laboratory equipment with an estimated life of seven years so

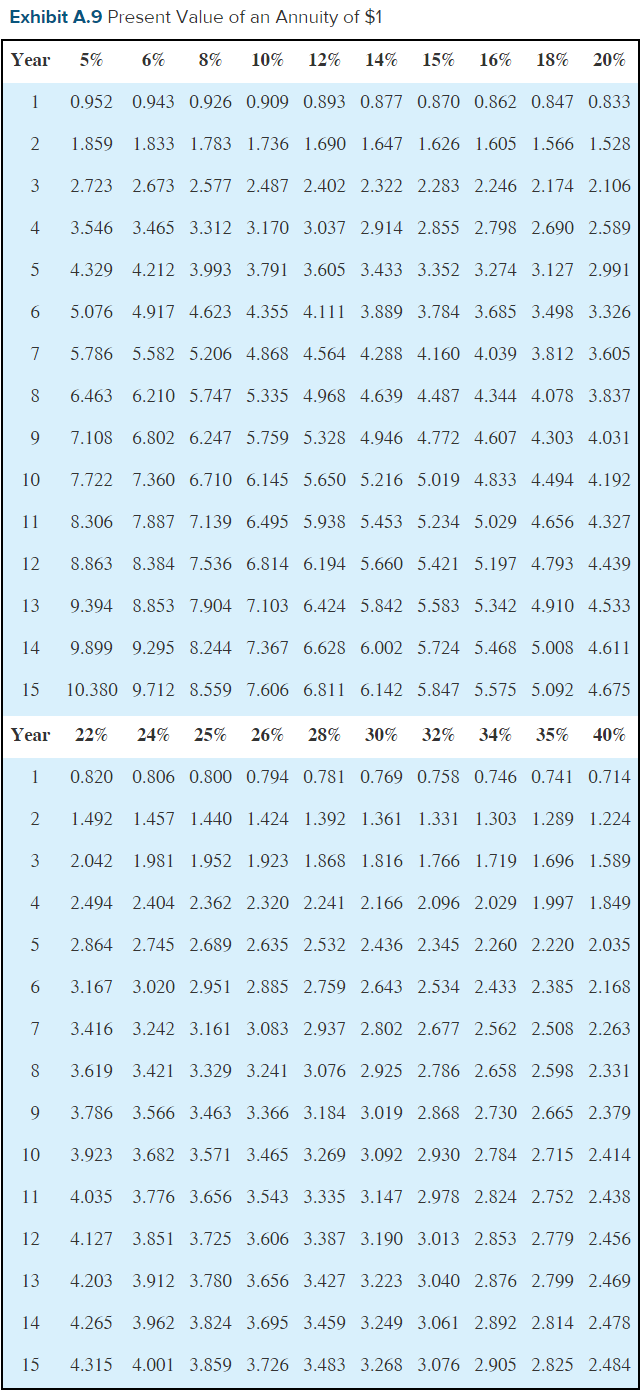

The Johnson Research Organization, a nonprofit organization that does not pay taxes, is considering buying laboratory equipment with an estimated life of seven years so it will not have to use outsiders' laboratories for certain types of work. The following are all of the cash flows affected by the decision: Use Exhibit A.8.

| Investment (outflow at time 0) | $ | 5,300,000 | |

| Periodic operating cash flows: | |||

| Annual cash savings because outside laboratories are not used | 1,450,000 | ||

| Additional cash outflow for people and supplies to operate the equipment | 250,000 | ||

| Salvage value after seven years, which is the estimated life of this project | 450,000 | ||

| Discount rate | 14 | % | |

Required:

Calculate the net present value of this decision. (Round PV factor to 3 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started