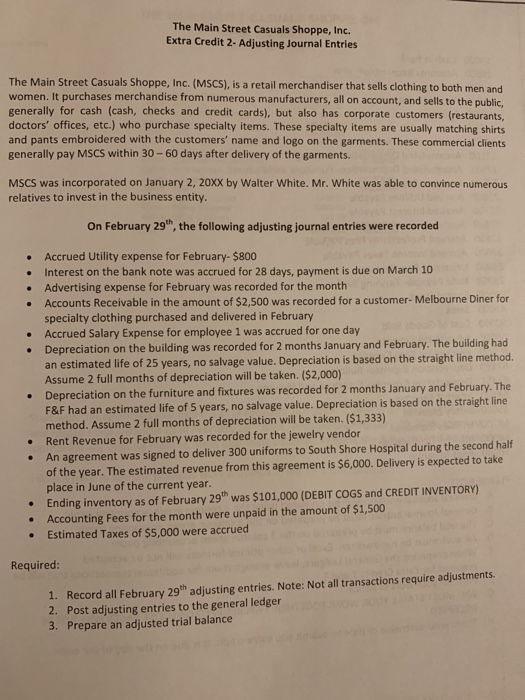

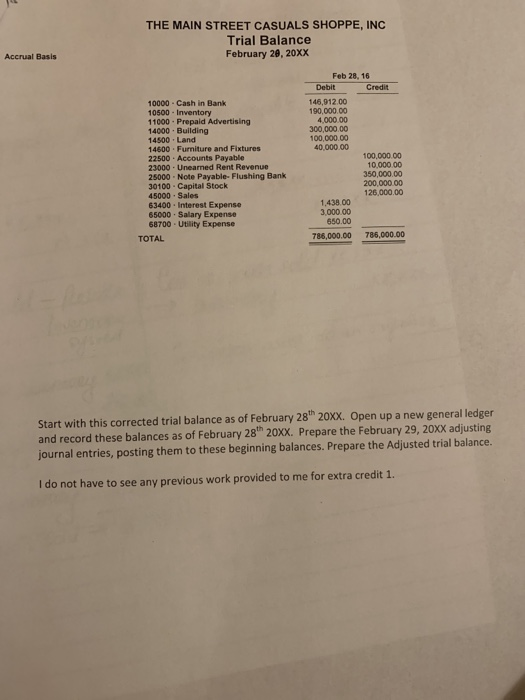

The Main Street Casuals Shoppe, Inc. Extra Credit 2- Adjusting Journal Entries The Main Street Casuals Shoppe, Inc. (MSCS), is a retail merchandiser that sells clothing to both men and women. It purchases merchandise from numerous manufacturers, all on account, and sells to the public generally for cash (cash, checks and credit cards), but also has corporate customers (restaurants doctors' offices, etc.) who purchase specialty items. These specialty items are usually matching shirts and pants embroidered with the customers' name and logo on the garments. These commercial clients generally pay MSCS within 30-60 days after delivery of the garments. MSCS was incorporated on January 2, 20XX by Walter White. Mr. White was able to convince numerous relatives to invest in the business entity. On February 29th, the following adjusting journal entries were recorded Accrued Utility expense for February- $800 Interest on the bank note was accrued for 28 days, payment is due on March 10 Advertising expense for February was recorded for the month Accounts Receivable in the amount of $2,500 was recorded for a customer-Melbourne Diner for specialty clothing purchased and delivered in February Accrued Salary Expense for employee 1 was accrued for one day Depreciation on the building was recorded for 2 months January and February. The building had an estimated life of 25 years, no salvage value. Depreciation is based on the straight line method. Assume 2 full months of depreciation will be taken. ($2,000) Depreciation on the furniture and fixtures was recorded for 2 months January and February. The e &F had an estimated life of 5 years, no salvage value. Depreciation is based on the method. Assume 2 full months of depreciation will be taken. ($1,333) Rent Revenue for February was recorded for the jewelry vendor An agreement was signed to deliver 300 uniforms to South Shore Hospital during the second half of the year. The estimated revenue from this agreement is $6,000. Delivery is expected to take place in June of the current year Ending inventory as of February 29th was $101,000 (DEBIT COGS and CREDIT INVENTORY) e Accounting Fees for the month were unpaid in the amount of $1,500 Estimated Taxes of $5,000 were accrued Required 1. Record all February 29th adjusting entries. Note: Not all transactions require adjustments Post adjusting entries to the general ledger Prepare an adjusted trial balance 3. THE MAIN STREET CASUALS SHOPPE, INC Trial Balance February 20, 20XX 0 Accrual Basis Feb 28, 16 Debit Credit 10000 Cash in Bank 10500- Inventory 11000 Prepaid Advertising 14000 Building 14500 Land 14600 Furniture and Fixtures 22500 Accounts Payable 23000 Unearned Rent Revenue 25000 Note Payable- Flushing Bank 30100 Capital Stock 45000 Sales 63400 Interest Expense 65000 Salary Expense 68700 Utility Expense 46,912.00 190,000.00 4,000.00 300,000.00 100,000.00 40,000.00 100,000.00 10,000.00 350,000.00 200,000.00 126,000.00 1-438 00 126.000 3,000.00 650.00 TOTAL 786,000.00 786,000.00 Start with this corrected trial balance as of February 28th 20xx. Open up a new general ledger and record these balances as of February 28th 20Xx. Prepare the February 29, 20XX adjusting journal entries, posting them to these beginning balances. Prepare the Adjusted trial balance. I do not have to see any previous work provided to me for extra credit 1. The Main Street Casuals Shoppe, Inc. Extra Credit 2- Adjusting Journal Entries The Main Street Casuals Shoppe, Inc. (MSCS), is a retail merchandiser that sells clothing to both men and women. It purchases merchandise from numerous manufacturers, all on account, and sells to the public generally for cash (cash, checks and credit cards), but also has corporate customers (restaurants doctors' offices, etc.) who purchase specialty items. These specialty items are usually matching shirts and pants embroidered with the customers' name and logo on the garments. These commercial clients generally pay MSCS within 30-60 days after delivery of the garments. MSCS was incorporated on January 2, 20XX by Walter White. Mr. White was able to convince numerous relatives to invest in the business entity. On February 29th, the following adjusting journal entries were recorded Accrued Utility expense for February- $800 Interest on the bank note was accrued for 28 days, payment is due on March 10 Advertising expense for February was recorded for the month Accounts Receivable in the amount of $2,500 was recorded for a customer-Melbourne Diner for specialty clothing purchased and delivered in February Accrued Salary Expense for employee 1 was accrued for one day Depreciation on the building was recorded for 2 months January and February. The building had an estimated life of 25 years, no salvage value. Depreciation is based on the straight line method. Assume 2 full months of depreciation will be taken. ($2,000) Depreciation on the furniture and fixtures was recorded for 2 months January and February. The e &F had an estimated life of 5 years, no salvage value. Depreciation is based on the method. Assume 2 full months of depreciation will be taken. ($1,333) Rent Revenue for February was recorded for the jewelry vendor An agreement was signed to deliver 300 uniforms to South Shore Hospital during the second half of the year. The estimated revenue from this agreement is $6,000. Delivery is expected to take place in June of the current year Ending inventory as of February 29th was $101,000 (DEBIT COGS and CREDIT INVENTORY) e Accounting Fees for the month were unpaid in the amount of $1,500 Estimated Taxes of $5,000 were accrued Required 1. Record all February 29th adjusting entries. Note: Not all transactions require adjustments Post adjusting entries to the general ledger Prepare an adjusted trial balance 3. THE MAIN STREET CASUALS SHOPPE, INC Trial Balance February 20, 20XX 0 Accrual Basis Feb 28, 16 Debit Credit 10000 Cash in Bank 10500- Inventory 11000 Prepaid Advertising 14000 Building 14500 Land 14600 Furniture and Fixtures 22500 Accounts Payable 23000 Unearned Rent Revenue 25000 Note Payable- Flushing Bank 30100 Capital Stock 45000 Sales 63400 Interest Expense 65000 Salary Expense 68700 Utility Expense 46,912.00 190,000.00 4,000.00 300,000.00 100,000.00 40,000.00 100,000.00 10,000.00 350,000.00 200,000.00 126,000.00 1-438 00 126.000 3,000.00 650.00 TOTAL 786,000.00 786,000.00 Start with this corrected trial balance as of February 28th 20xx. Open up a new general ledger and record these balances as of February 28th 20Xx. Prepare the February 29, 20XX adjusting journal entries, posting them to these beginning balances. Prepare the Adjusted trial balance. I do not have to see any previous work provided to me for extra credit 1