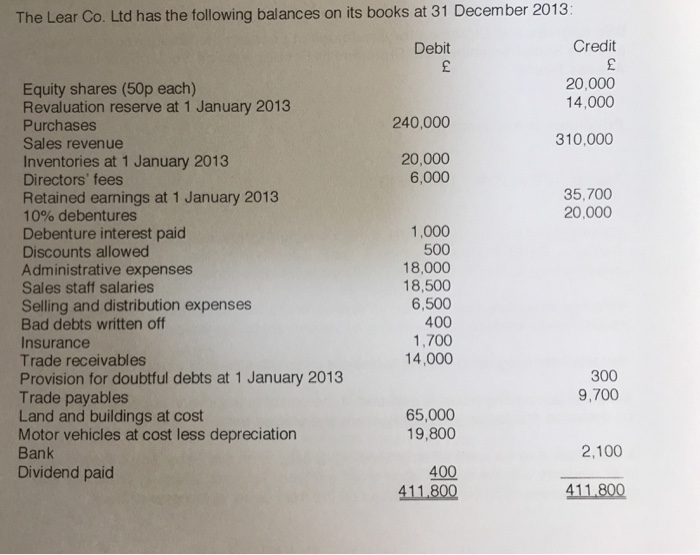

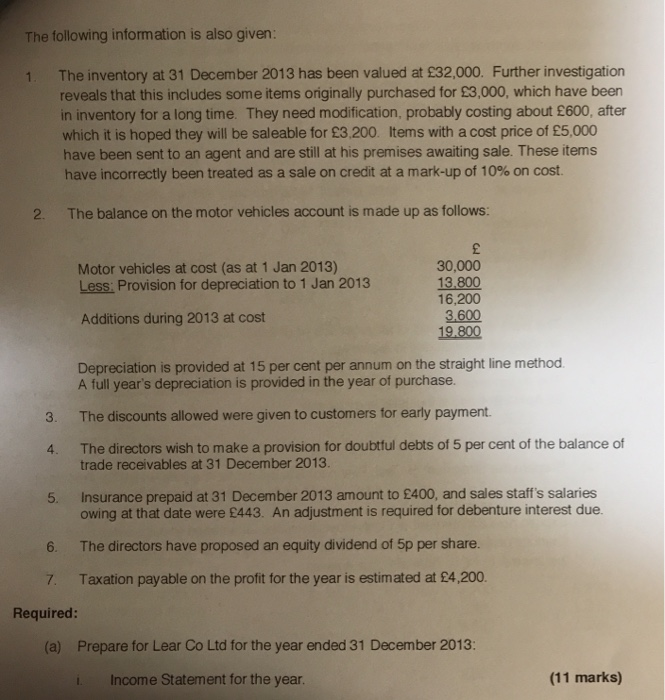

The Lear Co. Ltd has the following balances on its books at 31 December 2013: Credit Debit 20,000 14,000 Equity shares (50p each) Revaluation reserve at 1 January 2013 Purchases Sales revenue Inventories at 1 January 2013 Directors fees Retained earnings at 1 January 2013 10% debentures Debenture interest paid Discounts allowed Administrative expenses Sales staff salaries Selling and distribution expenses Bad debts written off Insurance Trade receivables Provision for doubtful debts at 1 January 2013 Trade payables Land and buildings at cost Motor vehicles at cost less depreciation Bank Dividend paid 240,000 310,000 20,000 6,000 35,700 20,000 1,000 500 18,000 18,500 6,500 400 1,700 14,000 300 9,700 65,000 19,800 2,100 400 411.800 The following information is also given: The inventory at 31 December 2013 has been valued at 32,000. Further investigation reveals that this includes some items originally purchased for 3,000, which have been in inventory for a long time. They need modification, probably costing about 600, after which it is hoped they will be saleable for 3,200. Items with a cost price of 5,000 have been sent to an agent and are still at his premises awaiting sale. These items have incorrectly been treated as a sale on credit at a mark-up of 10% on cost 1. 2. The balance on the motor vehicles account is made up as follows: 30,000 13.800 16,200 3600 19,800 Motor vehicles at cost (as at 1 Jan 2013) Less: Provision for depreciation to 1 Jan 2013 Additions during 2013 at cost Depreciation is provided at 15 per cent per annum on the straight line method A full year's depreciation is provided in the year of purchase. 3. The discounts allowed were given to customers for early payment 4. The directors wish to make a provision for doubtful debts of 5 per cent of the balance of 5. Insurance prepaid at 31 December 2013 amount to 400, and sales staff's salaries 6. The directors have proposed an equity dividend of 5p per share. trade receivables at 31 December 2013. owing at that date were 443. An adjustment is required for debenture interest due. Taxation payable on the profit for the year is estimated at 4,200. 7. Required: Prepare for Lear Co Ltd for the year ended 31 December 2013: (a) (11 marks) i Income Statement for the year The Lear Co. Ltd has the following balances on its books at 31 December 2013: Credit Debit 20,000 14,000 Equity shares (50p each) Revaluation reserve at 1 January 2013 Purchases Sales revenue Inventories at 1 January 2013 Directors fees Retained earnings at 1 January 2013 10% debentures Debenture interest paid Discounts allowed Administrative expenses Sales staff salaries Selling and distribution expenses Bad debts written off Insurance Trade receivables Provision for doubtful debts at 1 January 2013 Trade payables Land and buildings at cost Motor vehicles at cost less depreciation Bank Dividend paid 240,000 310,000 20,000 6,000 35,700 20,000 1,000 500 18,000 18,500 6,500 400 1,700 14,000 300 9,700 65,000 19,800 2,100 400 411.800 The following information is also given: The inventory at 31 December 2013 has been valued at 32,000. Further investigation reveals that this includes some items originally purchased for 3,000, which have been in inventory for a long time. They need modification, probably costing about 600, after which it is hoped they will be saleable for 3,200. Items with a cost price of 5,000 have been sent to an agent and are still at his premises awaiting sale. These items have incorrectly been treated as a sale on credit at a mark-up of 10% on cost 1. 2. The balance on the motor vehicles account is made up as follows: 30,000 13.800 16,200 3600 19,800 Motor vehicles at cost (as at 1 Jan 2013) Less: Provision for depreciation to 1 Jan 2013 Additions during 2013 at cost Depreciation is provided at 15 per cent per annum on the straight line method A full year's depreciation is provided in the year of purchase. 3. The discounts allowed were given to customers for early payment 4. The directors wish to make a provision for doubtful debts of 5 per cent of the balance of 5. Insurance prepaid at 31 December 2013 amount to 400, and sales staff's salaries 6. The directors have proposed an equity dividend of 5p per share. trade receivables at 31 December 2013. owing at that date were 443. An adjustment is required for debenture interest due. Taxation payable on the profit for the year is estimated at 4,200. 7. Required: Prepare for Lear Co Ltd for the year ended 31 December 2013: (a) (11 marks) i Income Statement for the year