Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The main objective in the 2nd photo During the current year, the following financial activity took place at Smith: - On January 1, the company

The main objective in the 2nd photo

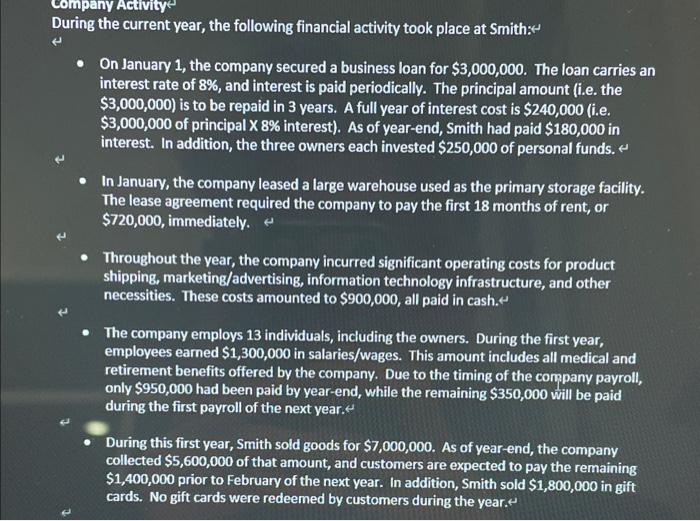

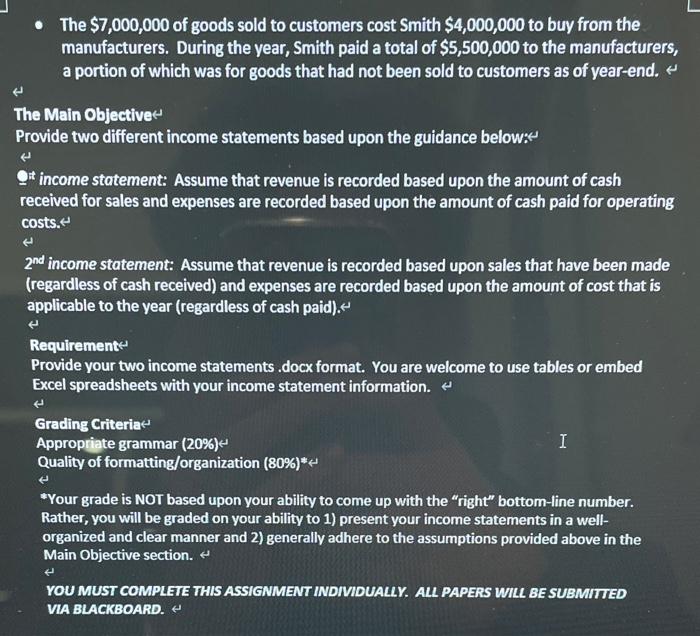

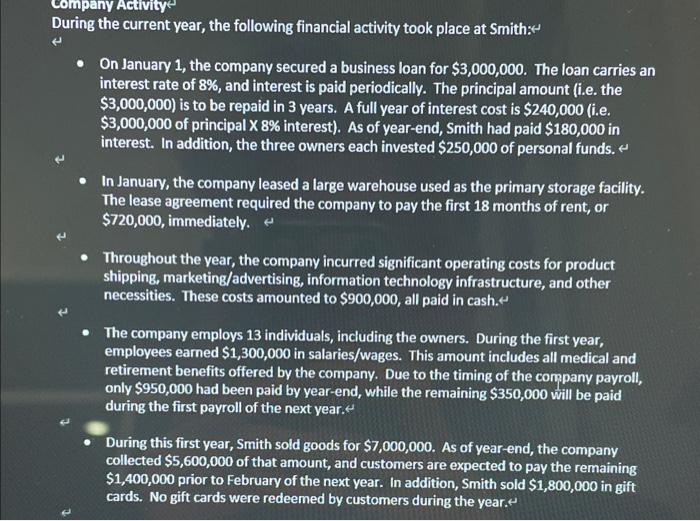

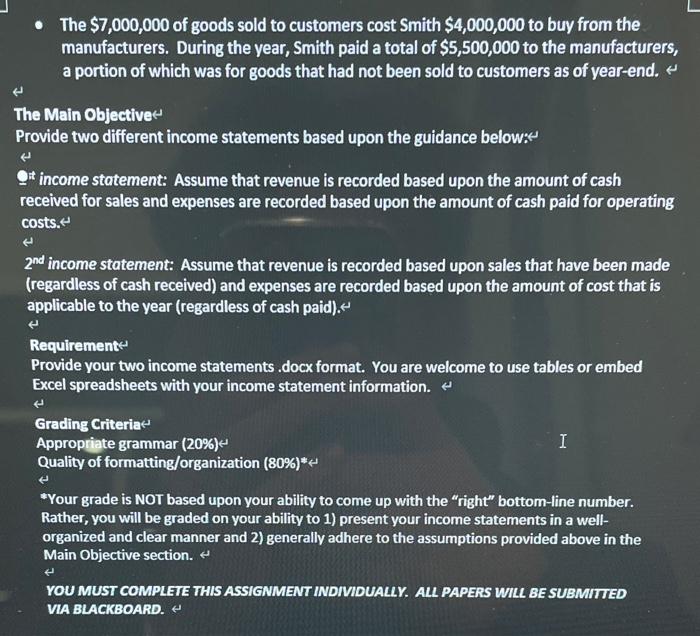

During the current year, the following financial activity took place at Smith: - On January 1, the company secured a business loan for $3,000,000. The loan carries an interest rate of 8%, and interest is paid periodically. The principal amount (i.e. the $3,000,000 ) is to be repaid in 3 years. A full year of interest cost is $240,000 (i.e. $3,000,000 of principal X8% interest). As of year-end, Smith had paid $180,000 in interest. In addition, the three owners each invested $250,000 of personal funds. - In January, the company leased a large warehouse used as the primary storage facility. The lease agreement required the company to pay the first 18 months of rent, or $720,000, immediately. - Throughout the year, the company incurred significant operating costs for product shipping, marketing/advertising, information technology infrastructure, and other necessities. These costs amounted to $900,000, all paid in cash. - The company employs 13 individuals, including the owners. During the first year, employees earned $1,300,000 in salaries/wages. This amount includes all medical and retirement benefits offered by the company. Due to the timing of the company payroll, only $950,000 had been paid by year-end, while the remaining $350,000 will be paid during the first payroll of the next year. - During this first year, Smith sold goods for $7,000,000. As of year-end, the company collected $5,600,000 of that amount, and customers are expected to pay the remaining $1,400,000 prior to February of the next year. In addition, Smith sold $1,800,000 in gift cards. No gift cards were redeemed by customers during the year. - The $7,000,000 of goods sold to customers cost Smith $4,000,000 to buy from the manufacturers. During the year, Smith paid a total of $5,500,000 to the manufacturers, a portion of which was for goods that had not been sold to customers as of year-end. The Main Objective Provide two different income statements based upon the guidance below: Qt income statement: Assume that revenue is recorded based upon the amount of cash received for sales and expenses are recorded based upon the amount of cash paid for operating costs. 2nd income statement: Assume that revenue is recorded based upon sales that have been made (regardless of cash received) and expenses are recorded based upon the amount of cost that is applicable to the year (regardless of cash paid). Requirement Provide your two income statements .docx format. You are welcome to use tables or embed Excel spreadsheets with your income statement information. Grading Criteria Appropriate grammar (20\%) Quality of formatting/organization (80\%)* "Your grade is NOT based upon your ability to come up with the "right" bottom-line number. Rather, you will be graded on your ability to 1) present your income statements in a wellorganized and clear manner and 2) generally adhere to the assumptions provided above in the Main Objective section. YOU MUST COMPLETE THIS ASSIGNMENT INDIVIDUALLY. ALL PAPERS WILL BE SUBMITIED VIA BLACKBOARD

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started