Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Lexington Company produces gas grills. This year's expected production is 2 0 , 0 0 0 units. Currently, Lexington makes all of the side

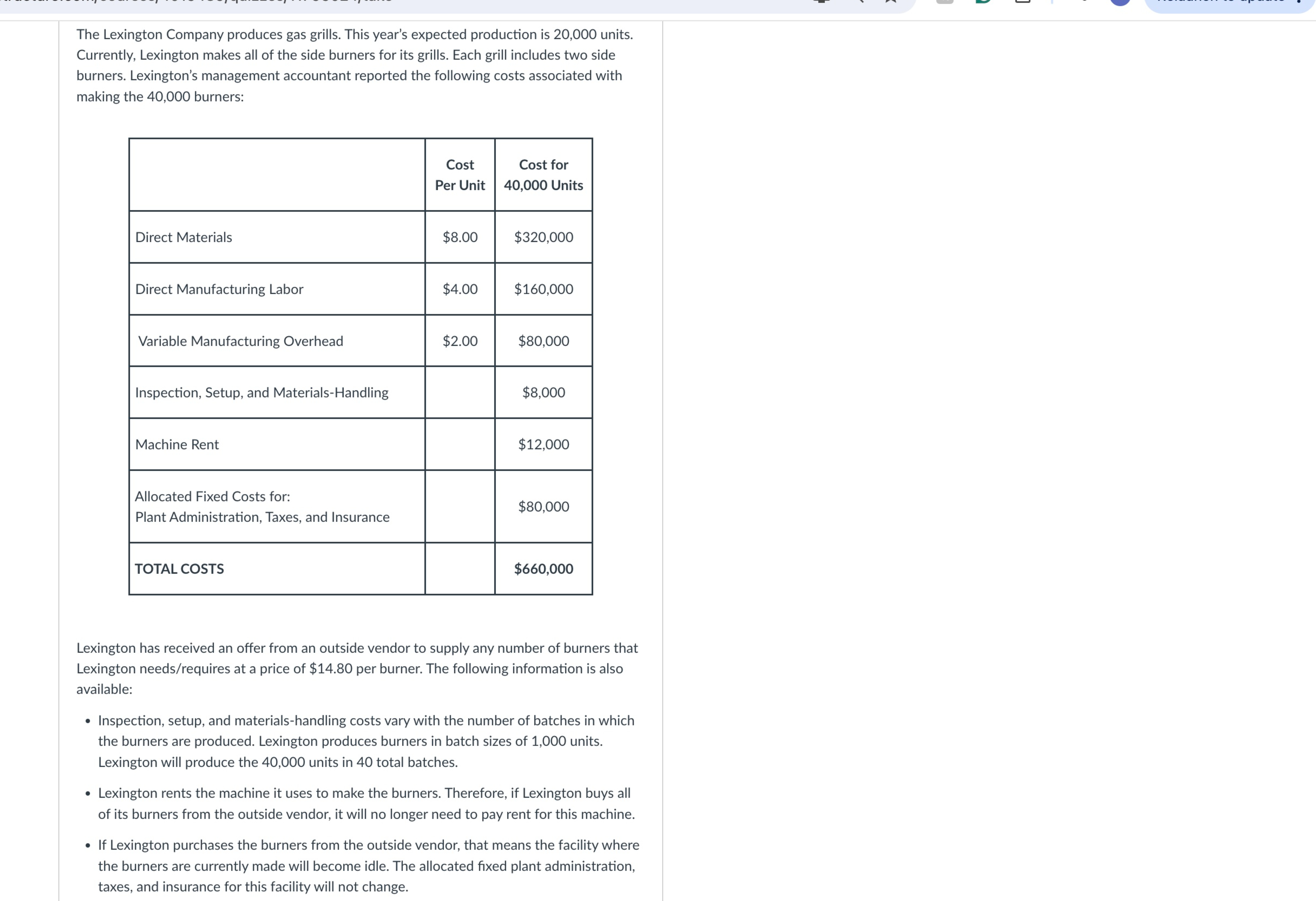

The Lexington Company produces gas grills. This year's expected production is units. Currently, Lexington makes all of the side burners for its grills. Each grill includes two side burners. Lexington's management accountant reported the following costs associated with making the burners:

tabletableCostPer UnittableCost for UnitsDirect Materials,$$Direct Manufacturing Labor,$$Variable Manufacturing Overhead,$$Inspection Setup, and MaterialsHandling,,$Machine Rent,,$tableAllocated Fixed Costs for:Plant Administration, Taxes, and Insurance$TOTAL COSTS,,$

Lexington has received an offer from an outside vendor to supply any number of burners that Lexington needsrequires at a price of $ per burner. The following information is also available:

Inspection, setup, and materialshandling costs vary with the number of batches in which the burners are produced. Lexington produces burners in batch sizes of units. Lexington will produce the units in total batches.

Lexington rents the machine it uses to make the burners. Therefore, if Lexington buys all of its burners from the outside vendor, it will no longer need to pay rent for this machine.

If Lexington purchases the burners from the outside vendor, that means the facility where the burners are currently made will become idle. The allocated fixed plant administration, taxes, and insurance for this facility will not change. Lexington has received an offer from an outside vendor to supply any number of burners that

Lexington needsrequires at a price of $ per burner. The following information is also

available:

Inspection, setup, and materialshandling costs vary with the number of batches in which

the burners are produced. Lexington produces burners in batch sizes of units.

Lexington will produce the units in total batches.

Lexington rents the machine it uses to make the burners. Therefore, if Lexington buys all

of its burners from the outside vendor, it will no longer need to pay rent for this machine.

If Lexington purchases the burners from the outside vendor, that means the facility where

the burners are currently made will become idle. The allocated fixed plant administration,

taxes, and insurance for this facility will not change.

ANSWER THE FOLLOWING QUESTIONS:

Question a:

Describe what decision Lexington has to make?

Question b:

List the alternatives that Lexington can take in regards to the burners.

Question c:

Evaluate the alternatives for Lexington. Be sure to show your calculations and clearly identify

any relevant costs information.

Question d:

What are the qualitative factors that Lexington should consider when deciding whether or not

to outsource?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started