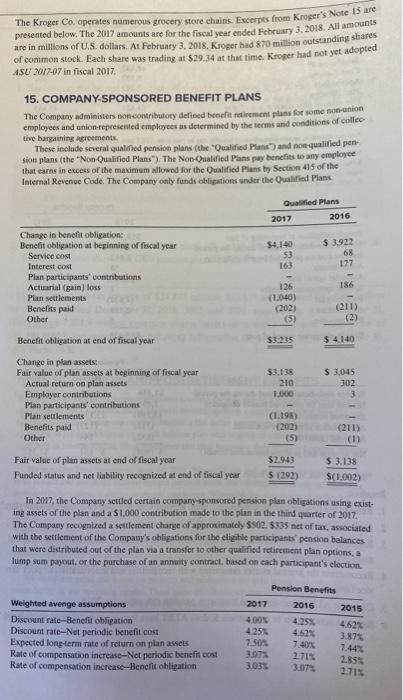

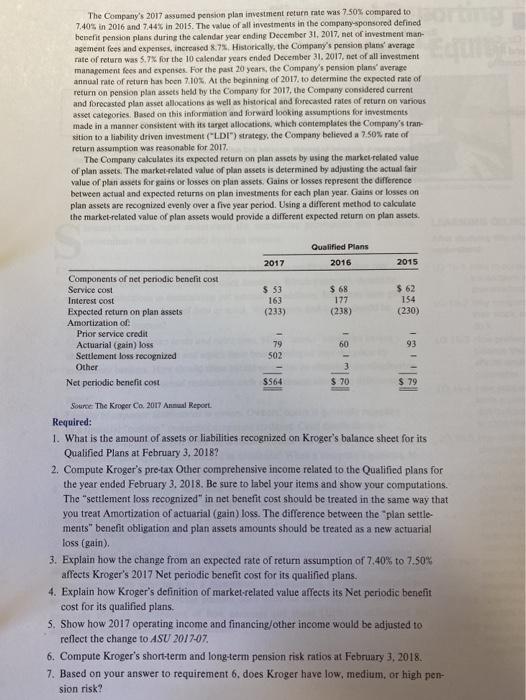

The Kroger Co operates numerous grocery store chains. Excerpes from Kroger's Note 15 are presented below. The 2017 amounts are for the fiscal year ended February 3, 2018. All amounts are in millions of U.S. dollars. At February 3, 2016. Kroger had 870 million outstanding shares of common stock. Each share was trading at $29.34 at that time. Kroger had not yet adopted ASU 2017-07 in fiscal 2017 15. COMPANY-SPONSORED BENEFIT PLANS The Company administers son contributory defined benefit retirement plans for some non union employees and union represented employees as determined by the terms and conditions of colle tive bargaining agreements These include several qualified pension plans (the "Qualified Plane") and non-qualified pen- Sion plans (the "Non Qualified Plans"). The Non-Qualified Pansy benefits to any employee that earns in excess of the maximum allowed for the Qualified Plans by Section 415 of the Internal Revenue Code. The Company only funds obligations under the Qualified Plans Qualified Plans 2017 2016 $4.140 53 163 $ 3.922 68 177 Change in benefit obligation Benefit obligation at beginning of fiscal year Service cost Interest cost Plan participants' contributions Actuarial (gain) loss Plan settlements Benefits paid Other 186 126 (1.040) (202) (5) (211) (2) Benefit obligation at end of fiscal year $3.235 $ 4.140 $3.138 210 1.000 $ 3,045 302 3 Change in plan assets: Fair value of plan assets at beginning of fiscal year Actual return on plan assets Employer contributions Plan participants contributions Plan settlements Benefits paid Other (1.198) (202) (5) (211) (1) Fair value of plan assets at end of fiscal year Funded status and net lability recognized at end of fiscal year $2.943 $ (292) $ 3.138 $1.002) In 2017, the Company settled certain company sponsored pension plan obligations using exist ing assets of the plan and a $1.000 contribution made to the plan in the third quarter of 2017 The Company recognized a settlement charge of approximately $502. $335 net of tax, associated with the settlement of the Company's obligations for the eligible participants pension balances that were distributed out of the plan via a transfer to other qualified retirement plan options, a lump sum payout, or the purchase of an annuity contract, based on cach participant's election Weighted avenge assumptions Discount rate-Benefit obligation Discount rate-Net periodic benefit cost Expected long-term rate of return on plan assets Rate of compensation increase-Net periodic benefit cost Rate of compensation increase-Benefit obligation Pension Benefits 2017 2016 2015 4.00 4.25% 4.62% 4.25% 4.62% 7.505 7.40% 7.44% 2.71% 2.85% 3.035 3.075 The Company's 2017 assumed pension plan investment return rate was 7.50% compared to 7.405 in 2016 and 7.44% in 2015. The value of all investments in the company sponsored defined henet pension plans during the calendar year ending December 31, 2017, net of investment man agement fees and expenses, increased 8.7% Historically, the Company's pension plans average rate of return was 5.7% for the 10 calendar years ended December 31, 2017, net of all investment management fees and expenses. For the past 20 years, the Company's pension plans' average annual rate of return has boon 7.10%. At the beginning of 2017. to determine the expected rate of return on pension plan assets held by the Company for 2017, the Company considered current and forecasted plan asset allocations as well as historical and forecasted rates of return on various asset categories. Based on this information and forward looking assumptions for investments made in a manner consistent with its target allocations, which contemplates the Company's tran sition to a linbility driven investment ('LDI") strategy, the Company believed a 7.50% rate of return assumption was reasonable for 2017 The Company calculates its expected return on plan assets by using the market related value of plan assets. The market related value of plan assets is determined by adjusting the actual fair value of plan assets for gains or losses on plan assets. Gains or losses represent the difference between actual and expected returns on plan investments for each plan year. Gains or losses on plan assets are recognized evenly over a five year period. Using a different method to calculate the market-related value of plan assets would provide a different expected return on plan assets. Qualified Plans 2016 2017 2015 $ 53 163 (233) $ 68 177 (238) $ 62 154 (230) Components of net periodic benefit cost Service cost Interest cost Expected return on plan assets Amortization of Prior service credit Actuarial (gain) loss Settlement loss recognized Other Net periodic benefit cost 60 93 79 502 $S64 $ 70 $ 79 Source: The Kroger Co2017 Annual Report Required: 1. What is the amount of assets or liabilities recognized on Kroger's balance sheet for its Qualified Plans at February 3, 2018? 2. Compute Kroger's pre-tax Other comprehensive income reluted to the Qualified plans for the year ended February 3, 2018. Be sure to label your items and show your computations. The "settlement loss recognized" in net benefit cost should be treated in the same way that you treat Amortization of actuarial (gain) loss. The difference between the plan settle- ments" benefit obligation and plan assets amounts should be treated as a new actuarial loss (gain). 3. Explain how the change from an expected rate of return assumption of 7.40% to 7.50% affects Kroger's 2017 Net periodic benefit cost for its qualified plans. 4. Explain how Kroger's definition of market-related value affects its Net periodic benefit cost for its qualified plans S. Show how 2017 operating income and financing other income would be adjusted to reflect the change to ASU 2017-07. 6. Compute Kroger's short-term and long-term pension risk ratios at February 3, 2018 7. Based on your answer to requirement 6. does Kroger have low, medium, or high pen sion risk