Answered step by step

Verified Expert Solution

Question

1 Approved Answer

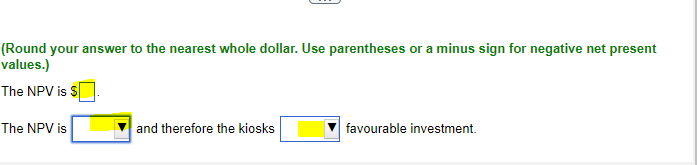

The localGiantTiger department store is considering investing in?self-checkout kiosks for its customers. The?self-checkout kiosks will cost$47,000 and have no residual value. Management expects the equipment

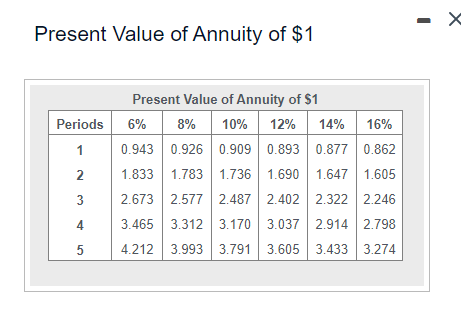

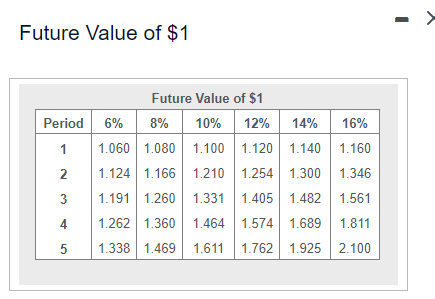

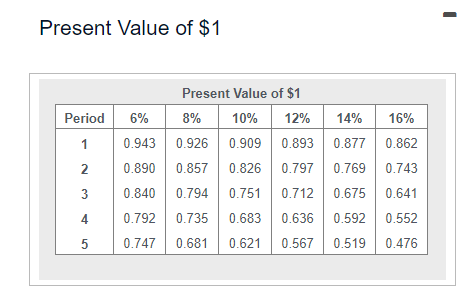

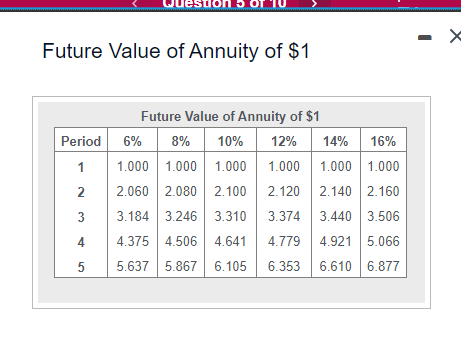

The localGiantTiger department store is considering investing in?self-checkout kiosks for its customers. The?self-checkout kiosks will cost$47,000 and have no residual value. Management expects the equipment to result in net cash savings over three years as customers grow accustomed to using the new?technology:$17,000the first?year; $21,000 the second?year; $27,000 the third year. Assuming a

10?% discount?rate, what is the NPV of the kiosk?investment? Is this a favourable?investment? Why or why?not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started