Question

The lease agreement and related facts indicate the following: Leased equipment had a retail cash selling price of $320,000. Its useful life was five years

The lease agreement and related facts indicate the following:

Leased equipment had a retail cash selling price of $320,000. Its useful life was five years with no residual value.

The lease term is Four years and the lessor paid $275,000 to acquire the equipment (thus, selling profit).

Lessors implicit rate when calculating annual lease payments was 8%.

Annual lease payments beginning January 1, 2018, the beginning of the lease, were $89,458.

Incremental costs of commissions for brokering the lease and consummating the completed lease transaction incurred by the lessor were $7,700.

Required: 1. & 2. Prepare the appropriate entries for the lessor to record the lease and the initial payment at its commencement and any entry(s) necessary at December 31, 2018, the fiscal year-end.

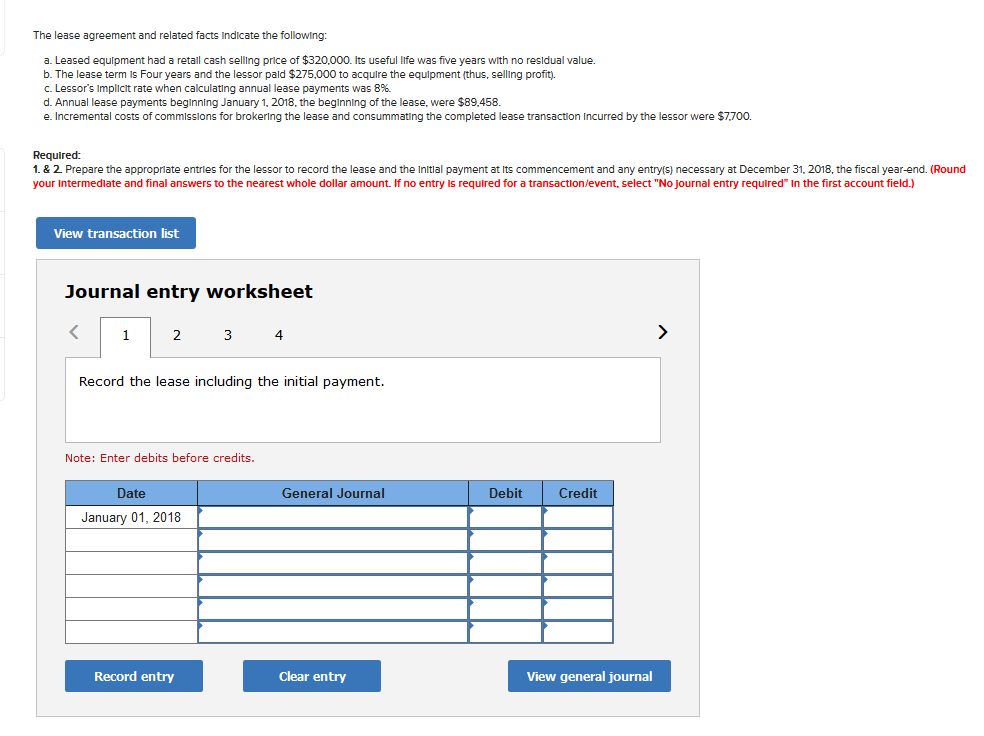

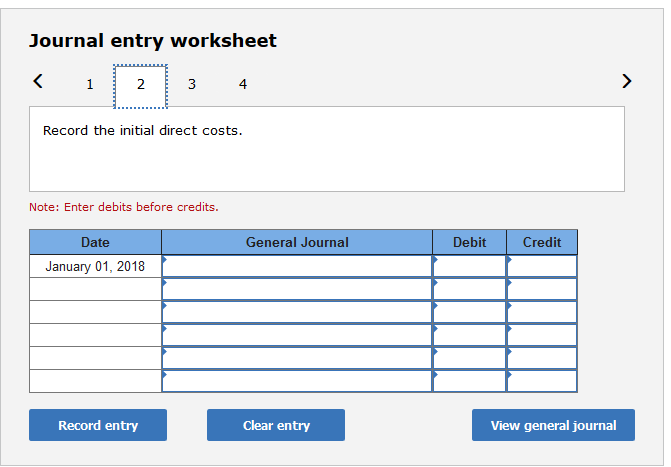

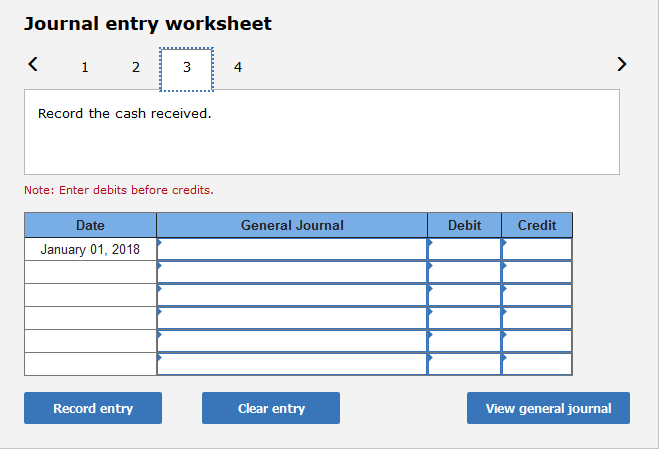

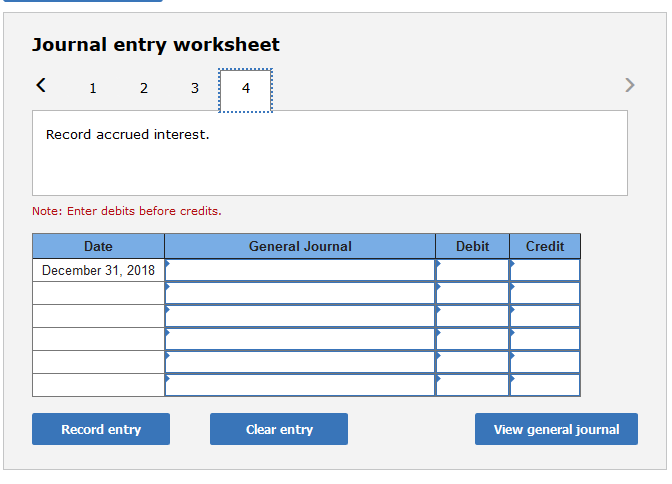

The lease agreement and related facts Indicate the following: a. Leased equipment had a retall cash selling price of $320,000. lts useful lfe was five years with no resldual value. b. The lease term is Four years and the lessor pald $275,000 to acquire the equlpment (thus, selling profit. c. Lessor's implicit rate when calculating annual lease payments was 8%. d. Annual lease payments beginning January 1, 2018, the beginning of the lease, were $89.458. e. Incremental costs of commlssions for brokering the lease and consummating the completed lease transaction Incurred by the lessor were $7,700. 1.& 2 Prepare the appropriate entries for the lessor to record the lease and the Initlal payment at Its commencement and any entry(s) necessary at December 31, 2018, the fiscal year-end. (Round your Intermedlate and final answers to the nearest whole dollar amount. If no entry is required for a transaction/event, select "No Journal entry required In the first account field.) View transaction list Journal entry worksheet 4 Record the lease including the initial payment. Note: Enter debits before credits. Date General Journal Debit Credit January 01, 2018 Record entry Clear entry View general journalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started