Question

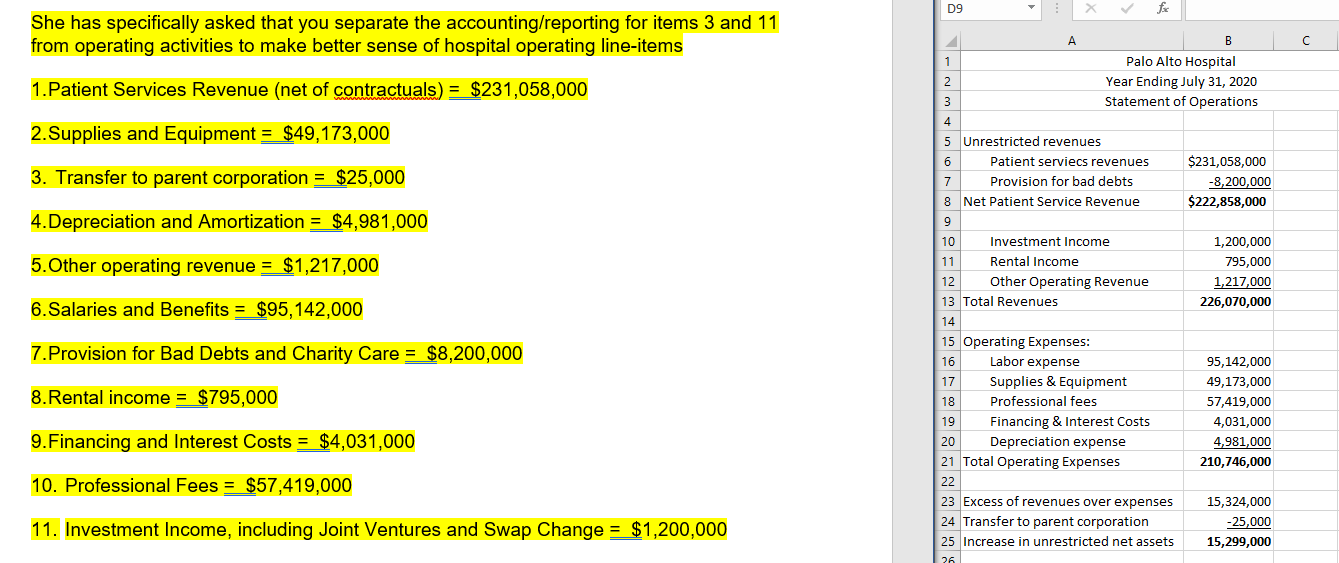

The left is the information given. The right is the excel sheet I prepared. I am not very good with accounting, but have been trying

The left is the information given. The right is the excel sheet I prepared.

I am not very good with accounting, but have been trying hard in my healthcare finance class. We were asked to read a case study and then given some numbers. The task here is to figure out which kind of financial statement to prepare and to create an excel sheet. Financial statements we've learned this week include: Balance Sheet, Statement of Operations (income), Statement of Changes in Net Assets, and Statement of Cash Flows.

Based on the numbers given, I felt like the Statement of Operations was the best option. Is this right? If so, did I enter the numbers right on excel? I have a quiz after based on this information. Class powerpoints and lectures didn't help a whole lot.

If I did it wrong, could somebody please help me by correcting it? Thank you so much.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started