Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The joint venture decides to form a manufacturing plant in Malaysia in order to take advantage of cost savings and to meet the increased demand

The joint venture decides to form a manufacturing plant in Malaysia in order to take advantage of cost savings and to meet the increased demand for medical ventilators. The financial team of Sanichi Technology has conducted a study to determine the features of various machineries available in the market suitable to produce the medical ventilators. The financial team has come up with two machines called Project WX60 and Project KGM125 with other supporting details.

Prepare a 5-year cash flow projection for Project WX60 and Project KGM125 with a suitable discount rate. Further, in comparing the return that your team will get from these two projects, evaluate and describe the best project to be selected using one of the investment appraisal method that you have learnt in the module.

(200 words excluding calculations)

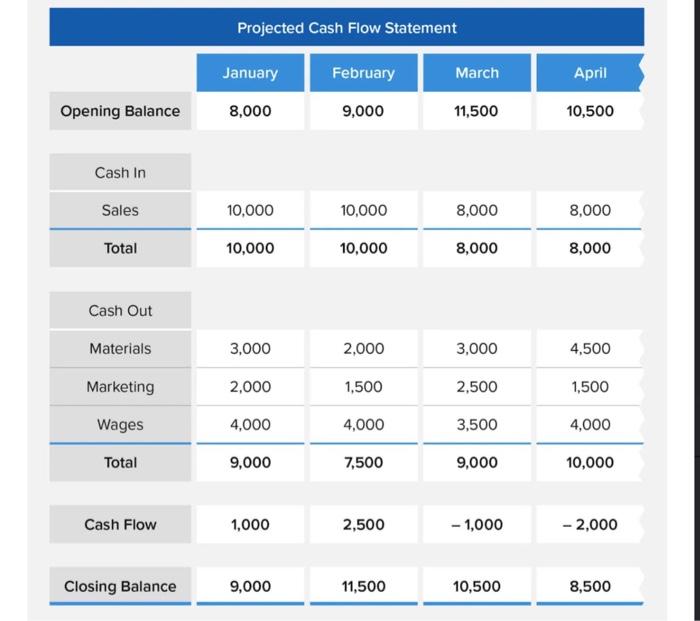

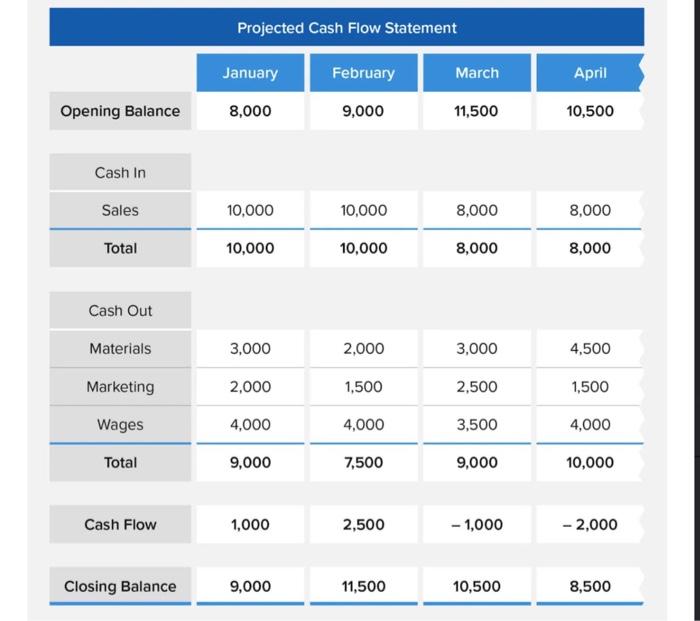

by using this form of cash flow statement... two project calculate seprately. use NPV as investment appraisal method

5 years projection cash flow for y1-y5 2022-2026 (2020 as y0)

for calculation details, just get a logic estimation. no figure to refer.

please use CAPM to calculate discount rate.

Projected Cash Flow Statement January February March April Opening Balance 8,000 9,000 11,500 10,500 Cash In Sales 10,000 10,000 8.000 8,000 Total 10,000 10,000 8,000 8,000 Cash Out Materials 3,000 2.000 3,000 4,500 Marketing 2,000 1,500 2,500 1,500 Wages 4,000 4,000 3,500 4,000 Total 9,000 7,500 9,000 10,000 Cash Flow 1,000 2,500 - 1,000 -2,000 Closing Balance 9,000 11,500 10,500 8,500 Projected Cash Flow Statement January February March April Opening Balance 8,000 9,000 11,500 10,500 Cash In Sales 10,000 10,000 8.000 8,000 Total 10,000 10,000 8,000 8,000 Cash Out Materials 3,000 2.000 3,000 4,500 Marketing 2,000 1,500 2,500 1,500 Wages 4,000 4,000 3,500 4,000 Total 9,000 7,500 9,000 10,000 Cash Flow 1,000 2,500 - 1,000 -2,000 Closing Balance 9,000 11,500 10,500 8,500 initial investment:

project A: 1,450,000

project B: 2,300,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started