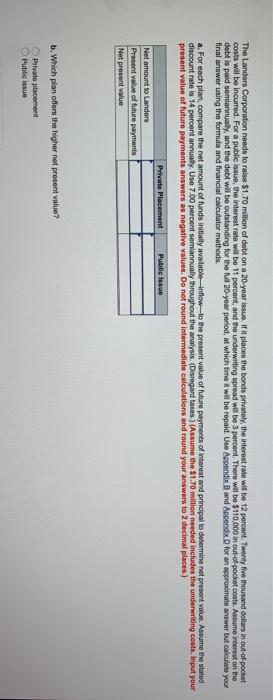

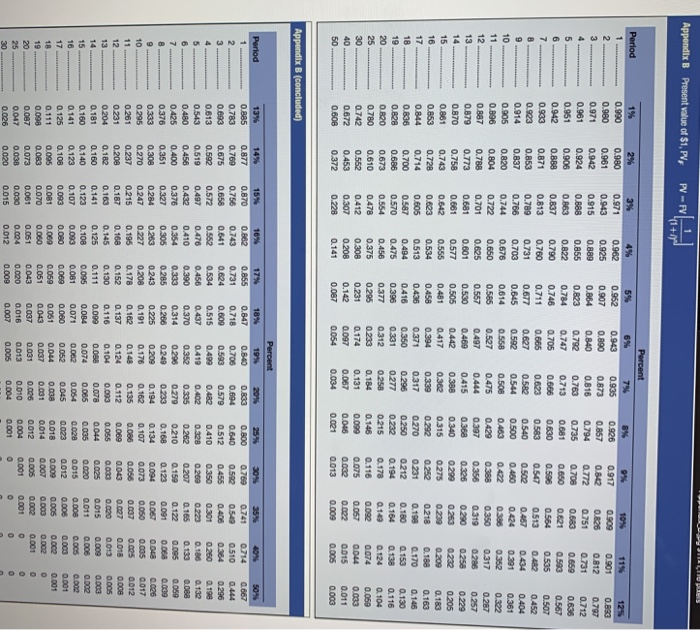

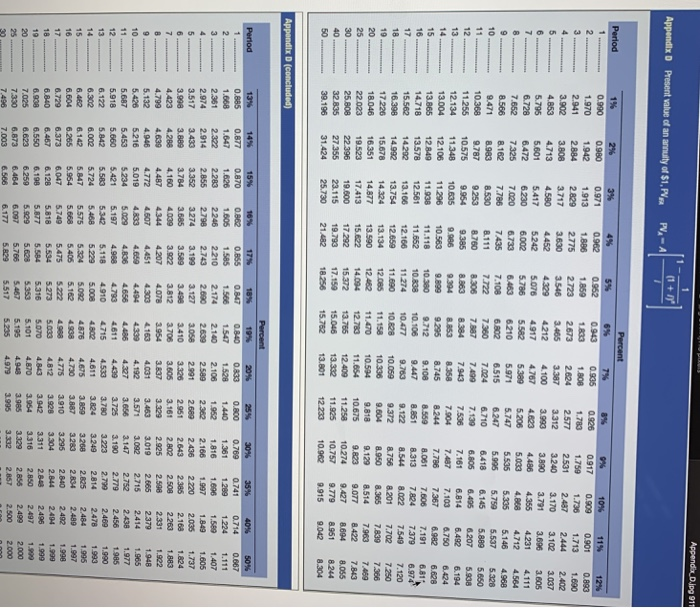

The Landers Corporation needs to raise $1.70 million of debt on a 20-year issue. If it places the bonds privately, the interest rate will be 12 percent. Twenty five thousand dollars in out-of-pocket costs will be incurred. For a public issue, the interest rate will be 11 percent, and the underwriting spread will be 3 percent. There will be $110,000 in out-of-pocket costs. Assume interest on the debt is paid semiannually, and the debt will be outstanding for the full 20-year period, at which time it will be repaid. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods a. For each plan, compare the net amount of funds initially available-inflow-to the present value of future payments of interest and principal to determine net present value. Assume the stated discount rate is 14 percent annually. Use 7.00 percent semiannually throughout the analysis. (Disregard taxes.) (Assume the $1.70 million needed includes the underwriting costs. Input your present value of future payments answers as negative values. Do not round intermediate calculations and round your answers to 2 decimal places.) Private Placement Public Issue Net amount to Landers Present value of future payments Net present value b. Which plan offers the higher net present value? Private placement O Public issue Appondix B Present value of $1, PV 1. PV-FV (1+ Percent Period 1% 2% 3% 4% 5% 6% 7% 8 % 0.926 9% 10% 11% 12% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.917 0.909 0.826 0.901 0.893 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.816 0.857 0.842 0.812 0.731 0.659 0.797 0.971 0.942 0.924 0.915 0.888 0.863 0.889 0.864 0.840 0,794 0.772 0.751 0712 0.961 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.636 0.951 0.906 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 7 0.933 0.871 0.813 0.789 0.766 0.760 0.711 0.665 0.623 0.583 0.540 0.500 0.547 0.513 0.482 0.452 a 0.923 O.853 0.731 0.703 m 0.677 0.627 0.582 0.502 0.467 0.434 0.404 0.914 0.837 0.645 0.592 0.544 0.460 0424 0.391 0.361 10 0.905 0.820 0.744 0.676 0.558 0.614 0.508 0.463 0.422 0.386 0.352 0.322 11 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 12. 0.887 0.788 0.773 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0319 0286 0.257 13 0.879 0.681 0.601 0.530 0.469 0.415 0368 0.326 0.290 0.258 0.229 14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0299 0.263 0232 0.205 15 0861 0743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0209 0.183 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0218 0.188 0.163 17 0.844 0714 0.605 0.513 0.436 0.371 0.317 0.270 0231 0.198 0.170 0.146 18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0212 0.180 0153 0.130 19 0.828 0.820 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.138 0.116 20 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 25 0.780 0.610 0.478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0074 0.059 30 0.308 0.208 0.742 0.552 0412 0.231 0.174 0.131 0.099 0.075 0.057 0044 0.033 40 0.672 0.453 0.307 0.142 0.097 0.067 0.046 0.032 0.022 0.015 0.011 50 0.608 0.372 0.228 0.141 0.067 0.054 0.034 0.021 0.013 0.009 0.005 0.003 Appendix B (concluded) Percent Perlod 13% 14% 15% 16% 17% 18% 19% 20% 25% 30% 35% 40% 50% 0.885 0.877 0.870 0.862 0.855 0.847 0840 0.833 0.800 0769 0741 0714 0667 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.640 0.592 0.549 0.510 0.444 0.658 0.641 0.624 0.609 0.593 0.364 0.296 0.693 0.613 0.675 0.579 0.512 0.455 0.408 0.592 0.572 0.552 0.534 0.515 0.499 0.482 0.410 0.350 0.301 0.260 0.198 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.328 0.209 0.223 0.186 0.132 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335 0.262 0.207 0.165 0.133 0.088 0.095 0.068 0.048 0.059 0.039 0.026 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279 0.210 0.159 0.122 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233 0.168 0.123 0.091 0.067 0.263 0.227 0.225 0.134 0.107 0.333 0.308 0.284 0.243 0209 0.194 0.094 0.247 0.208 0.191 0.176 0.162 0.073 0.050 0.035 0.017 10 0.295 0.270 0.056 0.025 0012 0.037 0.027 0.195 0.178 0.162 0.148 0.135 0.086 0.237 0.208 11 0.261 0.215 0.168 0.112 0.069 0018 0.008 12 0,231 0.187 0.152 0.137 0.124 0043 0.013 0.005 0.033 0.025 0.182 0.163 0.145 0.130 0.116 0.104 0.003 0.055 0.020 13 0.204 0.003 0.009 0.006 0.141 0.125 0.111 0.099 0.088 0.078 0.044 0.015 14 0.181 0.160 0.002 0.160 0.140 0.123 0.108 0.095 0.084 0074 0.065 0.035 0.020 0011 15 0.107 0.093 0.081 0.062 0.054 0.028 0.015 0.008 0.005 0.002 16 0.141 0.123 0.071 0.060 0,052 0.045 0.023 0.012 0.006 0.003 0.001 17 0.125 0.108 0.093 0.080 0.069 0.002 0.001 0.038 0.031 0.009 0.007 0.018 0.005 0.051 0.043 0.081 0.044 0.069 0.060 11 0.111 0.095 0.059 0.037 0014 0.003 0.002 0.098 0.083 0.070 0.051 0.031 0.026 0012 0.005 0.002 0.001 20 0.087 0.073 0.061 0.051 0.043 0.037 0.020 0.016 0.013 0.010 0.004 0.001 0.001 C 25 0.047 0.038 0.030 0.024 0.026 0.020 0.015 0.012 0.009 0.007 0.005 0.004 0.001 Appendix Dipg 911 1- (1+n Appendlx D Present value of an annuity of $1, PVa PV-A Percent Perlod 1% 2% 3% 4% 5% 6 % 7% 8% 0% 10% 11% 12% 0.990 0.980 0.971 0.962 0.952 0.943 2 1.970 0.935 0.926 0917 0.909 0.901 0.893 1.942 1.913 2.829 1886 1.859 1833 1.808 1.783 1.759 1.736 1.713 1.690 5 2.941 2.884 2775 2723 2.673 2624 2577 2.531 2.487 3.902 2.444 2.402 4 3.808 3.717 3.630 3.546 3465 3.387 4.100 3312 3.240 3.170 3.102 3.037 a 4.853 4.713 4.580 4452 4.329 4212 3.993 3.890 3791 4.355 5.795 5.601 3.696 3605 5.417 5242 5.076 4.917 4767 4.623 4.486 4.231 4.111 6.728 6.472 6.230 7.020 6.002 5,786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 7.652 7.325 6733 6.463 6210 5.971 5.747 5.535 5.335 5.146 4968 8.566 8.162 7.786 7.108 7722 7.435 6.802 6.515 6.247 5.995 5.759 5.328 5.650 5.537 10 9.471 8.983 8.530 8.111 7.360 6.710 6.418 7.024 6.145 5.889 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 6.207 5.938 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 6.194 13 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6750 6.424 14 13.004 12.106 11.296 10.563 9.899 9.295 45 7.786 7.367 6.982 6.628 15 16 13.865 14.718 12.849 11.938 11.118 10.380 9712 9.108 8.559 8.061 6.81 6.974 7.606 7.191 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 7.379 17 15.562 14.202 13.166 11.274 10.477 9.122 8.022 8.201 12.166 9.763 8.544 7.549 7.120 18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8756 7.702 7.250 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.839 7.366 20 18.046 16.351 14877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.963 7469 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 8422 7.843 30 25.808 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.694 8.055 32.835 39.196 40 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.951 8.244 50 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10.962 9.915 9.042 8.304 Appondix D (concluded) Percent Period 13% 14% 15% 16% 17% 18% 19% 20% 25 % 30% 35% 40 % 50% 0.855 Q847 0840 0833 0.800 1.440 ss 0.885 0.877 0.870 0.862 0.769 0741 0714 0.667 2 1.668 1.647 1.626 1605 1.585 1.566 1.547 1.528 1.361 1.289 1224 1.111 3 2.361 2.322 2.283 2246 2210 2.174 2.140 2.106 1.952 1.816 1.696 1.589 1.407 2.743 2.690 2.589 2.991 3.326 2.974 2.914 2.855 2798 2.639 2.362 2.166 1.997 1.849 1.605 3.517 3.433 3.352 3274 3.199 3.127 3.058 2.689 2.436 2.220 2.035 1.737 3.998 2.951 2.643 2.385 2.168 1.824 3.889 4.288 4.639 3.784 3.685 3.589 3.498 3410 4.423 4.160 4.039 3.922 3812 3706 3.605 3.161 2.802 2.508 2.263 1.883 4.799 4.487 4344 4207 4.078 3954 3.837 3.329 2.925 2.598 2.331 1.922 1.948 1.965 5.132 4.946 4.772 4607 4.451 4.303 4.163 4.031 3.463 3.019 2.665 2.379 10 5.426 5.216 5.019 4.833 4.659 4.494 4339 4.192 3.571 3.092 2.715 2.414 5.687 5.453 5.234 5.029 4.836 4656 4486 4.327 3656 3.147 2.752 2.438 1.977 5.918 5.660 5.421 5.197 4.988 4.793 4611 4.439 3725 3.190 2.779 2.456 1985 12 5.118 4910 4715 4.533 3.780 3223 2.799 2.469 1.990 13 6.122 5.842 5.583 5.342 5.229 5.008 4.802 4.611 3.824 3.249 2.814 2478 1.993 14 6.302 6.002 5.724 5.468 2.484 2.489 1995 3268 3283 4876 4.675 3.859 2.825 5.324 5.405 5.575 5.092 6.142 6.265 15 6.462 5.847 5.162 4.938 4.730 3.887 2.834 1.997 16 6.604 5.954 5.668 3.295 2.840 2.492 1.998 5.475 5222 4988 4775 3.910 6.047 6.128 17 6.729 6.373 5.749 5534 5.273 5.033 4.812 3.928 3304 2.844 2.494 1.999 18 6.840 6.467 5.818 5.584 5.070 4.843 3.942 3.311 2.848 2.496 1.999 5.316 6.938 7.025 19 6.550 6.198 5.877 2.497 1.999 5.929 5.628 5.353 5.101 4.870 3.954 3316 2.850 20 6.623 6.259 3329 2.855 2.499 2.000 7.330 6.873 6.097 5.766 5.467 5.195 4.948 3.985 25 6.464 4.979 3995 3.332 2.857 2.500 2.000 7.496 7.003 6.566 6.177 5.829 5.517 5.235