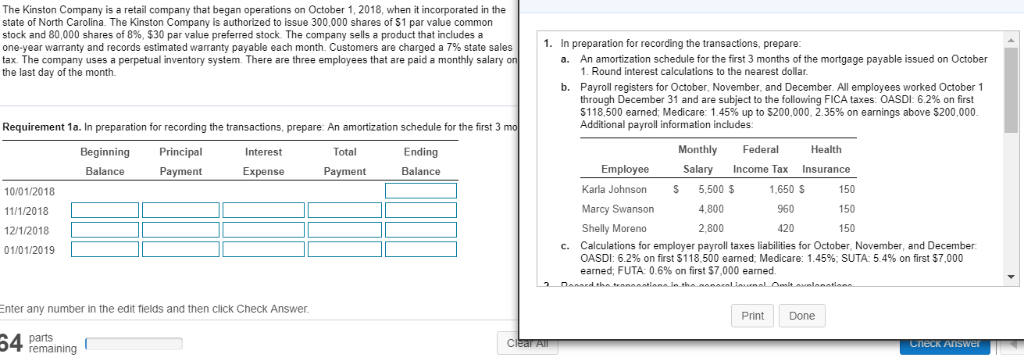

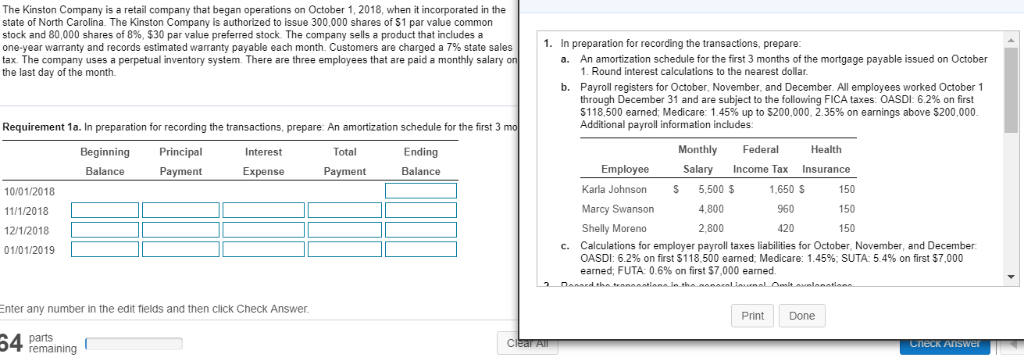

The Kinston Company is a retail company that began operations on October 1, 2018, when it incorporated in the state of North Carolina. The Kinston Company is authorized to issue 300,000 shares of $1 par value common stock and 80,000 shares of 8%, $30 par value preferred stock The company sells a product that includes a one-year warranty and records estimated warranty payable each month. Customers are charged a 7% state sales tax. The company uses a perpetual inventory system. There are three employees that are paid a monthly salary the last day of the month. 1. In preparation for recording the transactions, prepare An amortization schedule for the first 3 months of the mortgage payable issued on October 1. Round interest calculations to the nearest dollar a. b. Payroll registers for October, November, and December. All employees worked October 1 through December 31 and are subject to the following FICA taxes OASDI 6.2% on first $118,500 earned: Medicare: 1.45% up to $200,000. 2 35% on earnings above $200,000 Addition Requirement 1a. In preparation for recording the transactions, prepare: An amortization schedule for the first 3 al payroll information includes: Total Ending Monthly Federal Health BeginningPrincipal Payment Interest Employee Karla Johnson 5500 $ Marcy Swanson Shelly Moreno Balance Expense Payment Balance Salary Income Tax Insurance 10/01/2018 11/1/2018 12/1/2018 01/01/2019 1650 S 960 420 150 150 150 4,800 2,800 c. Calculations for employer payroll taxes liabilities for October, November, and December OASDI 6.2% on first $118.500 eamed: Medicare: 1.45%; SUTA 5 4% on first $7,000 earned; FUTA 0.6% on first $7,000 earned nter any number in the edit tields and then click Check Answer PrintDone parts remaining The Kinston Company is a retail company that began operations on October 1, 2018, when it incorporated in the state of North Carolina. The Kinston Company is authorized to issue 300,000 shares of $1 par value common stock and 80,000 shares of 8%, $30 par value preferred stock The company sells a product that includes a one-year warranty and records estimated warranty payable each month. Customers are charged a 7% state sales tax. The company uses a perpetual inventory system. There are three employees that are paid a monthly salary the last day of the month. 1. In preparation for recording the transactions, prepare An amortization schedule for the first 3 months of the mortgage payable issued on October 1. Round interest calculations to the nearest dollar a. b. Payroll registers for October, November, and December. All employees worked October 1 through December 31 and are subject to the following FICA taxes OASDI 6.2% on first $118,500 earned: Medicare: 1.45% up to $200,000. 2 35% on earnings above $200,000 Addition Requirement 1a. In preparation for recording the transactions, prepare: An amortization schedule for the first 3 al payroll information includes: Total Ending Monthly Federal Health BeginningPrincipal Payment Interest Employee Karla Johnson 5500 $ Marcy Swanson Shelly Moreno Balance Expense Payment Balance Salary Income Tax Insurance 10/01/2018 11/1/2018 12/1/2018 01/01/2019 1650 S 960 420 150 150 150 4,800 2,800 c. Calculations for employer payroll taxes liabilities for October, November, and December OASDI 6.2% on first $118.500 eamed: Medicare: 1.45%; SUTA 5 4% on first $7,000 earned; FUTA 0.6% on first $7,000 earned nter any number in the edit tields and then click Check Answer PrintDone parts remaining