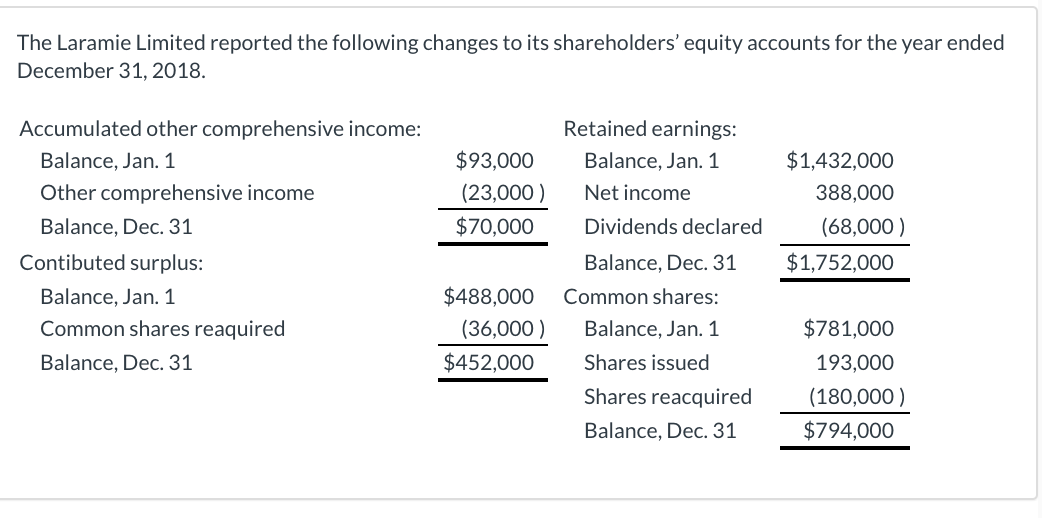

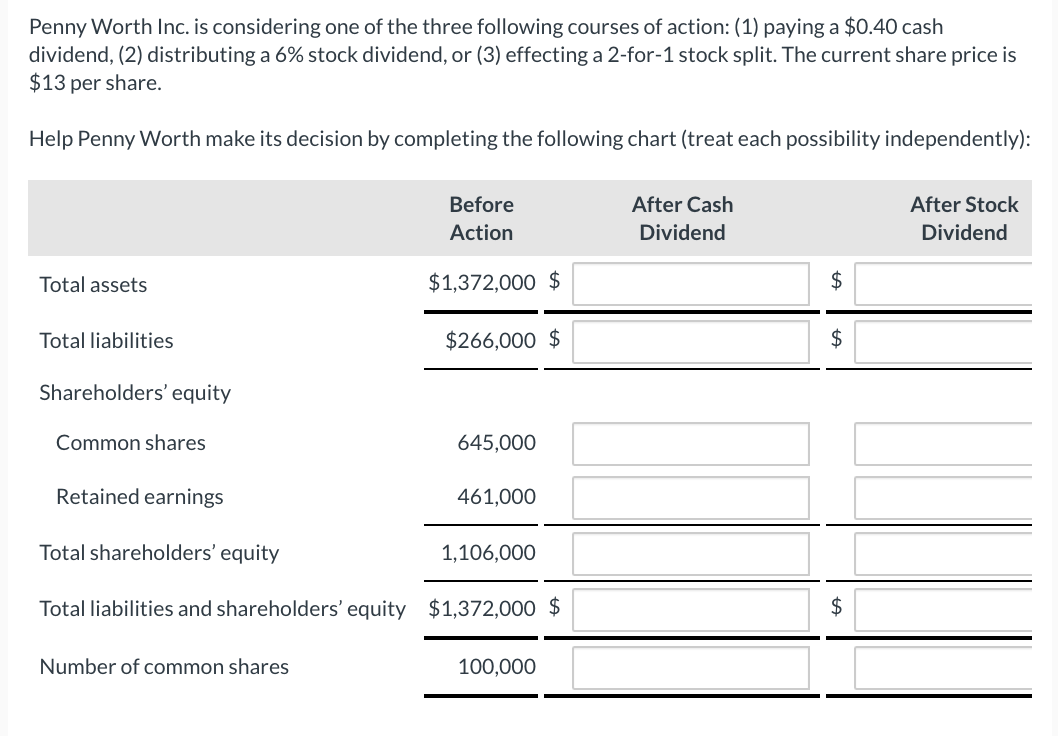

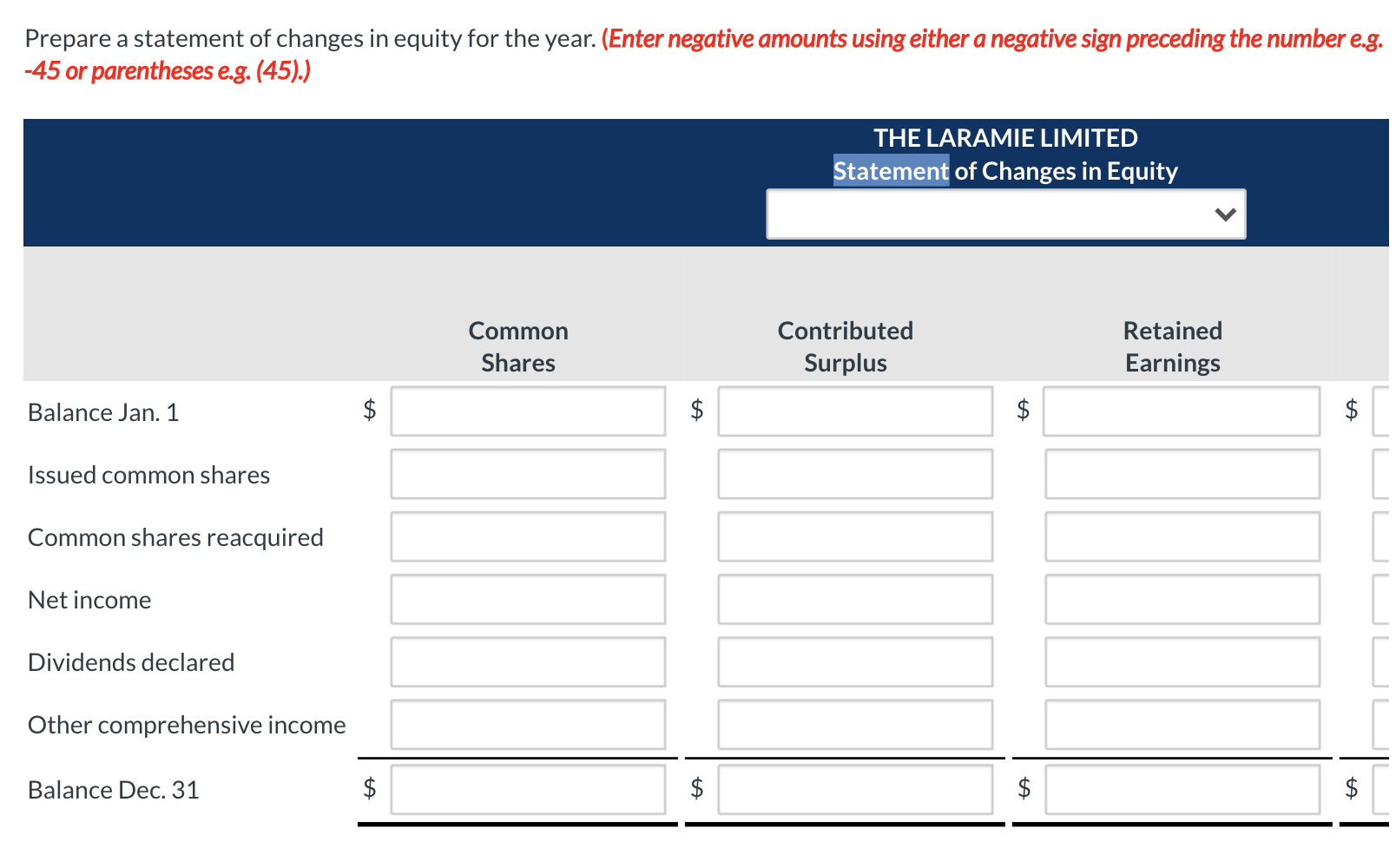

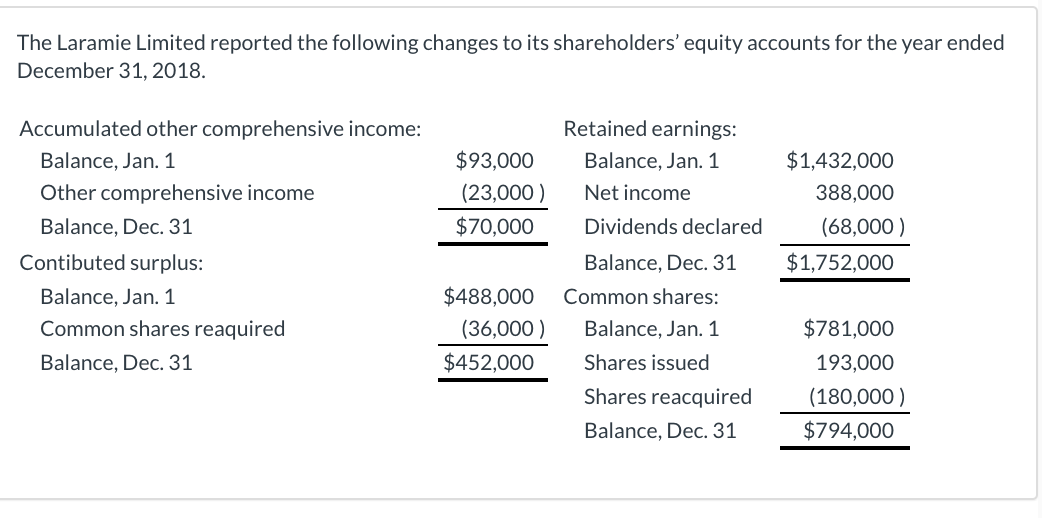

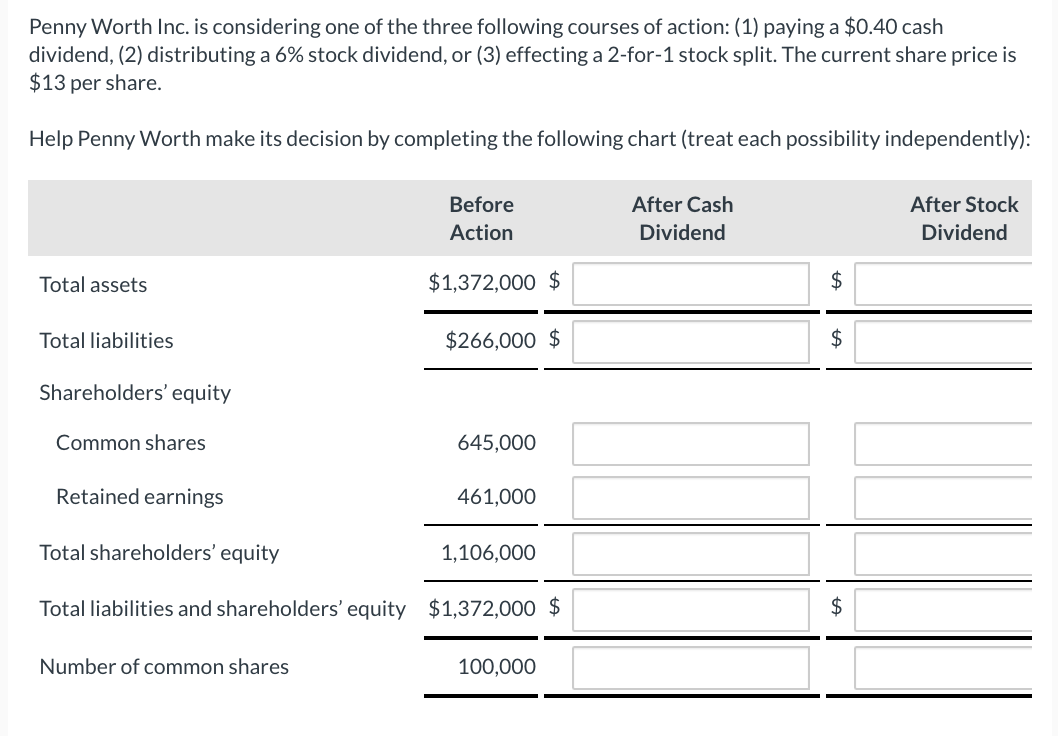

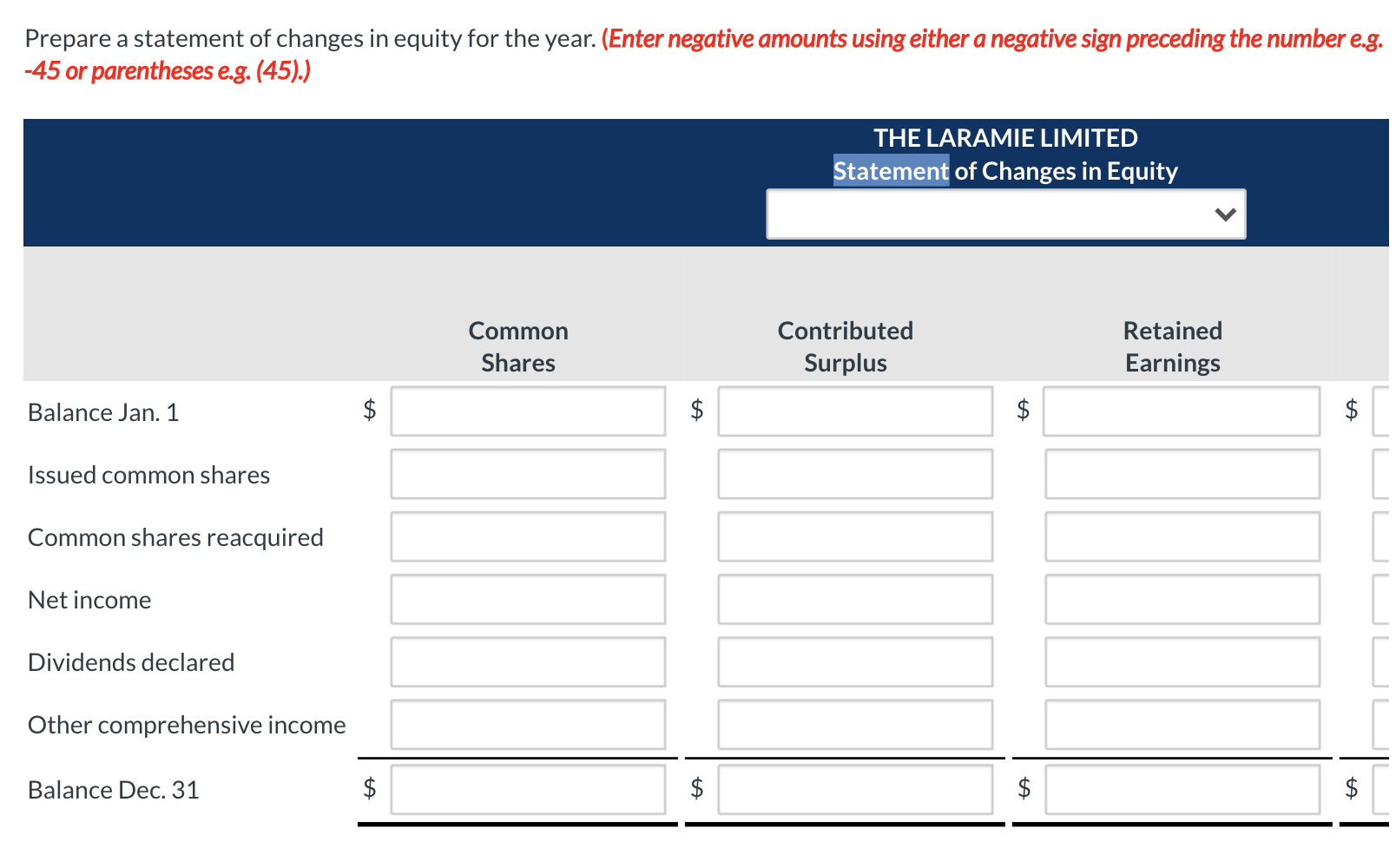

The Laramie Limited reported the following changes to its shareholders' equity accounts for the year ended December 31, 2018. $93,000 (23,000 $70,000 Accumulated other comprehensive income: Balance, Jan. 1 Other comprehensive income Balance, Dec. 31 Contibuted surplus: Balance, Jan. 1 Common shares reaquired Balance, Dec. 31 $1,432,000 388,000 (68,000) $1,752,000 Retained earnings: Balance, Jan. 1 Net income Dividends declared Balance, Dec. 31 Common shares: Balance, Jan. 1 Shares issued Shares reacquired Balance, Dec. 31 $488,000 (36,000 $452,000 $781,000 193,000 (180,000) $794,000 Penny Worth Inc. is considering one of the three following courses of action: (1) paying a $0.40 cash dividend, (2) distributing a 6% stock dividend, or (3) effecting a 2-for-1 stock split. The current share price is $13 per share. Help Penny Worth make its decision by completing the following chart (treat each possibility independently): Before Action After Cash Dividend After Stock Dividend Total assets $1,372,000 $ Total liabilities $266,000 $ $ Shareholders' equity Common shares 645,000 Retained earnings 461,000 Total shareholders' equity 1,106,000 Total liabilities and shareholders' equity $1,372,000 $ $ Number of common shares 100,000 Prepare a statement of changes in equity for the year. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) THE LARAMIE LIMITED Statement of Changes in Equity Common Shares Contributed Surplus Retained Earnings Balance Jan. 1 $ $ $ LA Issued common shares Common shares reacquired Net income Dividends declared Other comprehensive income A Balance Dec. 31 $ $ $ $ The Laramie Limited reported the following changes to its shareholders' equity accounts for the year ended December 31, 2018. $93,000 (23,000 $70,000 Accumulated other comprehensive income: Balance, Jan. 1 Other comprehensive income Balance, Dec. 31 Contibuted surplus: Balance, Jan. 1 Common shares reaquired Balance, Dec. 31 $1,432,000 388,000 (68,000) $1,752,000 Retained earnings: Balance, Jan. 1 Net income Dividends declared Balance, Dec. 31 Common shares: Balance, Jan. 1 Shares issued Shares reacquired Balance, Dec. 31 $488,000 (36,000 $452,000 $781,000 193,000 (180,000) $794,000 Penny Worth Inc. is considering one of the three following courses of action: (1) paying a $0.40 cash dividend, (2) distributing a 6% stock dividend, or (3) effecting a 2-for-1 stock split. The current share price is $13 per share. Help Penny Worth make its decision by completing the following chart (treat each possibility independently): Before Action After Cash Dividend After Stock Dividend Total assets $1,372,000 $ Total liabilities $266,000 $ $ Shareholders' equity Common shares 645,000 Retained earnings 461,000 Total shareholders' equity 1,106,000 Total liabilities and shareholders' equity $1,372,000 $ $ Number of common shares 100,000 Prepare a statement of changes in equity for the year. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) THE LARAMIE LIMITED Statement of Changes in Equity Common Shares Contributed Surplus Retained Earnings Balance Jan. 1 $ $ $ LA Issued common shares Common shares reacquired Net income Dividends declared Other comprehensive income A Balance Dec. 31 $ $ $ $