Question

The local government of a city has to build a bridge to connect the city with another big city nearby. This government has to bear

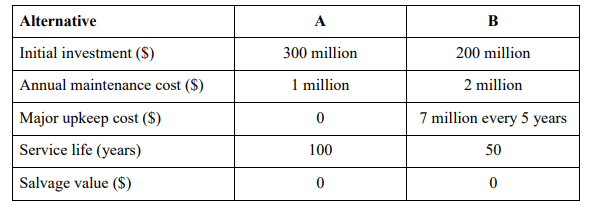

The local government of a city has to build a bridge to connect the city with another big city nearby. This government has to bear all the construction and maintenance costs. There are two alternatives. The first alternative (A) requires a much larger initial investment but the maintenance and operating costs in the future will be much lower. The second alternative (B) incurs a smaller initial investment but larger cash outflows in the future. In addition, Alternative A will last twice as long as Alternative B. Both of them have no salvage value. Based on the information given in the following table assuming the amounts remain unchanged over time, i.e.the repeatability assumption applies , do the analyses specified below. [Note: To simplify the calculations, assume that the annual maintenance costs and upkeep cost will be incurred up to the last year of the service lives of both alternatives.]

a) Which alternative should the government choose if it adopts an interest rate of 5% and a study period of 100 years? Use the annual worth (AW) method to evaluate the alternatives and show your calculations clearly in the space specified below.

b) Redo the analysis in (i) using the present worth (PW) method.

c) Perform necessary calculations to verify whether your answers to (i) and (ii) are consistent with each other.

d) If the government expects the market interest rate to rise in the near future and adopts a higher interest rate than 5%, will it change the government?s choice? Explain

your answer without any calculation. .

Alternative Initial investment ($) Annual maintenance cost ($) Major upkeep cost ($) Service life (years) Salvage value ($) A 300 million 1 million 0 100 0 B 200 million 2 million 7 million every 5 years 50 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Annual Worth AW method In this method we calculate the annual equivalent value of all the cash inflows and cash outflows ie we consider this as an annuity and calculate the equal periodic worth or c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started