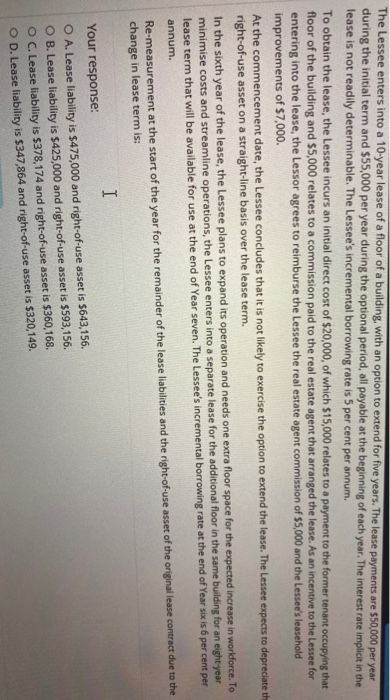

The Lessee enters into a 10-year lease of a floor of a building, with an option to extend for five years. The lease payments are $50,000 per year during the initial term and $55,000 per year during the optional period, all payable at the beginning of each year. The interest rate implicit in the lease is not readily determinable. The Lessee's incremental borrowing rate is 5 per cent per annum To obtain the lease, the Lessee incurs an initial direct cost of $20,000, of which $15,000 relates to a payment to the former tenant occupying that floor of the building and $5,000 relates to a commission paid to the real estate agent that arranged the lease. As an incentive to the Lessee for entering into the lease, the Lessor agrees to reimburse the Lessee the real estate agent commission of 55,000 and the Lessee's leasehold improvements of $7,000. At the commencement date, the Lessee concludes that it is not likely to exercise the option to extend the lease. The Lessee expects to depreciate the right-of-use asset on a straight-line basis over the lease term. In the sixth year of the lease, the Lessee plans to expand its operation and needs one extra floor space for the expected increase in workforce. To minimise costs and streamline operations, the Lessee enters into a separate lease for the additional floor in the same building for an eight year lease term that will be available for use at the end of Year seven. The Lessee's incremental borrowing rate at the end of Year six is 6 per cent per annum. Re-measurement at the start of the year for the remainder of the lease liabilities and the right-of-use asset of the original lease contract due to the change in lease term is: 1 Your response: O A. Lease liability is $475,000 and right-of-use asset is 5643,156. O B.Lease liability is $425,000 and right-of-use asset is $593,156. O C. Lease liability is $378,174 and right-of-use asset is $360,168, O D. Lease liability is $347,864 and right-of-use asset is $320,149. The Lessee enters into a 10-year lease of a floor of a building, with an option to extend for five years. The lease payments are $50,000 per year during the initial term and $55,000 per year during the optional period, all payable at the beginning of each year. The interest rate implicit in the lease is not readily determinable. The Lessee's incremental borrowing rate is 5 per cent per annum To obtain the lease, the Lessee incurs an initial direct cost of $20,000, of which $15,000 relates to a payment to the former tenant occupying that floor of the building and $5,000 relates to a commission paid to the real estate agent that arranged the lease. As an incentive to the Lessee for entering into the lease, the Lessor agrees to reimburse the Lessee the real estate agent commission of 55,000 and the Lessee's leasehold improvements of $7,000. At the commencement date, the Lessee concludes that it is not likely to exercise the option to extend the lease. The Lessee expects to depreciate the right-of-use asset on a straight-line basis over the lease term. In the sixth year of the lease, the Lessee plans to expand its operation and needs one extra floor space for the expected increase in workforce. To minimise costs and streamline operations, the Lessee enters into a separate lease for the additional floor in the same building for an eight year lease term that will be available for use at the end of Year seven. The Lessee's incremental borrowing rate at the end of Year six is 6 per cent per annum. Re-measurement at the start of the year for the remainder of the lease liabilities and the right-of-use asset of the original lease contract due to the change in lease term is: 1 Your response: O A. Lease liability is $475,000 and right-of-use asset is 5643,156. O B.Lease liability is $425,000 and right-of-use asset is $593,156. O C. Lease liability is $378,174 and right-of-use asset is $360,168, O D. Lease liability is $347,864 and right-of-use asset is $320,149