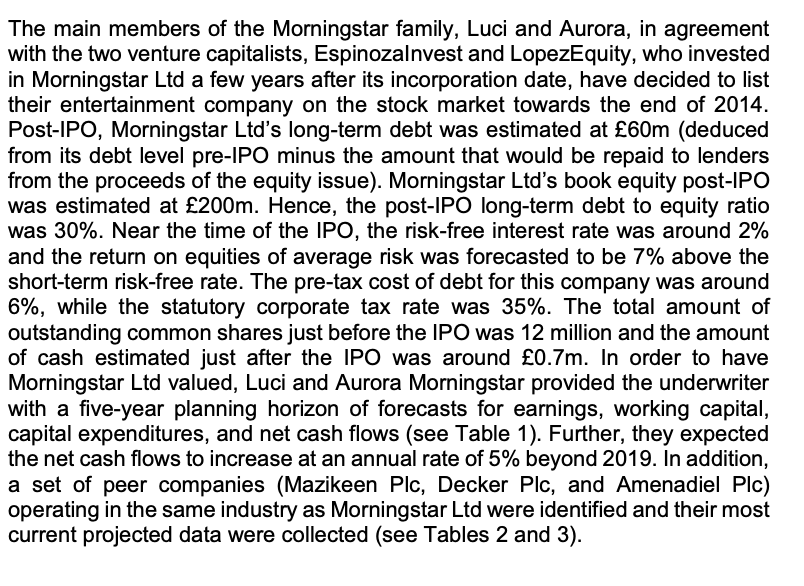

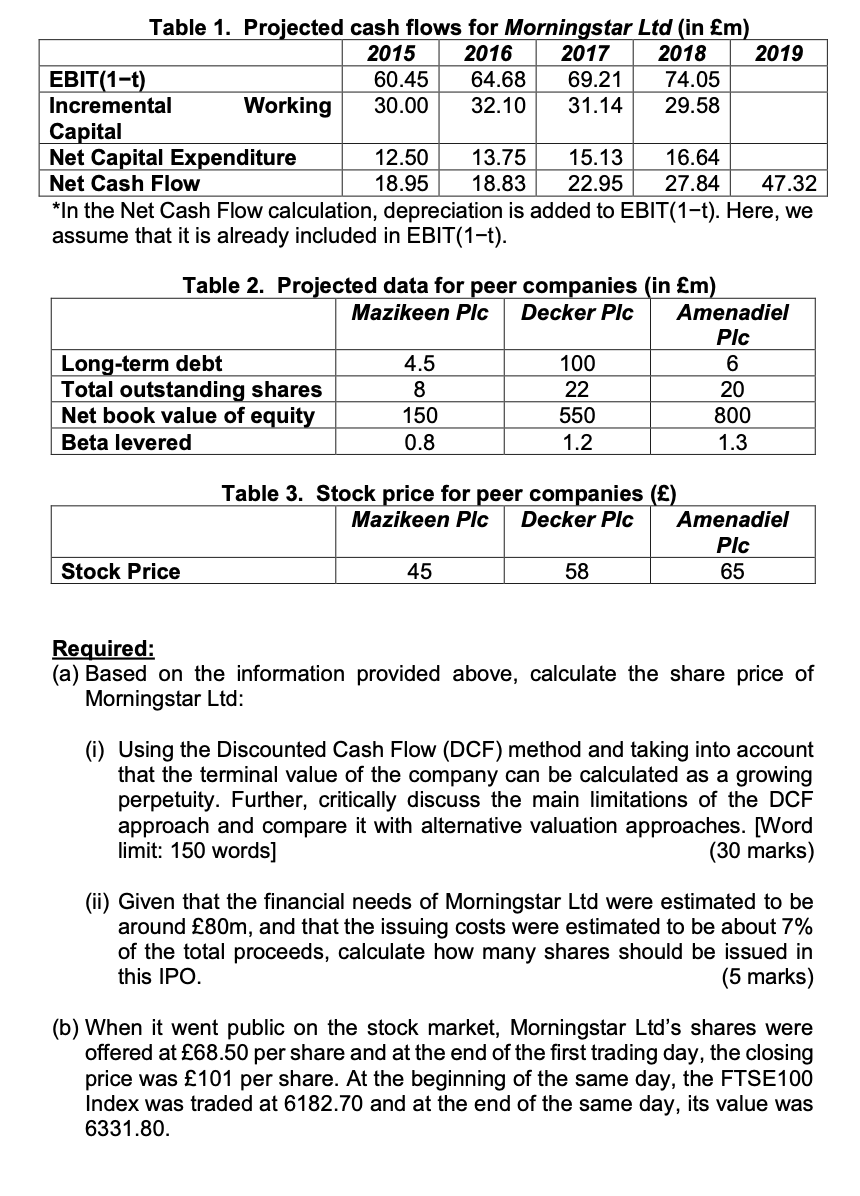

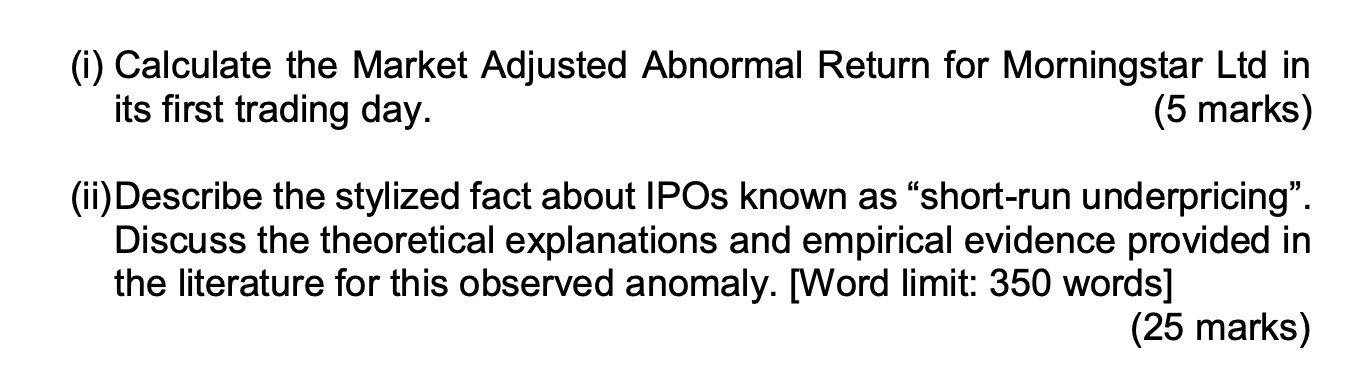

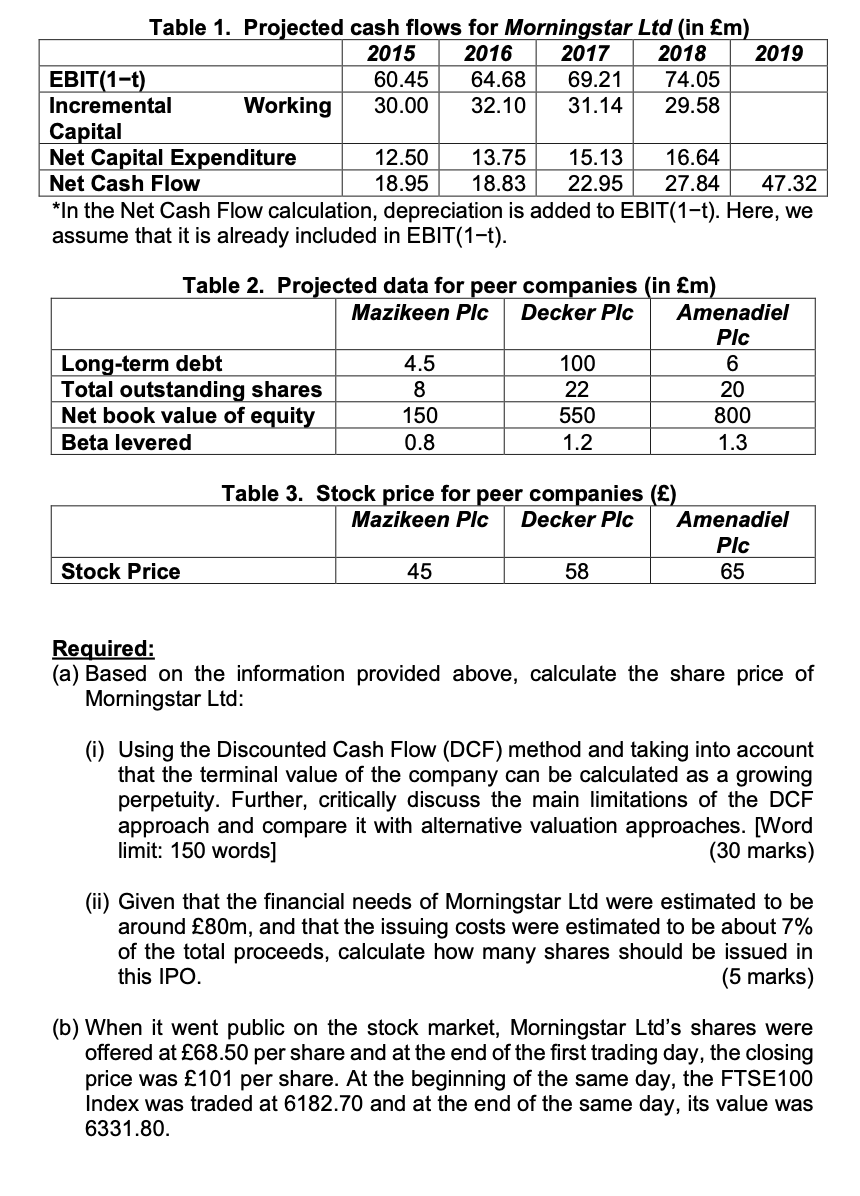

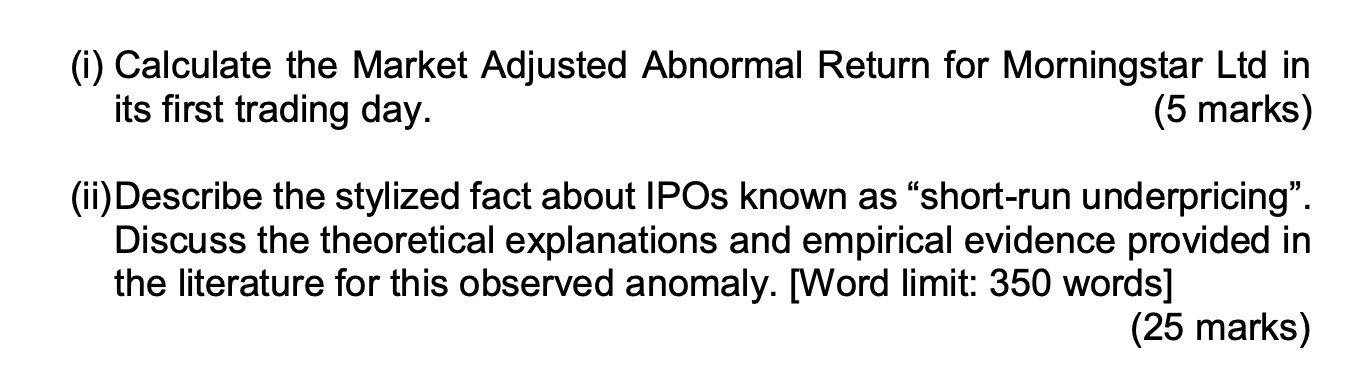

The main members of the Morningstar family, Luci and Aurora, in agreement with the two venture capitalists, Espinozalnvest and LopezEquity, who invested in Morningstar Ltd a few years after its incorporation date, have decided to list their entertainment company on the stock market towards the end of 2014. Post-IPO, Morningstar Ltd's long-term debt was estimated at 60m (deduced from its debt level pre-IPO minus the amount that would be repaid to lenders from the proceeds of the equity issue). Morningstar Ltd's book equity post-IPO was estimated at 200m. Hence, the post-IPO long-term debt to equity ratio was 30%. Near the time of the IPO, the risk-free interest rate was around 2% and the return on equities of average risk was forecasted to be 7% above the short-term risk-free rate. The pre-tax cost of debt for this company was around 6%, while the statutory corporate tax rate was 35%. The total amount of outstanding common shares just before the IPO was 12 million and the amount of cash estimated just after the IPO was around 0.7m. In order to have Morningstar Ltd valued, Luci and Aurora Morningstar provided the underwriter with a five-year planning horizon of forecasts for earnings, working capital, capital expenditures, and net cash flows (see Table 1). Further, they expected the net cash flows to increase at an annual rate of 5% beyond 2019. In addition, a set of peer companies (Mazikeen Plc, Decker Plc, and Amenadiel Plc) operating in the same industry as Morningstar Ltd were identified and their most current projected data were collected (see Tables 2 and 3). Table 1. Projected cash flows for Morningstar Ltd (in m) 2015 2016 2017 2018 2019 EBIT(1-t) 60.45 64.68 69.21 74.05 Incremental Working 30.00 32.10 31.14 29.58 Capital Net Capital Expenditure 12.50 13.75 15.13 16.64 Net Cash Flow 18.95 18.83 22.95 27.84 47.32 *In the Net Cash Flow calculation, depreciation is added to EBIT(1t). Here, we assume that it is already included in EBIT(1-t). Table 2. Projected data for peer companies (in m) Mazikeen Plc Decker Plc Amenadiel Plc Long-term debt 4.5 100 6 Total outstanding shares 8 22 20 Net book value of equity 150 550 800 Beta levered 0.8 1.2 1.3 Table 3. Stock price for peer companies () Mazikeen Plc Decker Plc Amenadiel PIC 45 58 65 Stock Price Required: (a) Based on the information provided above, calculate the share price of Morningstar Ltd: (i) Using the Discounted Cash Flow (DCF) method and taking into account that the terminal value of the company can be calculated as a growing perpetuity. Further, critically discuss the main limitations of the DCF approach and compare it with alternative valuation approaches. [Word limit: 150 words] (30 marks) (ii) Given that the financial needs of Morningstar Ltd were estimated to be around 80m, and that the issuing costs were estimated to be about 7% of the total proceeds, calculate how many shares should be issued in this IPO. (5 marks) (b) When it went public on the stock market, Morningstar Ltd's shares were offered at 68.50 per share and at the end of the first trading day, the closing price was 101 per share. At the beginning of the same day, the FTSE100 Index was traded at 6182.70 and at the end of the same day, its value was 6331.80. (i) Calculate the Market Adjusted Abnormal Return for Morningstar Ltd in its first trading day. (5 marks) (ii)Describe the stylized fact about IPOs known as short-run underpricing". Discuss the theoretical explanations and empirical evidence provided in the literature for this observed anomaly. [Word limit: 350 words] (25 marks) The main members of the Morningstar family, Luci and Aurora, in agreement with the two venture capitalists, Espinozalnvest and LopezEquity, who invested in Morningstar Ltd a few years after its incorporation date, have decided to list their entertainment company on the stock market towards the end of 2014. Post-IPO, Morningstar Ltd's long-term debt was estimated at 60m (deduced from its debt level pre-IPO minus the amount that would be repaid to lenders from the proceeds of the equity issue). Morningstar Ltd's book equity post-IPO was estimated at 200m. Hence, the post-IPO long-term debt to equity ratio was 30%. Near the time of the IPO, the risk-free interest rate was around 2% and the return on equities of average risk was forecasted to be 7% above the short-term risk-free rate. The pre-tax cost of debt for this company was around 6%, while the statutory corporate tax rate was 35%. The total amount of outstanding common shares just before the IPO was 12 million and the amount of cash estimated just after the IPO was around 0.7m. In order to have Morningstar Ltd valued, Luci and Aurora Morningstar provided the underwriter with a five-year planning horizon of forecasts for earnings, working capital, capital expenditures, and net cash flows (see Table 1). Further, they expected the net cash flows to increase at an annual rate of 5% beyond 2019. In addition, a set of peer companies (Mazikeen Plc, Decker Plc, and Amenadiel Plc) operating in the same industry as Morningstar Ltd were identified and their most current projected data were collected (see Tables 2 and 3). Table 1. Projected cash flows for Morningstar Ltd (in m) 2015 2016 2017 2018 2019 EBIT(1-t) 60.45 64.68 69.21 74.05 Incremental Working 30.00 32.10 31.14 29.58 Capital Net Capital Expenditure 12.50 13.75 15.13 16.64 Net Cash Flow 18.95 18.83 22.95 27.84 47.32 *In the Net Cash Flow calculation, depreciation is added to EBIT(1t). Here, we assume that it is already included in EBIT(1-t). Table 2. Projected data for peer companies (in m) Mazikeen Plc Decker Plc Amenadiel Plc Long-term debt 4.5 100 6 Total outstanding shares 8 22 20 Net book value of equity 150 550 800 Beta levered 0.8 1.2 1.3 Table 3. Stock price for peer companies () Mazikeen Plc Decker Plc Amenadiel PIC 45 58 65 Stock Price Required: (a) Based on the information provided above, calculate the share price of Morningstar Ltd: (i) Using the Discounted Cash Flow (DCF) method and taking into account that the terminal value of the company can be calculated as a growing perpetuity. Further, critically discuss the main limitations of the DCF approach and compare it with alternative valuation approaches. [Word limit: 150 words] (30 marks) (ii) Given that the financial needs of Morningstar Ltd were estimated to be around 80m, and that the issuing costs were estimated to be about 7% of the total proceeds, calculate how many shares should be issued in this IPO. (5 marks) (b) When it went public on the stock market, Morningstar Ltd's shares were offered at 68.50 per share and at the end of the first trading day, the closing price was 101 per share. At the beginning of the same day, the FTSE100 Index was traded at 6182.70 and at the end of the same day, its value was 6331.80. (i) Calculate the Market Adjusted Abnormal Return for Morningstar Ltd in its first trading day. (5 marks) (ii)Describe the stylized fact about IPOs known as short-run underpricing". Discuss the theoretical explanations and empirical evidence provided in the literature for this observed anomaly. [Word limit: 350 words] (25 marks)