Answered step by step

Verified Expert Solution

Question

1 Approved Answer

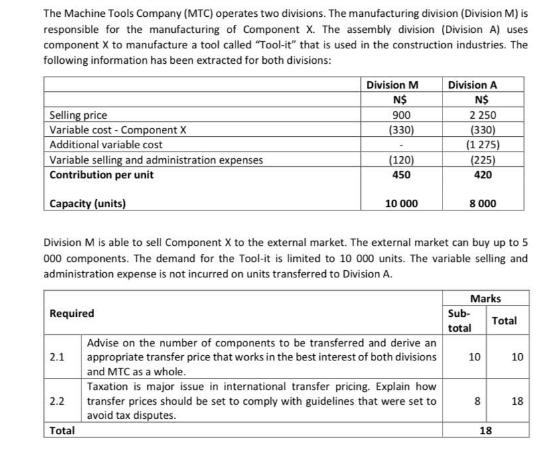

The Machine Tools Company (MTC) operates two divisions. The manufacturing division (Division M) is responsible for the manufacturing of Component X. The assembly division

The Machine Tools Company (MTC) operates two divisions. The manufacturing division (Division M) is responsible for the manufacturing of Component X. The assembly division (Division A) uses component X to manufacture a tool called "Tool-it" that is used in the construction industries. The following information has been extracted for both divisions: Selling price Variable cost-Component X Additional variable cost Variable selling and administration expenses Contribution per unit Capacity (units) Required 2.1 2.2 Division M N$ 900 (330) Total (120) 450 Division M is able to sell Component X to the external market. The external market can buy up to 5 000 components. The demand for the Tool-it is limited to 10 000 units. The variable selling and administration expense is not incurred on units transferred to Division A. 10 000 Advise on the number of components to be transferred and derive an appropriate transfer price that works in the best interest of both divisions and MTC as a whole. Division A N$ 2 250 (330) (1 275) (225) 420 Taxation is major issue in international transfer pricing. Explain how transfer prices should be set to comply with guidelines that were set to avoid tax disputes. 8 000 Marks Sub- total 10 00 8 Total 18 10 18

Step by Step Solution

There are 3 Steps involved in it

Step: 1

21 Advising on Component Transfer and Transfer Price To determine the number of components to be transferred from Division M to Division A and the appropriate transfer price we need to consider the ov...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started