Answered step by step

Verified Expert Solution

Question

1 Approved Answer

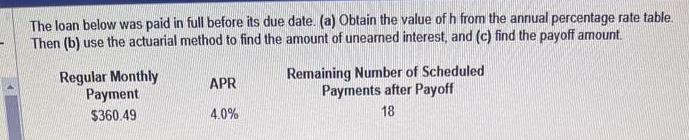

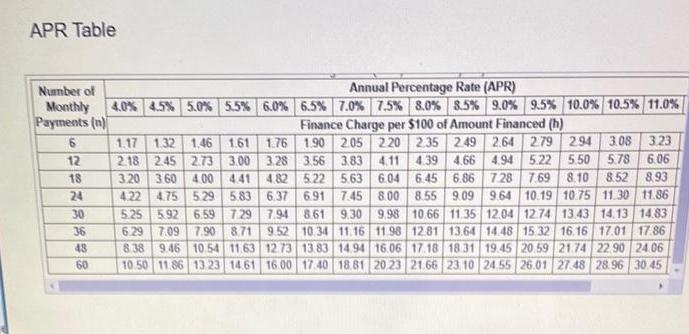

The loan below was paid in full before its due date. (a) Obtain the value of h from the annual percentage rate table. Then

The loan below was paid in full before its due date. (a) Obtain the value of h from the annual percentage rate table. Then (b) use the actuarial method to find the amount of unearned interest, and (c) find the payoff amount. Regular Monthly Payment $360.49 APR 4.0% Remaining Number of Scheduled Payments after Payoff 18 APR Table Number of Annual Percentage Rate (APR) Monthly 4.0% 4.5% 5.0% 5.5% 6.0% 6.5% 7.0% 7,5% 8.0 % 8.5% 9.0% 9.5% 10.0 % 10.5% 11.0% Payments (n) 6 12 2819 18 24 30 36 43 60 2.18 3.20 Finance Charge per $100 of Amount Financed (h) 1.17 1.32 1.46 1.61 1.76 1.90 2.05 220 235 249 2.64 2.79 2.94 3.08 3.23 2.45 2.73 3.00 3.28 3.56 3.83 4.11 4.39 4.66 4.94 5.22 5.50 5.78 6.06 3.60 4.00 4.41 4.82 5.22 5.63 6.04 6.45 6.86 7.28 7.69 8.10 8.52 8.93 4.22 4.75 5.29 5.83 6.37 6.91 7.45 8.00 8.55 9.09 9.64 10.19 10.75 11.30 11.86 5.25 5.92 6.59 7.29 7.94 8.61 9.30 9.98 10.66 11.35 12.04 12.74 13.43 14.13 14.83 6.29 7.09 7.90 8.71 9.52 10.34 11.16 11.98 12.81 13.64 15.32 16.16 17.01 17.86 8.38 9.46 10.54 11.63 12.73 13.83 14.94 16.06 17.18 18.31 19.45 20.59 21.74 22.90 24.06 10.50 11.86 13 23 14.61 16.00 17.40 18.81 20 23 21.66 23 10 24.55 26.01 27.48 28.96 30.45 The loan below was paid in full before its due date. (a) Obtain the value of h from the annual percentage rate table. Then (b) use the actuarial method to find the amount of unearned interest, and (c) find the payoff amount. Regular Monthly Payment $360.49 APR 4.0% Remaining Number of Scheduled Payments after Payoff 18 APR Table Number of Annual Percentage Rate (APR) Monthly 4.0% 4.5% 5.0% 5.5% 6.0% 6.5% 7.0 % 7,5% 8.0 % 8.5% 9.0% 9.5% 10.0 % 10.5% 11.0% Payments (n) 6 12 2819 18 24 30 36 43 60 2.18 3.20 Finance Charge per $100 of Amount Financed (h) 1.17 1.32 1.46 1.61 1.76 1.90 2.05 220 235 249 2.64 2.79 2.94 3.08 3.23 2.45 2.73 3.00 3.28 3.56 3.83 4.11 4.39 4.66 4.94 5.22 5.50 5.78 6.06 3.60 4.00 4.41 4.82 5.22 5.63 6.04 6.45 6.86 7.28 7.69 8.10 8.52 8.93 4.22 4.75 5.29 5.83 6.37 6.91 7.45 8.00 8.55 9.09 9.64 10.19 10.75 11.30 11.86 5.25 5.92 6.59 7.29 7.94 8.61 9.30 9.98 10.66 11.35 12.04 12.74 13.43 14.13 14.83 6.29 7.09 7.90 8.71 9.52 10.34 11.16 11.98 12.81 13.64 15.32 16.16 17.01 17.86 8.38 9.46 10.54 11.63 12.73 13.83 14.94 16.06 17.18 18.31 19.45 20.59 21.74 22.90 24.06 10.50 11.86 13 23 14.61 16.00 17.40 18.81 20 23 21.66 23 10 24.55 26.01 27.48 28.96 30.45

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Obtain the value of h from the annual percentage rate table Since the loan was paid in full before ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started