Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The loanable funds theory says that factors affecting the supply and demand for loanable funds explain the fluctuations in the market interest rate. Before examining

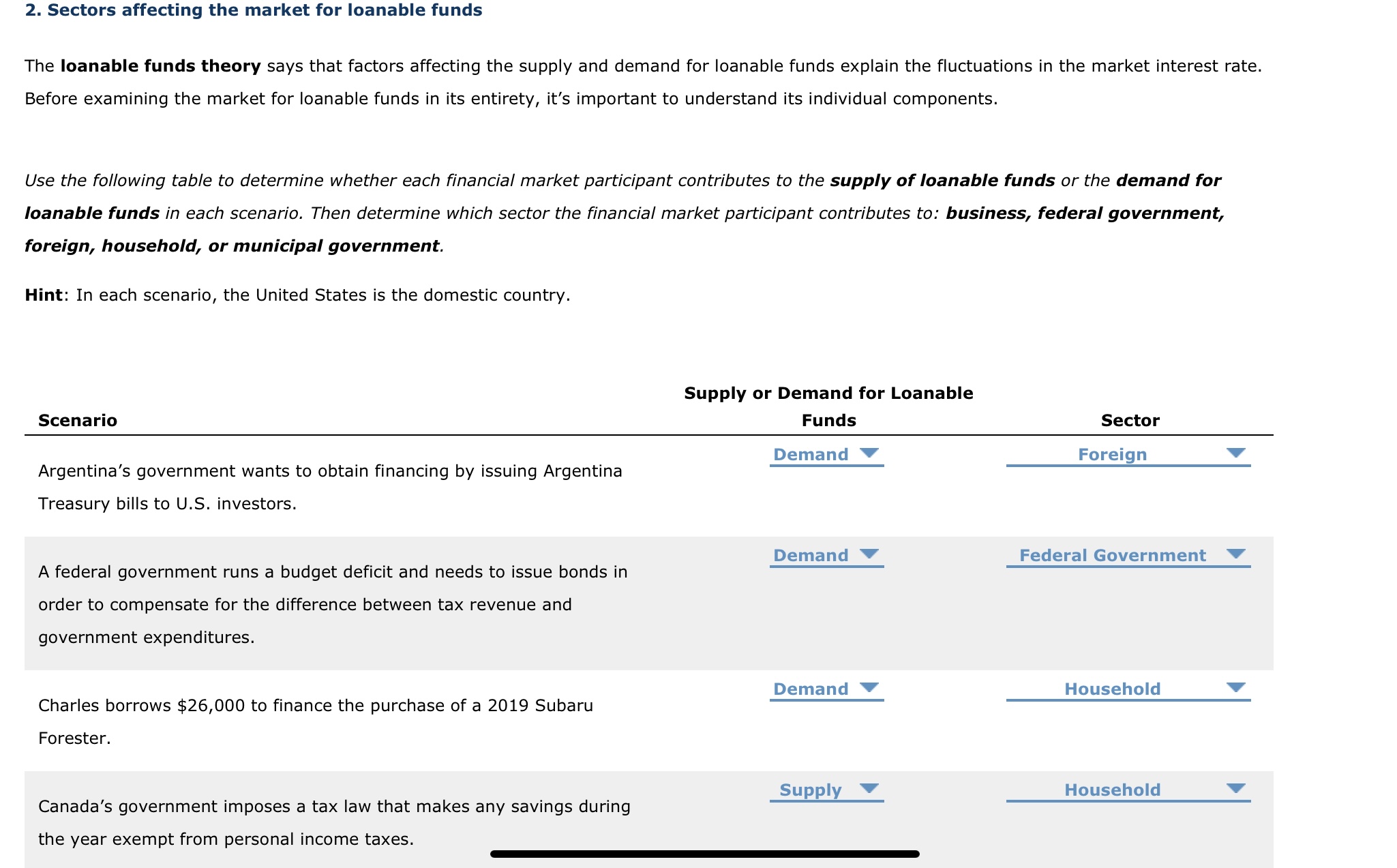

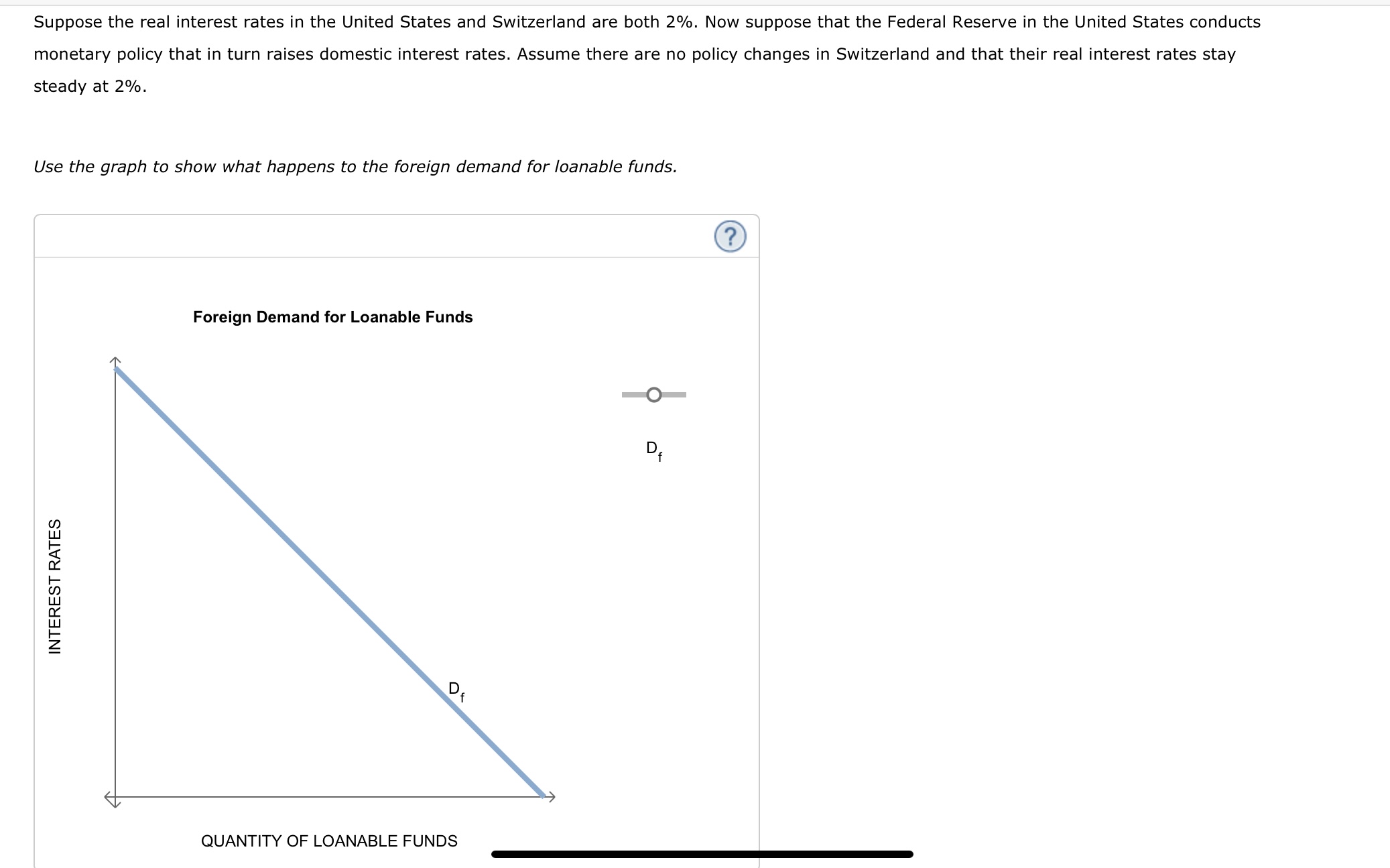

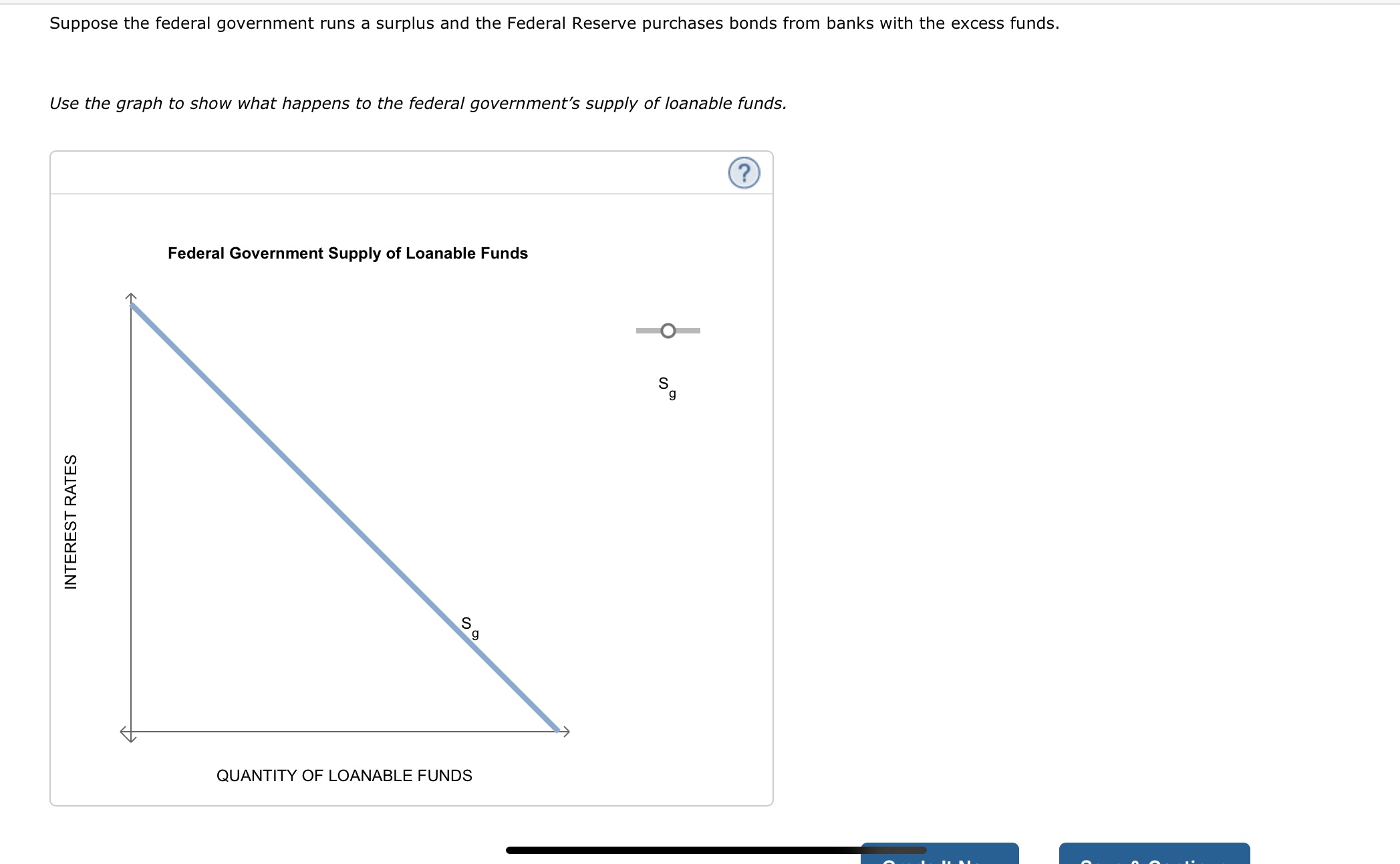

The loanable funds theory says that factors affecting the supply and demand for loanable funds explain the fluctuations in the market interest rate. Before examining the market for loanable funds in its entirety, it's important to understand its individual components. Use the following table to determine whether each financial market participant contributes to the supply of loanable funds or the demand for loanable funds in each scenario. Then determine which sector the financial market participant contributes to: business, federal government, foreign, household, or municipal government. Hint: In each scenario, the United States is the domestic country. Suppose the real interest rates in the United States and Switzerland are both 2%. Now suppose that the Federal Reserve in the United States conducts monetary policy that in turn raises domestic interest rates. Assume there are no policy changes in Switzerland and that their real interest rates stay steady at 2%. Use the graph to show what happens to the foreign demand for loanable funds. Suppose the federal government runs a surplus and the Federal Reserve purchases bonds from banks with the excess funds. Use the graph to show what happens to the federal government's supply of loanable funds

The loanable funds theory says that factors affecting the supply and demand for loanable funds explain the fluctuations in the market interest rate. Before examining the market for loanable funds in its entirety, it's important to understand its individual components. Use the following table to determine whether each financial market participant contributes to the supply of loanable funds or the demand for loanable funds in each scenario. Then determine which sector the financial market participant contributes to: business, federal government, foreign, household, or municipal government. Hint: In each scenario, the United States is the domestic country. Suppose the real interest rates in the United States and Switzerland are both 2%. Now suppose that the Federal Reserve in the United States conducts monetary policy that in turn raises domestic interest rates. Assume there are no policy changes in Switzerland and that their real interest rates stay steady at 2%. Use the graph to show what happens to the foreign demand for loanable funds. Suppose the federal government runs a surplus and the Federal Reserve purchases bonds from banks with the excess funds. Use the graph to show what happens to the federal government's supply of loanable funds Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started