Question

The Major Motors Corporation is trying to decide whether to introduce a new mid- size car. The directors of the company only want to produce

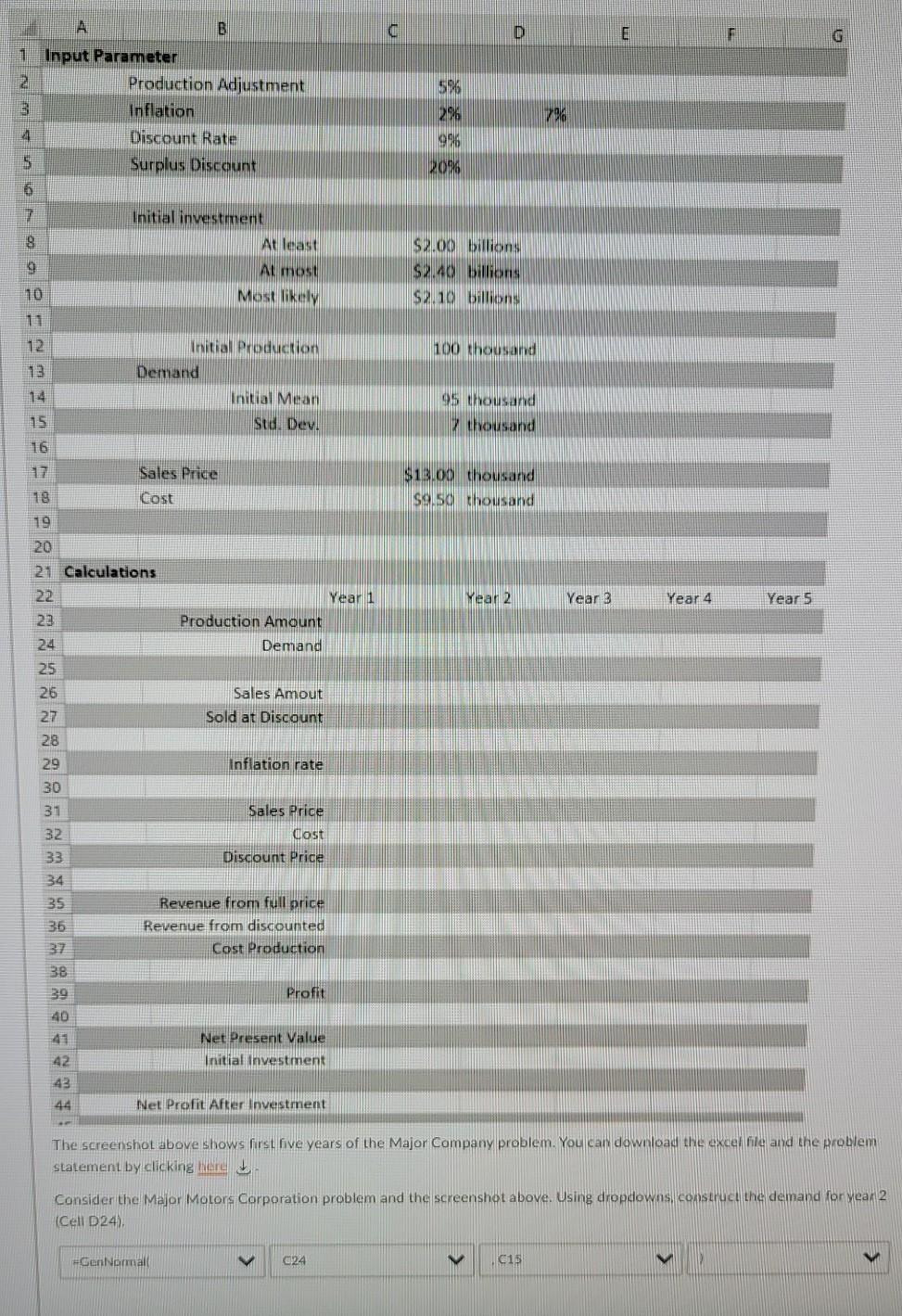

The Major Motors Corporation is trying to decide whether to introduce a new mid- size car. The directors of the company only want to produce the car if it has at least an 80% chance of generating a positive NPV over the next 10 years. If the company decides to produce the car, it will have to pay an uncertain initial start-up cost that is estimated to follow a triangular distribution with a minimum value of $2 billion, maximum value of $2.4 billion, and a most likely value of $2.1 billion. In the first year, the company would produce 100,000 units. Demand during the first year is uncertain but expected to be normally distributed with a mean of 95,000 and standard deviation of 7,000. For any year in which the demand exceeds production, production will be increased by 5% in the following year. For any year in which the production exceeds demand, production will be decreased by 5% in the next year, and the excess cars will be sold to a rental car company at a 20% discount. After the first year, the demand in any year will be modeled as a normally distributed random variable with a mean equal to the actual demand in the previous year and standard deviation of 7,000. In the first year, the sales price of the car will be $13,000, and the total variable cost per car is expected to be $9,500. Both the selling price and variable cost is expected to increase each year at the rate of inflation, which is assumed to be uniformly distributed between 2% and 7%. The company uses a discount rate of 9% to discount future cash flows.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started