Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the last 2 questios please please Use the following information on Company Y and peltorm pro-formea financial modeling usung a planned expansan method fo answers

the last 2 questios please

please

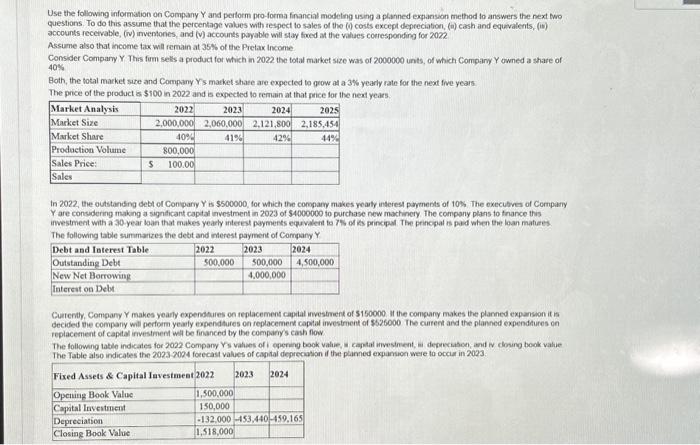

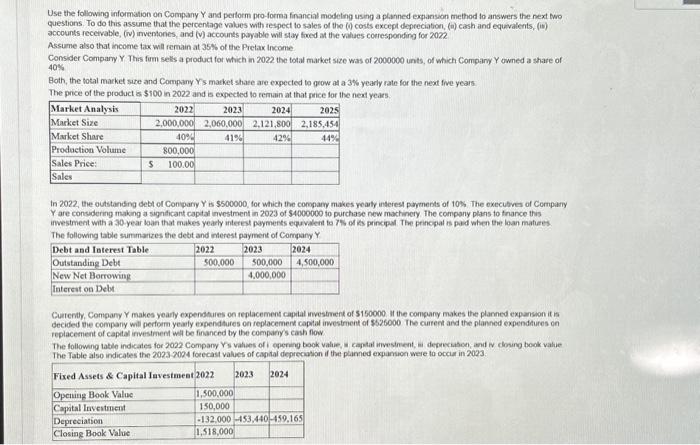

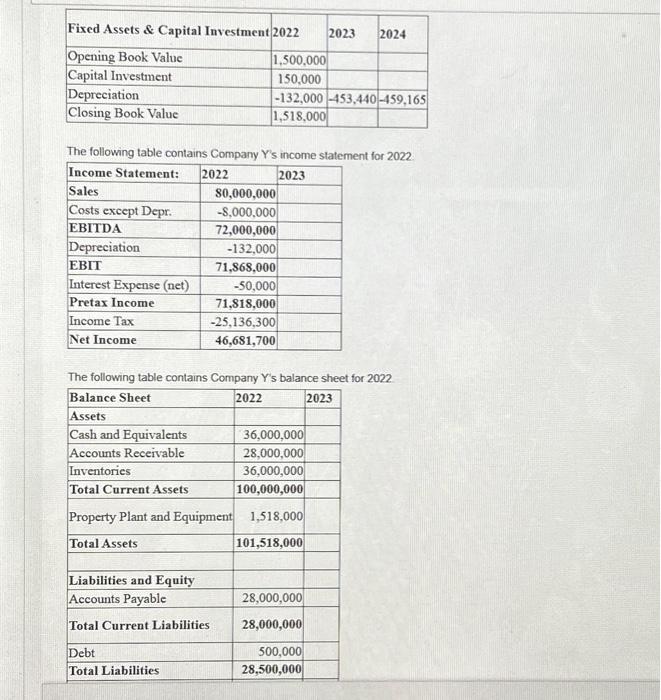

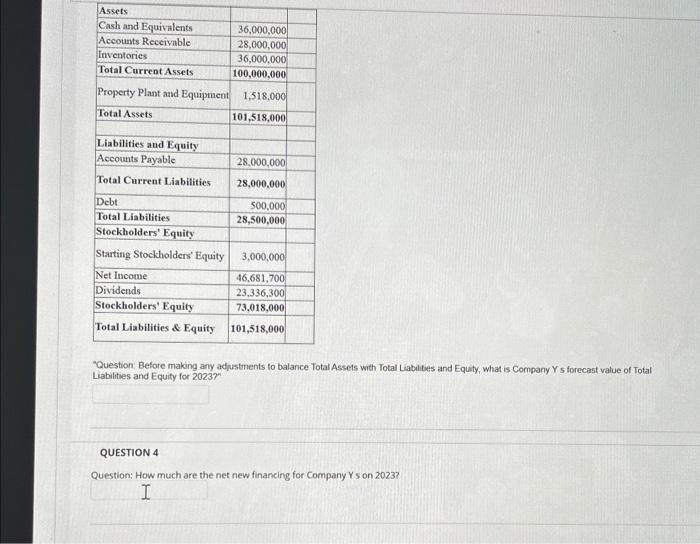

Use the following information on Company Y and peltorm pro-formea financial modeling usung a planned expansan method fo answers the next Wo questions. To do this assume that the percentage valaes with sespect to sales of the (o) costs except depreciation, (i) cash and equivalents, (it) accounts recervable, (iv) inventones, and (v) accounts payable will stay faed at the vahaes coeresponding for 2022 . Assume also that income tax wil renain at 35 of the Pretax income Consider Compary Y This firm sells a product fot which in 2022 the total market size was of 2000000 units, of which Company Y owned a share of 404 Both, the botal market sire and Company Yrs matket shate are expected to grow at a 3% yearly rate for the neat fwe years. The price of the product is $100 in 2022 and is expected to remin at that netice lor the neat years. In 2022, the outstanding debt of Conpary Y is $500000, for which the compary makes yeauly interest payments af 10y, The oxecubive af Cernpatr Y are consdering making a signdicant captal investment in 2023 of 54000000 to purchase new machinery. The company plans to france this investment with a 30 year ban that makes yearly interest payments equvaleit fo 7 th of is pincipal The princpal is pad when the loan mafuees. The following table summaries the debt and merest payment of Compans Y Burtertly, Compary Y makes yoarly expendeares on teplacement capial inestrent of 5150000 . the compary makes ite planned expansion it is decided the compary will pertoem yeaply expenditures on replacemen caphal investroent of 5526000 The current and the planned expenditures en replacement of capial irvestrent well be financed by the compary's cash foov The Table also indicates the 2023.2024 foeccast values of captal deprecastion if the planned expansioc were to occiar in 2023. The following table contains Comparv Y's inrome statement for 2022 The following table contains Company Y s balance sheet for 2022 "Question: Before makng any adjustments to balance Total Assets with Total Liabilbes and Equity, what is Company Y s forecast value of Total Liabilities and Equity for 2023 ? QUESTION 4 Question: How much are the net new financing for Company Ys on 2023? Use the following information on Company Y and peltorm pro-formea financial modeling usung a planned expansan method fo answers the next Wo questions. To do this assume that the percentage valaes with sespect to sales of the (o) costs except depreciation, (i) cash and equivalents, (it) accounts recervable, (iv) inventones, and (v) accounts payable will stay faed at the vahaes coeresponding for 2022 . Assume also that income tax wil renain at 35 of the Pretax income Consider Compary Y This firm sells a product fot which in 2022 the total market size was of 2000000 units, of which Company Y owned a share of 404 Both, the botal market sire and Company Yrs matket shate are expected to grow at a 3% yearly rate for the neat fwe years. The price of the product is $100 in 2022 and is expected to remin at that netice lor the neat years. In 2022, the outstanding debt of Conpary Y is $500000, for which the compary makes yeauly interest payments af 10y, The oxecubive af Cernpatr Y are consdering making a signdicant captal investment in 2023 of 54000000 to purchase new machinery. The company plans to france this investment with a 30 year ban that makes yearly interest payments equvaleit fo 7 th of is pincipal The princpal is pad when the loan mafuees. The following table summaries the debt and merest payment of Compans Y Burtertly, Compary Y makes yoarly expendeares on teplacement capial inestrent of 5150000 . the compary makes ite planned expansion it is decided the compary will pertoem yeaply expenditures on replacemen caphal investroent of 5526000 The current and the planned expenditures en replacement of capial irvestrent well be financed by the compary's cash foov The Table also indicates the 2023.2024 foeccast values of captal deprecastion if the planned expansioc were to occiar in 2023. The following table contains Comparv Y's inrome statement for 2022 The following table contains Company Y s balance sheet for 2022 "Question: Before makng any adjustments to balance Total Assets with Total Liabilbes and Equity, what is Company Y s forecast value of Total Liabilities and Equity for 2023 ? QUESTION 4 Question: How much are the net new financing for Company Ys on 2023 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started