Answered step by step

Verified Expert Solution

Question

1 Approved Answer

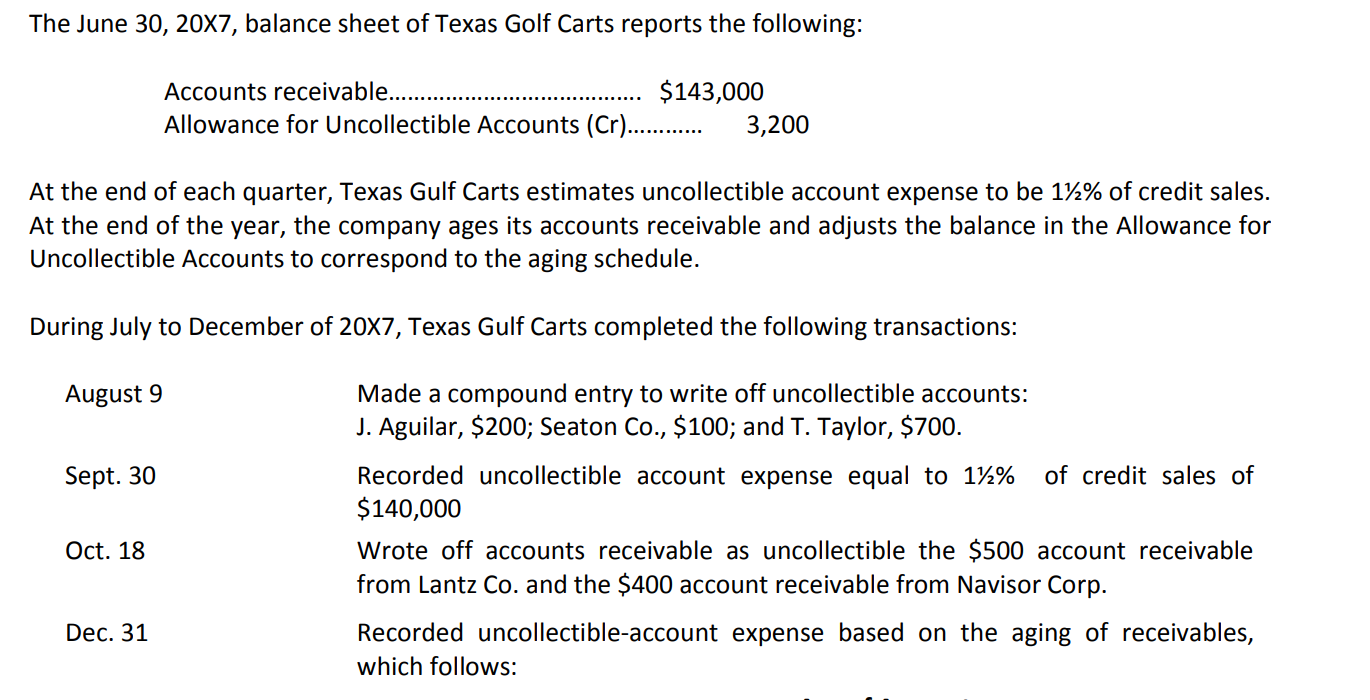

The June 30, 20X7, balance sheet of Texas Golf Carts reports the following: Accounts receivable...... $143,000 Allowance for Uncollectible Accounts (Cr) ....... 3,200 At

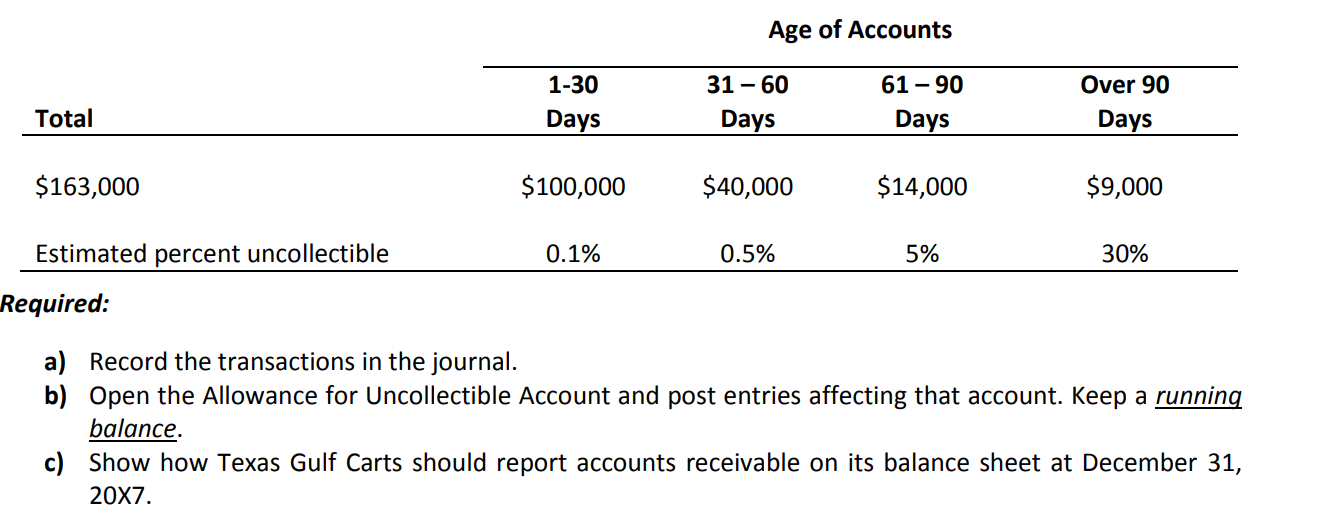

The June 30, 20X7, balance sheet of Texas Golf Carts reports the following: Accounts receivable...... $143,000 Allowance for Uncollectible Accounts (Cr) ....... 3,200 At the end of each quarter, Texas Gulf Carts estimates uncollectible account expense to be 1% of credit sales. At the end of the year, the company ages its accounts receivable and adjusts the balance in the Allowance for Uncollectible Accounts to correspond to the aging schedule. During July to December of 20X7, Texas Gulf Carts completed the following transactions: August 9 Sept. 30 Oct. 18 Dec. 31 Made a compound entry to write off uncollectible accounts: J. Aguilar, $200; Seaton Co., $100; and T. Taylor, $700. Recorded uncollectible account expense equal to 1% of credit sales of $140,000 Wrote off accounts receivable as uncollectible the $500 account receivable from Lantz Co. and the $400 account receivable from Navisor Corp. Recorded uncollectible-account expense based on the aging of receivables, which follows: Total $163,000 Estimated percent uncollectible Required: Age of Accounts 1-30 31-60 61-90 Over 90 Days Days Days Days $100,000 $40,000 $14,000 $9,000 0.1% 0.5% 5% 30% a) Record the transactions in the journal. b) Open the Allowance for Uncollectible Account and post entries affecting that account. Keep a running balance. c) Show how Texas Gulf Carts should report accounts receivable on its balance sheet at December 31, 20X7.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started