Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The LIFO liquidation that occurred in 2019 reported net income of $1million higher than if the liquidation had not occurred. Why did this occur and

The LIFO liquidation that occurred in 2019 reported net income of $1million higher than if the liquidation had not occurred. Why did this occur and what does this tell us about the unit costs of those units in beginning inventory that were sold during 2019?

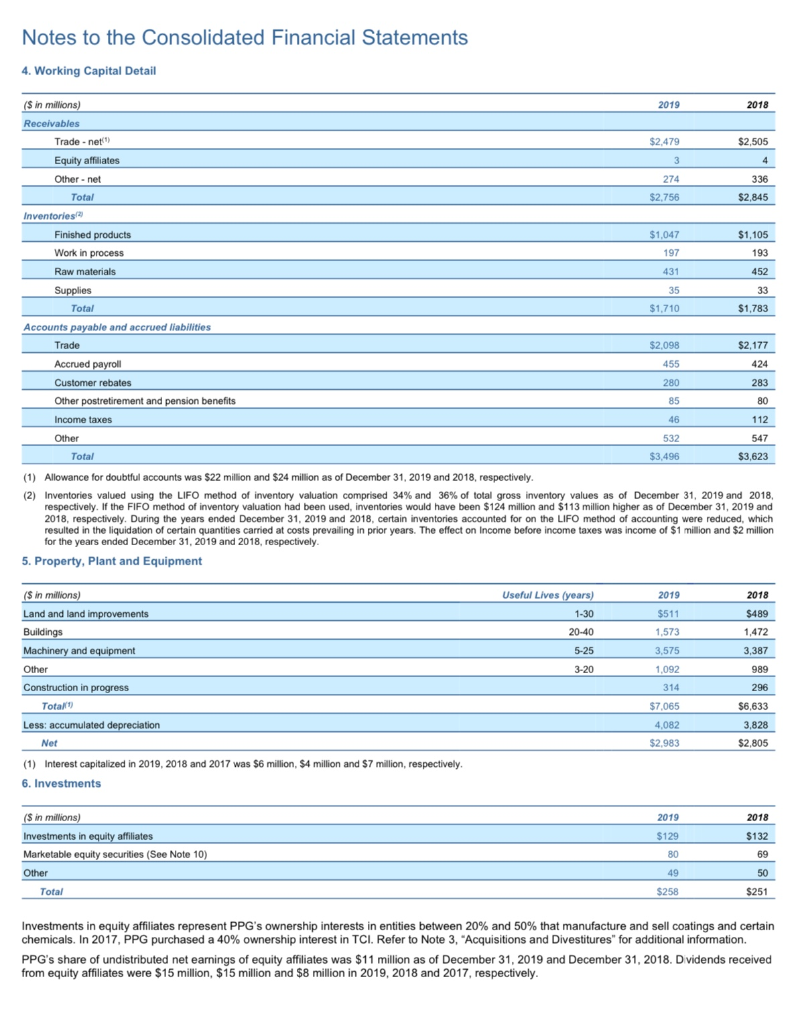

Notes to the Consolidated Financial Statements 4. Working Capital Detail 2019 2018 (S in millions) Receivables Trade-net Equity affiliates Other - net $2,505 $2,479 3 4 274 336 $2,845 Total $2.756 $1,047 $1,105 197 193 Inventories Finished products Work in process Raw materials Supplies Total 431 452 35 33 $1,710 $1.783 Accounts payable and accrued liabilities Trade $2,098 $2,177 455 424 280 283 Accrued payroll Customer rebates Other postretirement and pension benefits Income taxes 85 80 46 112 Other 547 532 $3,496 Total $3,623 (1) Allowance for doubtful accounts was $22 million and $24 million as of December 31, 2019 and 2018, respectively. (2) Inventories valued using the LIFO method of inventory valuation comprised 34% and 36% of total gross inventory values as of December 31, 2019 and 2018, respectively. If the FIFO method of inventory valuation had been used, inventories would have been $124 million and $113 million higher as of December 31, 2019 and 2018, respectively. During the years ended December 31, 2019 and 2018, certain inventories accounted for on the LIFO method of accounting were reduced, which resulted in the liquidation of certain quantities carried at costs prevailing in prior years. The effect on Income before income taxes was income of $1 million and $2 million for the years ended December 31, 2019 and 2018, respectively. 5. Property, Plant and Equipment (5 in millions) Land and land improvements Buildings Useful Lives (years) 1-30 20-40 2019 $511 2018 $489 1,472 1,573 Machinery and equipment 5-25 3,575 3,387 Other 3-20 1,092 989 314 296 $7,065 $6,633 Construction in progress Totalt Less: accumulated depreciation Net 4,082 $2,983 3,828 $2.805 (1) Interest capitalized in 2019, 2018 and 2017 was $6 million, 54 million and $7 million, respectively, 6. Investments 2019 2018 $129 $132 (5 in millions) Investments in equity affiliates Marketable equity securities (See Note 10) Other Total 80 69 49 50 $258 $251 Investments in equity affiliates represent PPG's ownership interests in entities between 20% and 50% that manufacture and sell coatings and certain chemicals. In 2017, PPG purchased a 40% ownership interest in TCI. Refer to Note 3, "Acquisitions and Divestitures" for additional information. PPG's share of undistributed net earnings of equity affiliates was $11 million as of December 31, 2019 and December 31, 2018. Dividends received from equity affiliates were $15 million, $15 million and $8 million in 2019, 2018 and 2017, respectively

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started