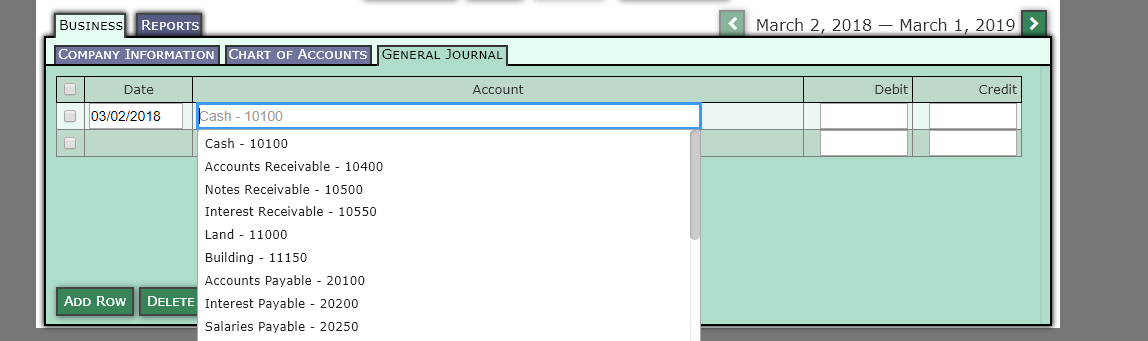

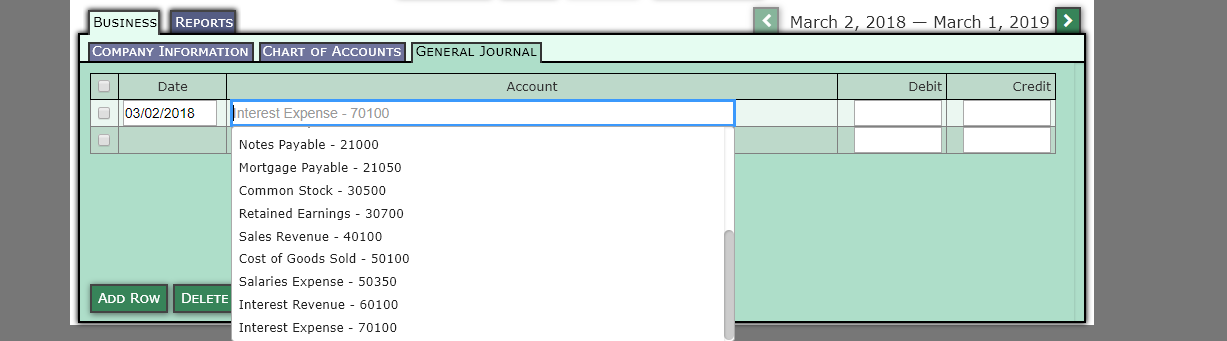

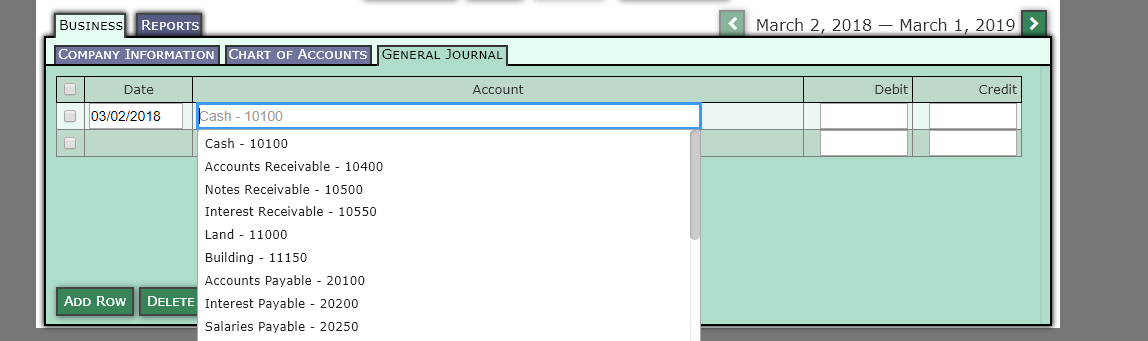

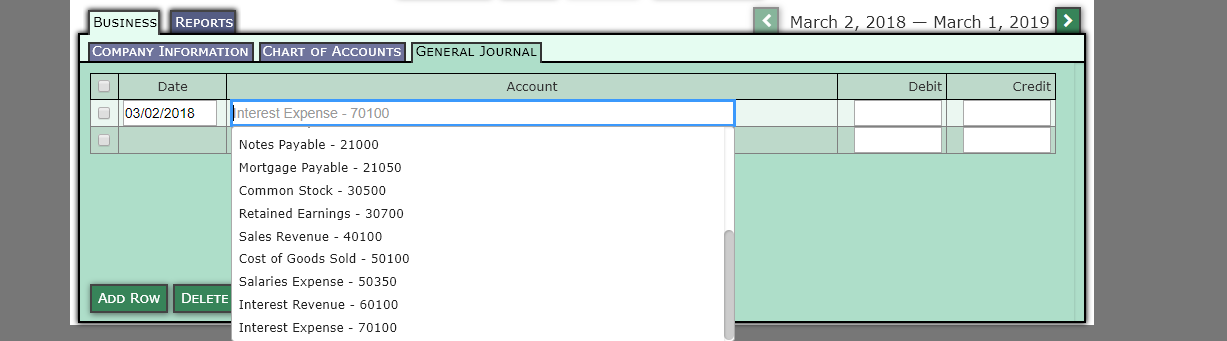

the last two pictures are the titles of the accounts that i have to use. thank you!

the last two pictures are the titles of the accounts that i have to use. thank you!

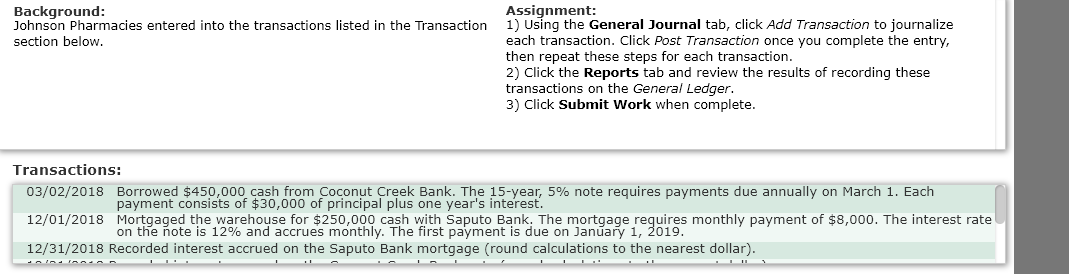

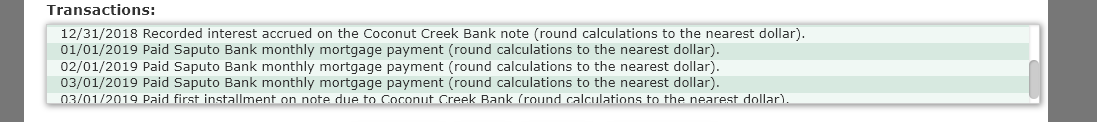

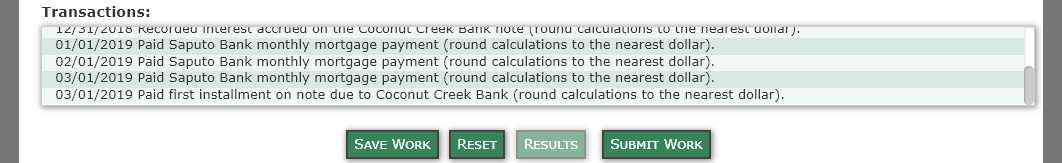

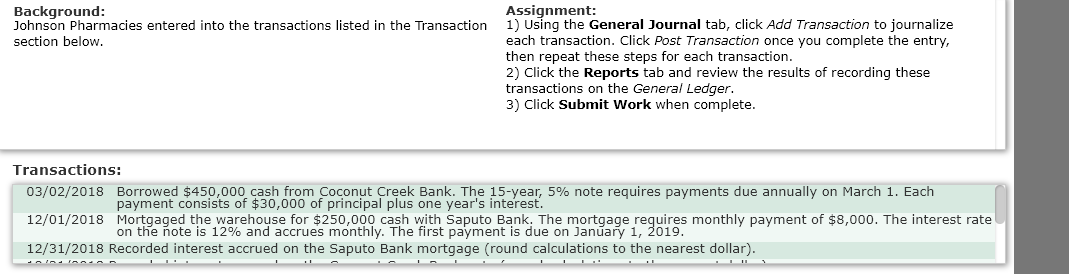

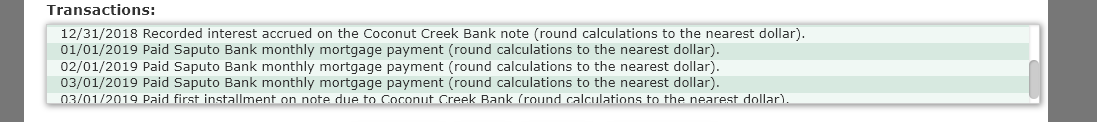

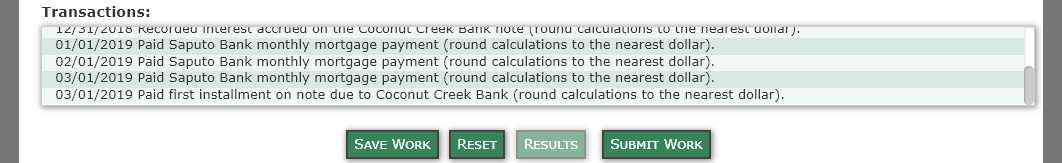

Background: Johnson Pharmacies entered into the transactions listed in the Transaction section below. Assignment: 1) Using the General Journal tab, click Add Transaction to journalize each transaction. Click Post Transaction once you complete the entry, then repeat these steps for each transaction. 2) Click the Reports tab and review the results of recording these transactions on the General Ledger. 3) Click Submit Work when complete. Transactions: 03/02/2018 Borrowed $450,000 cash from Coconut Creek Bank. The 15-year, 5% note requires payments due annually on March 1. Each payment consists of $30,000 of principal plus one year's interest. 12/01/2018 Mortgaged the warehouse for $250,000 cash with Saputo Bank. The mortgage requires monthly payment of $8,000. The interest rate on the note is 12% and accrues monthly. The first payment is due on January 1, 2019. 12/31/2018 Recorded interest accrued on the Saputo Bank mortgage (round calculations to the nearest dollar). Transactions: 12/31/2018 Recorded interest accrued on the Coconut Creek Bank note (round calculations to the nearest dollar). 01/01/2019 Paid Saputo Bank monthly mortgage payment (round calculations to the nearest dollar). 02/01/2019 Paid Saputo Bank monthly mortgage payment (round calculations to the nearest dollar). 03/01/2019 Paid Saputo Bank monthly mortgage payment (round calculations to the nearest dollar). 03/01/2019 Paid first installment on note due to Coconut Creek Bank (round calculations to the nearest dollar). Debit Credit BUSINESS REPORTS COMPANY INFORMATION CHART OF ACCOUNTS GENERAL JOURNAL 0 Date Account O 03/02/2018 Cash - 10100 Cash - 10100 Accounts Receivable - 10400 Notes Receivable - 10500 Interest Receivable - 10550 Land - 11000 Building - 11150 Accounts Payable - 20100 ADD Row DELETE Interest Payable - 20200 Salaries Payable - 20250 BUSINESS REPORTS COMPANY INFORMATION CHART OF ACCOUNTS GENERAL JOURNAL Account Debit Credit 0 O Date 03/02/2018 nterest Expense - 70100 Notes Payable - 21000 Mortgage Payable - 21050 Common Stock - 30500 Retained Earnings - 30700 Sales Revenue - 40100 Cost of Goods Sold - 50100 Salaries Expense - 50350 Interest Revenue - 60100 Interest Expense - 70100 ADD Row DELETE Background: Johnson Pharmacies entered into the transactions listed in the Transaction section below. Assignment: 1) Using the General Journal tab, click Add Transaction to journalize each transaction. Click Post Transaction once you complete the entry, then repeat these steps for each transaction. 2) Click the Reports tab and review the results of recording these transactions on the General Ledger. 3) Click Submit Work when complete. Transactions: 03/02/2018 Borrowed $450,000 cash from Coconut Creek Bank. The 15-year, 5% note requires payments due annually on March 1. Each payment consists of $30,000 of principal plus one year's interest. 12/01/2018 Mortgaged the warehouse for $250,000 cash with Saputo Bank. The mortgage requires monthly payment of $8,000. The interest rate on the note is 12% and accrues monthly. The first payment is due on January 1, 2019. 12/31/2018 Recorded interest accrued on the Saputo Bank mortgage (round calculations to the nearest dollar). Transactions: 12/31/2018 Recorded interest accrued on the Coconut Creek Bank note (round calculations to the nearest dollar). 01/01/2019 Paid Saputo Bank monthly mortgage payment (round calculations to the nearest dollar). 02/01/2019 Paid Saputo Bank monthly mortgage payment (round calculations to the nearest dollar). 03/01/2019 Paid Saputo Bank monthly mortgage payment (round calculations to the nearest dollar). 03/01/2019 Paid first installment on note due to Coconut Creek Bank (round calculations to the nearest dollar). Debit Credit BUSINESS REPORTS COMPANY INFORMATION CHART OF ACCOUNTS GENERAL JOURNAL 0 Date Account O 03/02/2018 Cash - 10100 Cash - 10100 Accounts Receivable - 10400 Notes Receivable - 10500 Interest Receivable - 10550 Land - 11000 Building - 11150 Accounts Payable - 20100 ADD Row DELETE Interest Payable - 20200 Salaries Payable - 20250 BUSINESS REPORTS COMPANY INFORMATION CHART OF ACCOUNTS GENERAL JOURNAL Account Debit Credit 0 O Date 03/02/2018 nterest Expense - 70100 Notes Payable - 21000 Mortgage Payable - 21050 Common Stock - 30500 Retained Earnings - 30700 Sales Revenue - 40100 Cost of Goods Sold - 50100 Salaries Expense - 50350 Interest Revenue - 60100 Interest Expense - 70100 ADD Row DELETE

the last two pictures are the titles of the accounts that i have to use. thank you!

the last two pictures are the titles of the accounts that i have to use. thank you!