Answered step by step

Verified Expert Solution

Question

1 Approved Answer

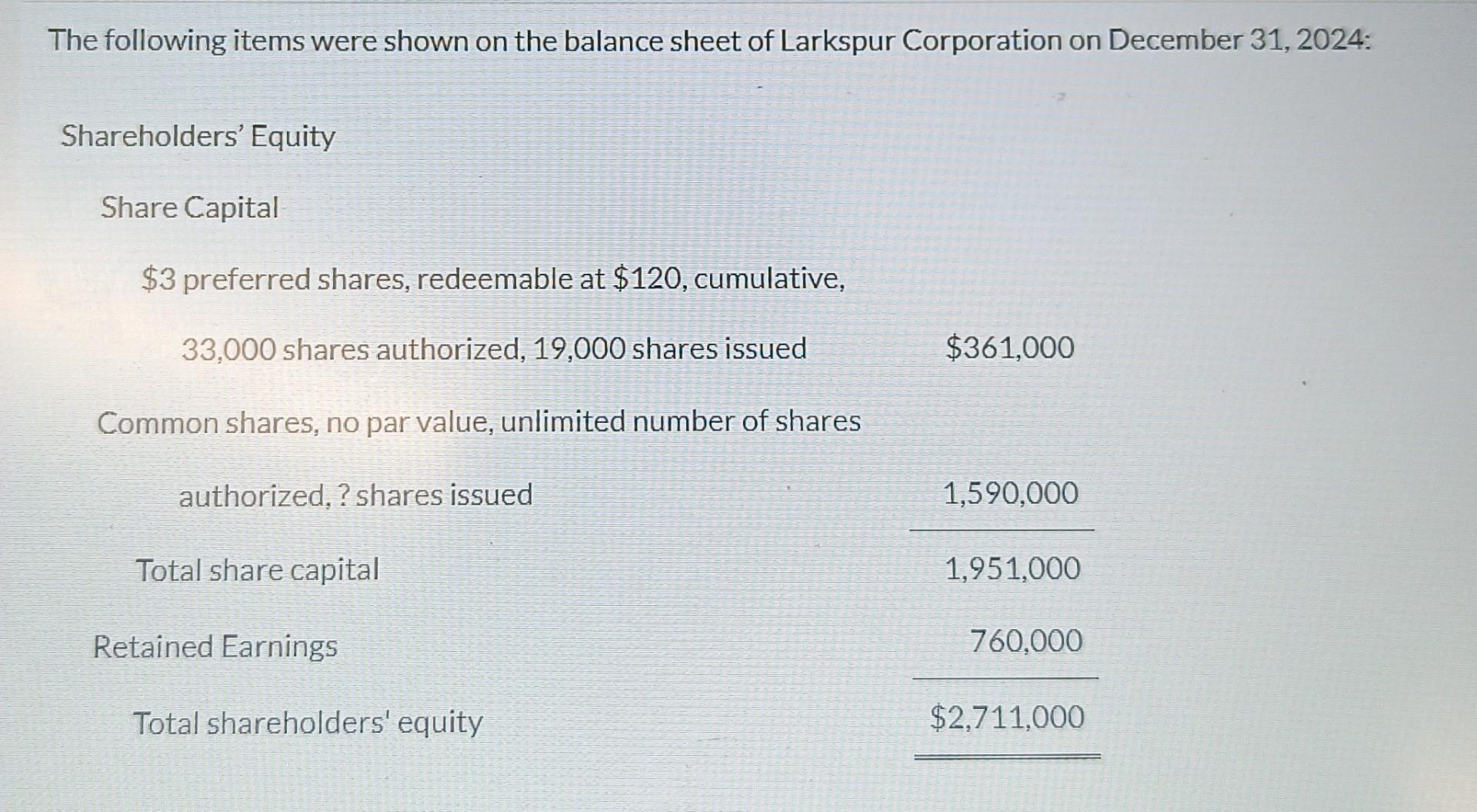

The following items were shown on the balance sheet of Larkspur Corporation on December 31, 2024: Shareholders' Equity Share Capital $3 preferred shares, redeemable

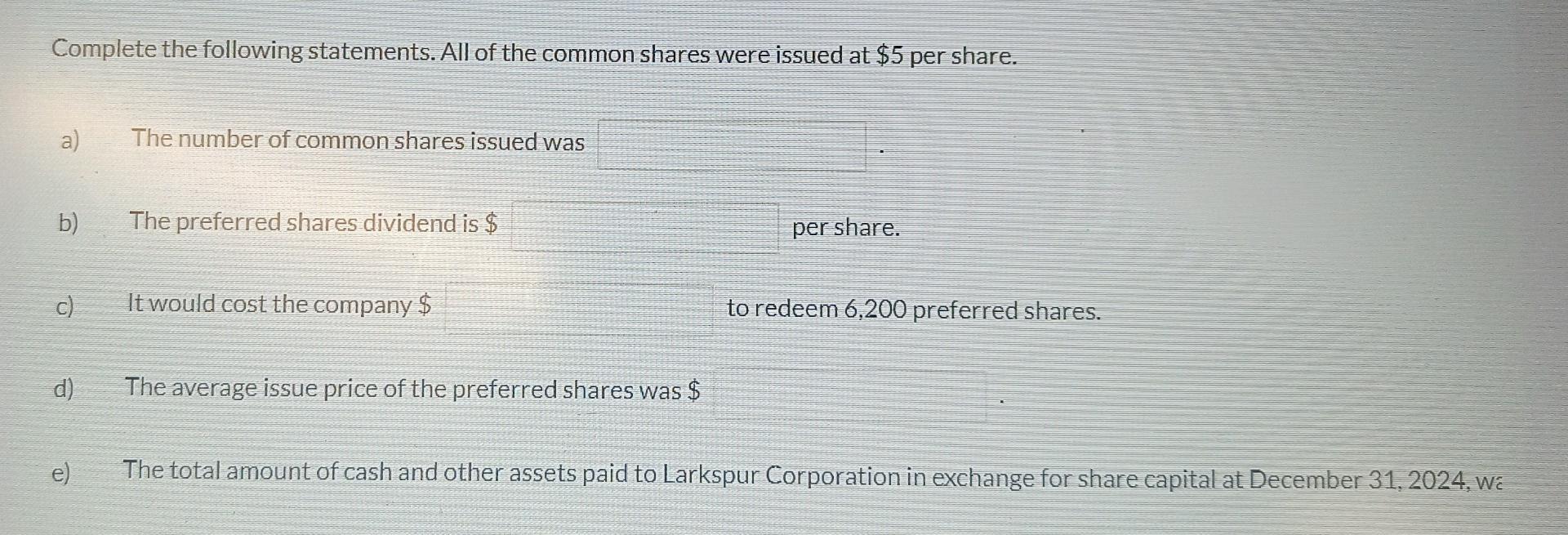

The following items were shown on the balance sheet of Larkspur Corporation on December 31, 2024: Shareholders' Equity Share Capital $3 preferred shares, redeemable at $120, cumulative, 33,000 shares authorized, 19,000 shares issued Common shares, no par value, unlimited number of shares authorized,? shares issued Total share capital Retained Earnings Total shareholders' equity $361,000 1,590,000 1,951,000 760,000 $2,711,000 Complete the following statements. All of the common shares were issued at $5 per share. a) b) c) The number of common shares issued was The preferred shares dividend is $ It would cost the company $ The average issue price of the preferred shares was $ per share. to redeem 6,200 preferred shares. The total amount of cash and other assets paid to Larkspur Corporation in exchange for share capital at December 31, 2024, w

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a The number of common shares issued Common Share Capital Total Share Capital Preferred Share Capita...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started