Question

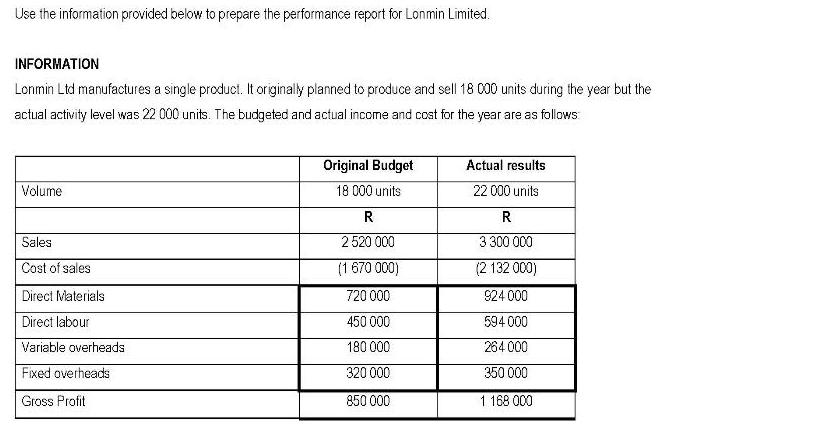

Use the information provided below to prepare the performance report for Lonmin Limited. INFORMATION Lonmin Ltd manufactures a single product. It originally planned to

Use the information provided below to prepare the performance report for Lonmin Limited. INFORMATION Lonmin Ltd manufactures a single product. It originally planned to produce and sell 18 000 units during the year but the actual activity level was 22 000 units. The budgeted and actual income and cost for the year are as follows: Volume Sales Cost of sales Direct Materials Direct labour Variable overheads Fixed overheads Gross Profit Original Budget 18 000 units R 2 520 000 (1 670 000) 720 000 450 000 180 000 320 000 850 000 Actual results 22 000 units R 3 300 000 (2 132 000) 924 000 594 000 264.000 350 000 1 168 000

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Volume Sales Cost of sales Direct materials Direct l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management and Cost Accounting

Authors: Colin Drury

8th edition

978-1408041802, 1408041804, 978-1408048566, 1408048566, 978-1408093887

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App