Answered step by step

Verified Expert Solution

Question

1 Approved Answer

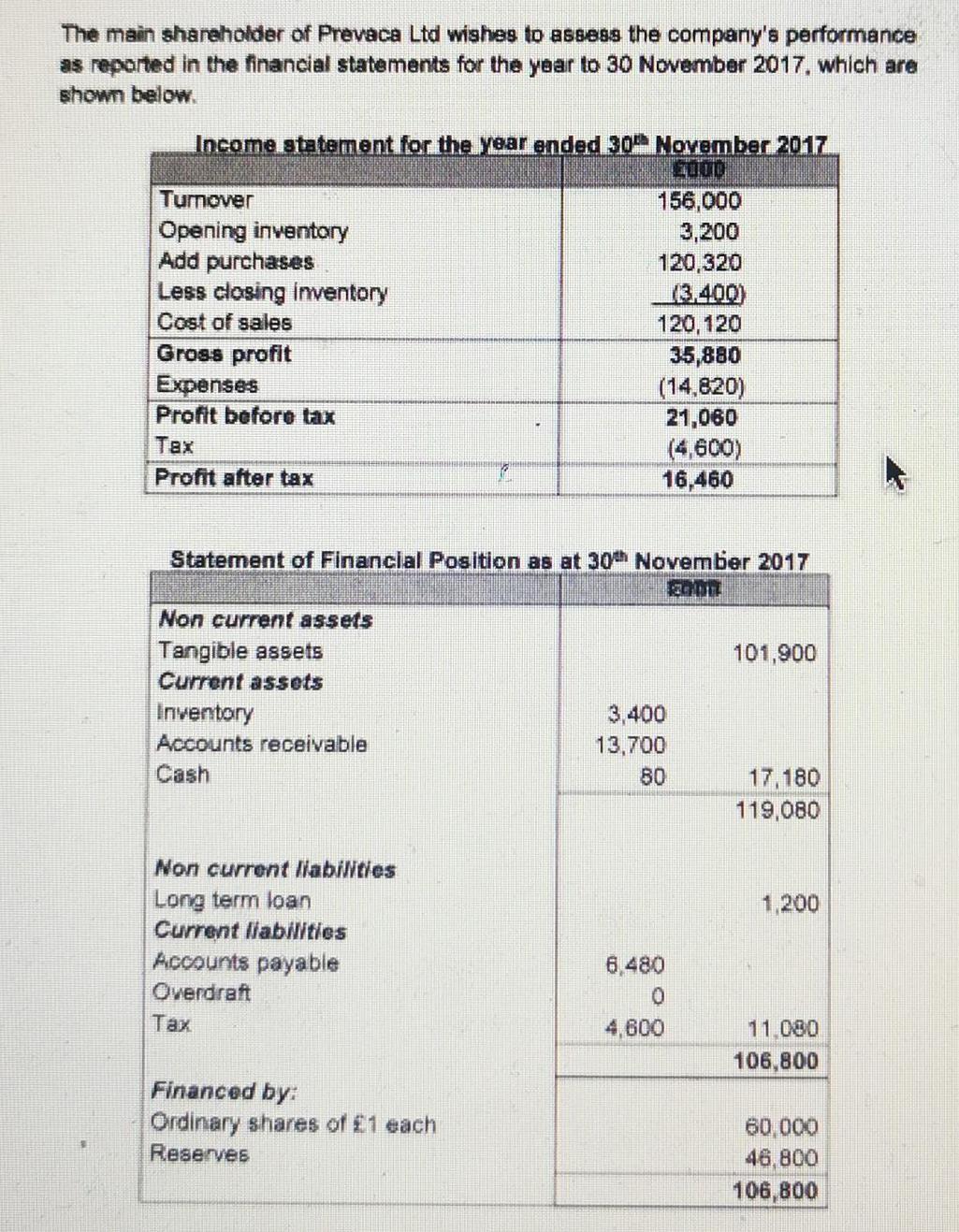

The main shareholder of Prevaca Ltd wishes to assess the company's performance as reported in the financial statements for the year to 30 November

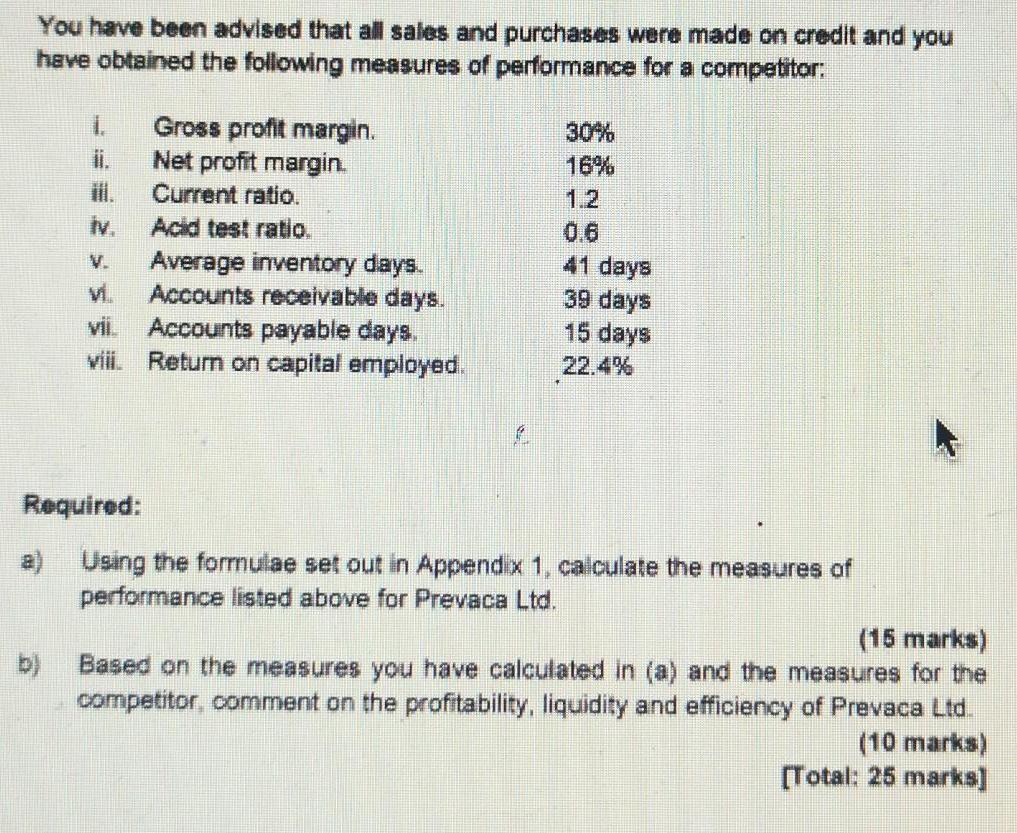

The main shareholder of Prevaca Ltd wishes to assess the company's performance as reported in the financial statements for the year to 30 November 2017, which are shown below. Income statement for the year ended 30th November 2017 FOOD Turnover Opening inventory Add purchases Less closing inventory Cost of sales Gross profit Expenses Profit before tax Tax Profit after tax Statement of Financial Position as at 30th November 2017 Non current assets Tangible assets Current assets Inventory Accounts receivable Cash Non current liabilities Long term loan Current liabilities Accounts payable Overdraft Tax 156,000 3,200 120,320 (3.400) 120,120 35,880 (14,820) 21,060 (4,600) 16,460 Financed by: Ordinary shares of 1 each Reserves 3,400 13,700 80 6,480 0 4,600 101,900 17,180 119,080 1,200 11,080 106,800 60,000 46,800 106,800 You have been advised that all sales and purchases were made on credit and you have obtained the following measures of performance for a competitor: 1. b) III. iv. Gross profit margin. Net profit margin. Current ratio. Acid test ratio. Average inventory days. Accounts receivable days. vii Accounts payable days. viii. Return on capital employed. C 16% 41 days 39 days 15 days Required: a) Using the formulae set out in Appendix 1, calculate the measures of performance listed above for Prevaca Ltd. (15 marks) Based on the measures you have calculated in (a) and the measures for the competitor, comment on the profitability, liquidity and efficiency of Prevaca Ltd. (10 marks) [Total: 25 marks]

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Ratio Formula Result 1 Gross profit margin gross profitturnover100 23 2 Ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started