Answered step by step

Verified Expert Solution

Question

1 Approved Answer

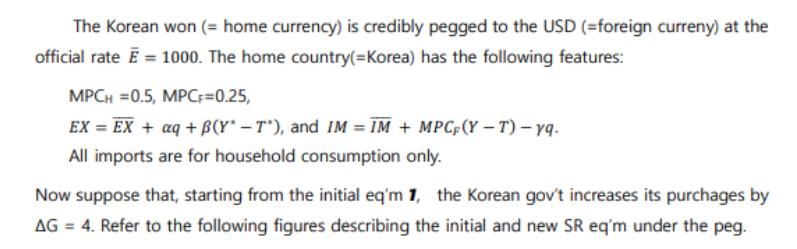

The Korean won (= home currency) is credibly pegged to the USD (=foreign curreny) at the official rate E = 1000. The home country(=Korea)

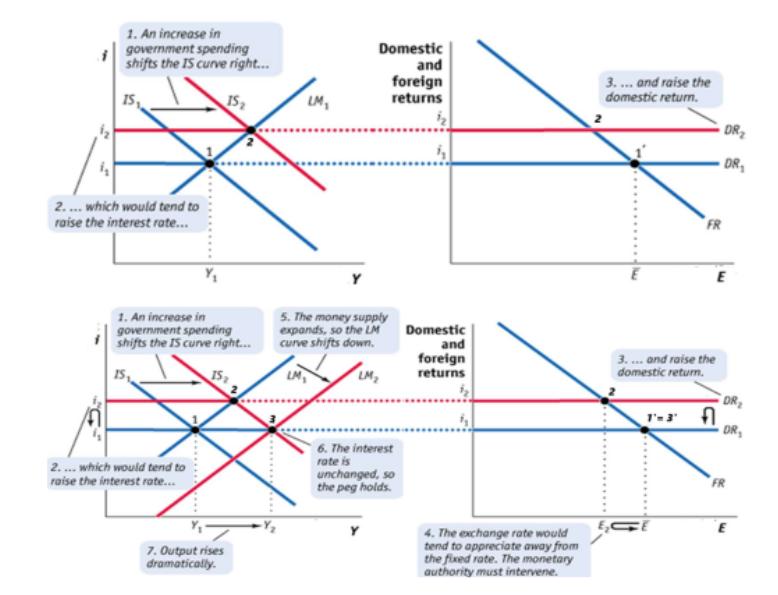

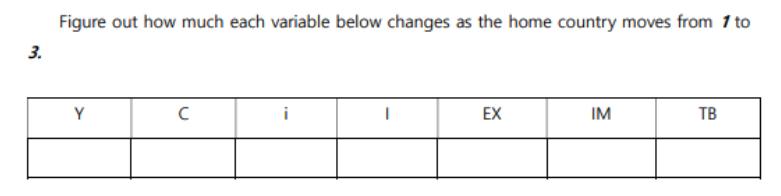

The Korean won (= home currency) is credibly pegged to the USD (=foreign curreny) at the official rate E = 1000. The home country(=Korea) has the following features: MPCH =0.5, MPCF=0.25, EX = EX + aq +B(Y* -T), and IM=IM + MPC, (Y-T)- yq. All imports are for household consumption only. Now suppose that, starting from the initial eq'm 1, the Korean gov't increases its purchages by AG = 4. Refer to the following figures describing the initial and new SR eq'm under the peg. 1. An increase in government spending shifts the IS curve right... 15 IS 2.... which would tend to raise the interest rate... 1. An increase in government spending shifts the IS curve right... 15 15, 2.... which would tend to raise the interest rate... 7. Output rises dramatically. LM, Domestic and foreign returns 5. The money supply expands, so the LM curve shifts down. LM, LM 6. The interest rate is unchanged, so the peg holds. 4 Domestic and foreign returns 4. The exchange rate would tend to appreciate away from the fixed rate. The monetary authority must intervene. 3.... and raise the domestic return. FR DR DR E 3.... and raise the domestic return. DR DR FR 3. Figure out how much each variable below changes as the home country moves from 1 to Y EX IM TB

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 Y Gross National Product Initial equilibrium I Y AG 4 New equilibrium Yc Yc Y Y 2 EX Exports ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started