Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Madison Corporation is evaluating a project to expand its product line of printers. The shares sell for $41.00. The projected sales are $123.4 million

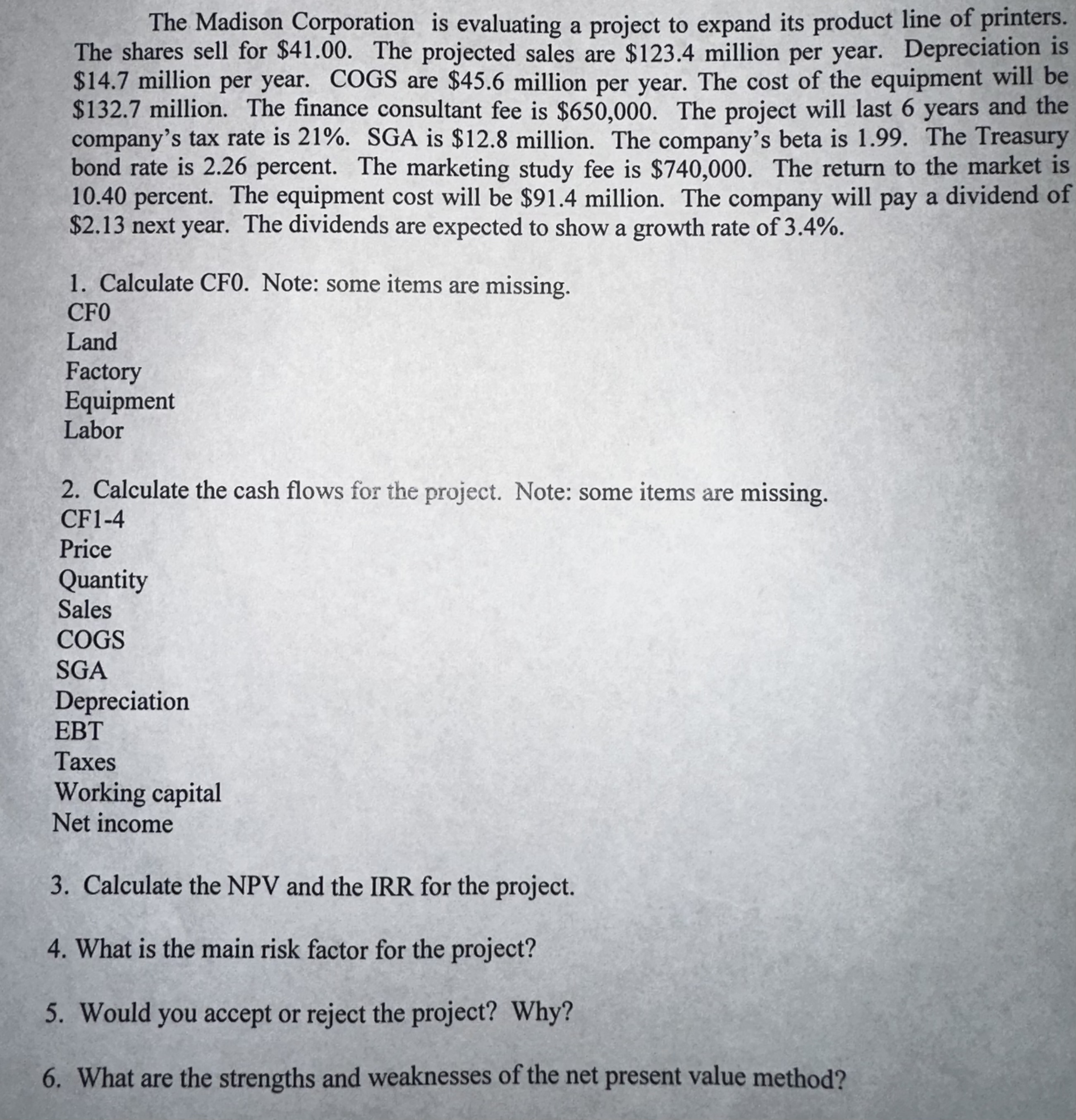

The Madison Corporation is evaluating a project to expand its product line of printers. The shares sell for $41.00. The projected sales are $123.4 million per year. Depreciation is $14.7 million per year. COGS are $45.6 million per year. The cost of the equipment will be $132.7 million. The finance consultant fee is $650,000. The project will last 6 years and the company's tax rate is 21%. SGA is $12.8 million. The company's beta is 1.99 . The Treasury bond rate is 2.26 percent. The marketing study fee is $740,000. The return to the market is 10.40 percent. The equipment cost will be $91.4 million. The company will pay a dividend of $2.13 next year. The dividends are expected to show a growth rate of 3.4%. 1. Calculate CF0. Note: some items are missing. CF0 Land Factory Equipment Labor 2. Calculate the cash flows for the project. Note: some items are missing. CF1-4 Price Quantity Sales COGS SGA Depreciation EBT Taxes Working capital Net income 3. Calculate the NPV and the IRR for the project. 4. What is the main risk factor for the project? 5. Would you accept or reject the project? Why? 6. What are the strengths and weaknesses of the net present value method

The Madison Corporation is evaluating a project to expand its product line of printers. The shares sell for $41.00. The projected sales are $123.4 million per year. Depreciation is $14.7 million per year. COGS are $45.6 million per year. The cost of the equipment will be $132.7 million. The finance consultant fee is $650,000. The project will last 6 years and the company's tax rate is 21%. SGA is $12.8 million. The company's beta is 1.99 . The Treasury bond rate is 2.26 percent. The marketing study fee is $740,000. The return to the market is 10.40 percent. The equipment cost will be $91.4 million. The company will pay a dividend of $2.13 next year. The dividends are expected to show a growth rate of 3.4%. 1. Calculate CF0. Note: some items are missing. CF0 Land Factory Equipment Labor 2. Calculate the cash flows for the project. Note: some items are missing. CF1-4 Price Quantity Sales COGS SGA Depreciation EBT Taxes Working capital Net income 3. Calculate the NPV and the IRR for the project. 4. What is the main risk factor for the project? 5. Would you accept or reject the project? Why? 6. What are the strengths and weaknesses of the net present value method Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started