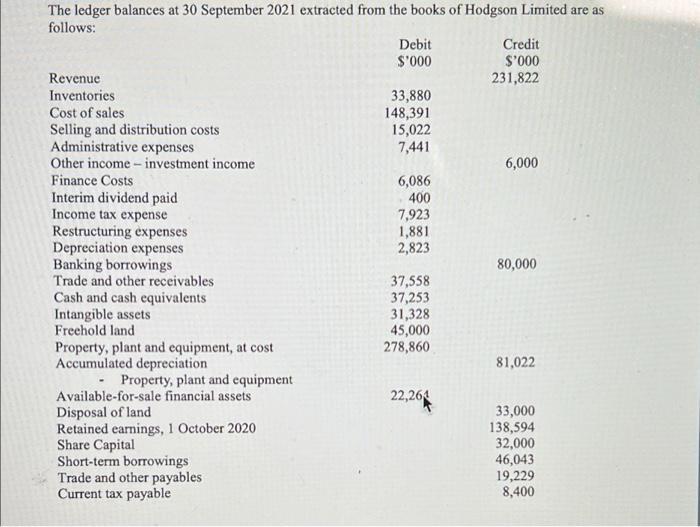

The ledger balances at 30 September 2021 extracted from the books of Hodgson Limited are as follows: Revenue Inventories Cost of sales Selling and

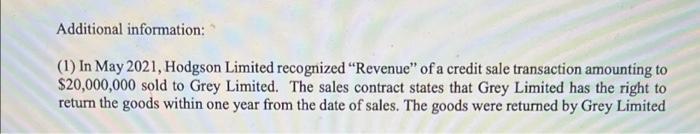

The ledger balances at 30 September 2021 extracted from the books of Hodgson Limited are as follows: Revenue Inventories Cost of sales Selling and distribution costs Administrative expenses Other income-investment income Finance Costs Interim dividend paid Income tax expense Restructuring expenses. Depreciation expenses Banking borrowings Trade and other receivables Cash and cash equivalents Intangible assets Freehold land Property, plant and equipment, at cost Accumulated depreciation Property, plant and equipment Available-for-sale financial assets Disposal of land Retained earnings, 1 October 2020 Share Capital Short-term borrowings Trade and other payables Current tax payable Debit $'000 33,880 148,391 15,022 7,441 6,086 400 7,923 1,881 2,823 37,558 37,253 31,328 45,000 278,860 22,264 Credit $'000 231,822 6,000 80,000 81,022 33,000 138,594 32,000 46,043 19,229 8,400 Additional information: (1) In May 2021, Hodgson Limited recognized "Revenue" of a credit sale transaction amounting to $20,000,000 sold to Grey Limited. The sales contract states that Grey Limited has the right to return the goods within one year from the date of sales. The goods were returned by Grey Limited in July but all the relevant transactions have not been recorded. Cost of the related sales amounted to $12,800,000. (2) Hodgson Limited uses perpetual system to record inventories. (3) Depreciation charges on all items of property, plant and equipment for the year ended 30 September 2021 have been made before the extraction of ledger balances. Depreciation charges are to be grouped under "Administrative expense" in the financial statement. (4) "Bank borrowings" represent a bank loan. $10,000,000 will become due during the year ending 30 September 2022. (5) The fair value of the "financial assets" at 30 September 2021 is close to their carrying amounts. (6)" Disposal of land" represents the sales proceeds of a plot of freehold land sold during the year ended 30 September 2021. The cost of land was $28,500,000. The land is held for sale. Required: Prepare the Statement of Comprehensive Income (using function of expenses method) for the year ended 30 September 2021 and the Statement of Financial Position as at 30 September 2021 of Hodgson Limited. You are required to present the figures in thousands. Your presentation of the two statements has to comply with the format required under IFRS (please refer to Chapter 2 & 3, Spiceland).

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started