Question

The JRM Co. granted its employees 1,000,000 shares of stock on January 1, Year 1. On the grant date, the fair value of each share

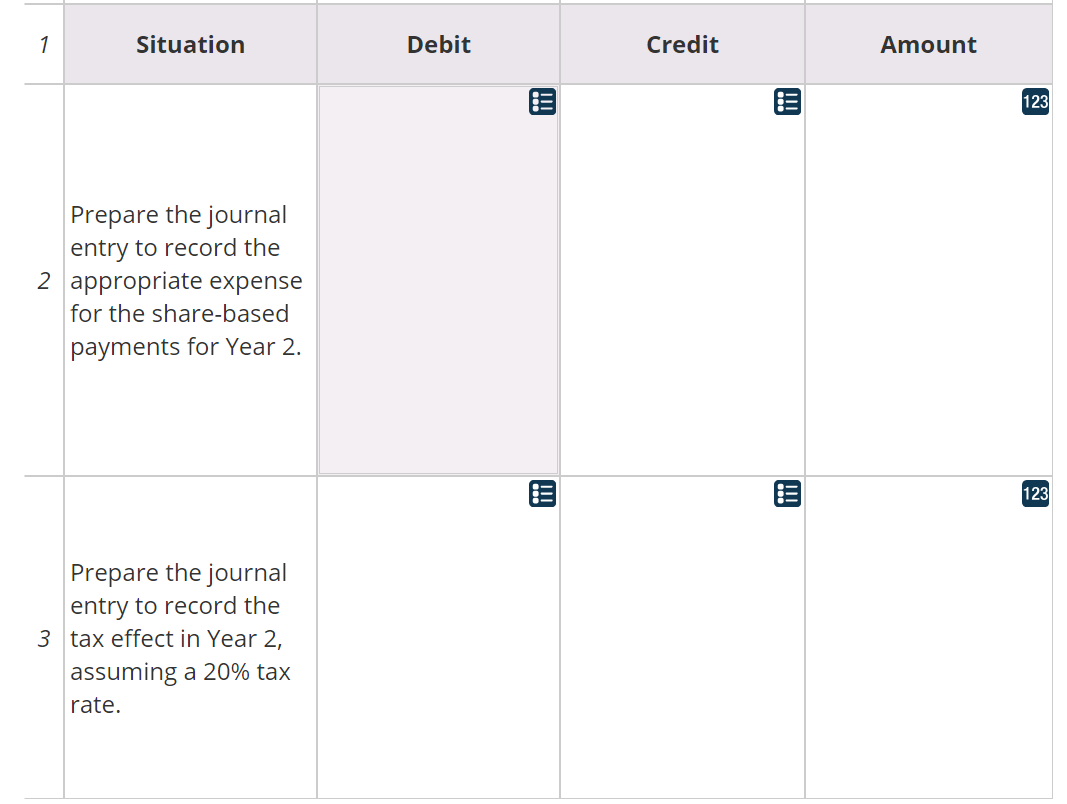

The JRM Co. granted its employees 1,000,000 shares of stock on January 1, Year 1. On the grant date, the fair value of each share was $36. The shares cliff vest at the end of 3 years, and no forfeitures are expected. Management expects that all shares will vest because the staff performance indicates a successful 3-year period. The fair values of the stock on the following dates were: December 31, Year 1: $39 December 31, Year 2: $45 December 31, Year 3: $48 (estimated) For each of the situations below, prepare the information for the appropriate journal entry for Year 2, including the tax effect. In columns B and C, click on the cells and select the appropriate account from the option list provided. An option may be used once or not at all. In column D, enter the appropriate amount as a positive, whole value.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started