Answered step by step

Verified Expert Solution

Question

1 Approved Answer

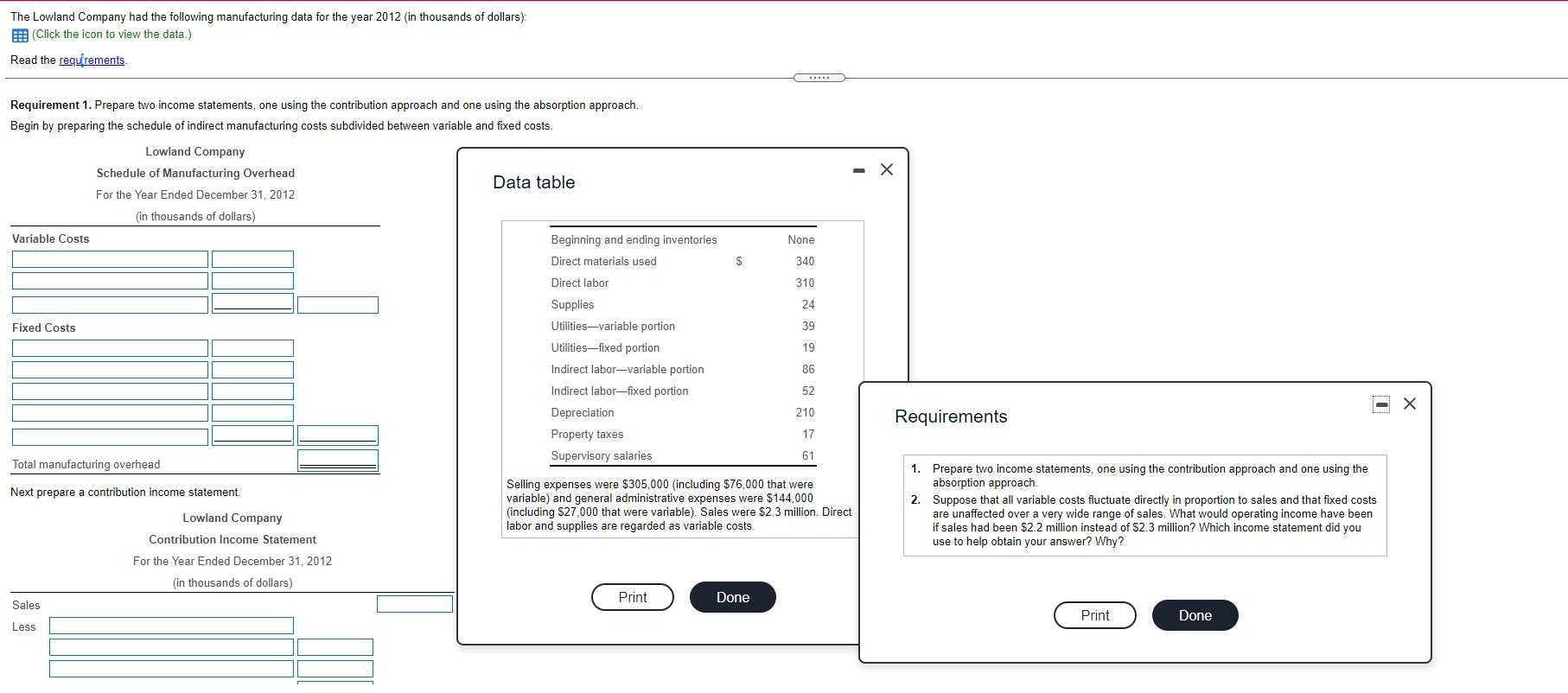

The Lowland Company had the following manufacturing data for the year 2012 (in thousands of dollars): (Click the icon to view the data.) Read

The Lowland Company had the following manufacturing data for the year 2012 (in thousands of dollars): (Click the icon to view the data.) Read the requirements. Requirement 1. Prepare two income statements, one using the contribution approach and one using the absorption approach. Begin by preparing the schedule of indirect manufacturing costs subdivided between variable and fixed costs. Variable Costs Fixed Costs Lowland Company Schedule of Manufacturing Overhead For the Year Ended December 31, 2012 (in thousands of dollars) Total manufacturing overhead Next prepare a contribution income statement. Sales Less Lowland Company Contribution Income Statement For the Year Ended December 31, 2012 (in thousands of dollars) Data table Beginning and ending inventories Direct materials used Direct labor Supplies Utilities-variable portion Utilities-fixed portion Indirect labor-variable portion Indirect labor-fixed portion Depreciation Property taxes Supervisory salaries $ Print Selling expenses were $305,000 (including $76,000 that were variable) and general administrative expenses were $144,000 (including $27,000 that were variable). Sales were $2.3 million. Direct labor and supplies are regarded as variable costs. None 340 310 24 39 19 86 52 210 17 61 Done X Requirements 1. Prepare two income statements, one using the contribution approach and one using the absorption approach. 2. Suppose that all variable costs fluctuate directly in proportion to sales and that fixed costs are unaffected over a very wide range of sales. What would operating income have been if sales had been $2.2 million instead of $2.3 million? Which income statement did you use to help obtain your answer? Why? Print Done

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Requirement 1 Schedule of manufacturing overheads Variable Cost Supplies Utilities V...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started