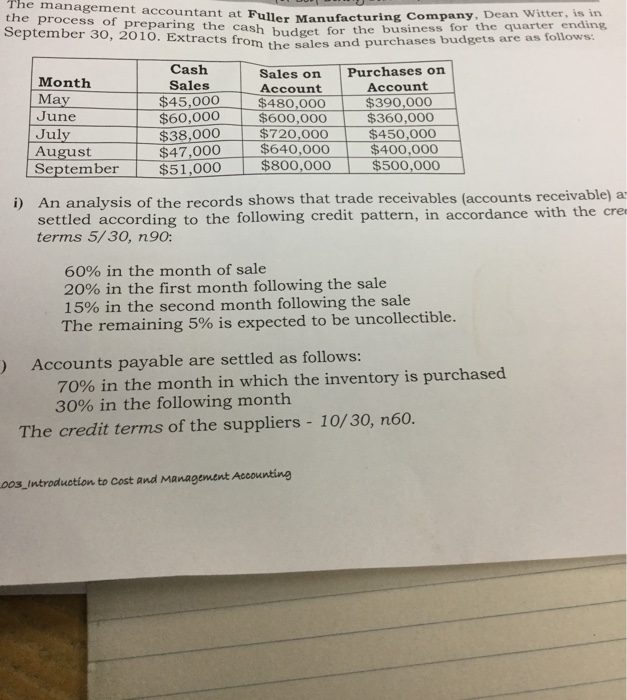

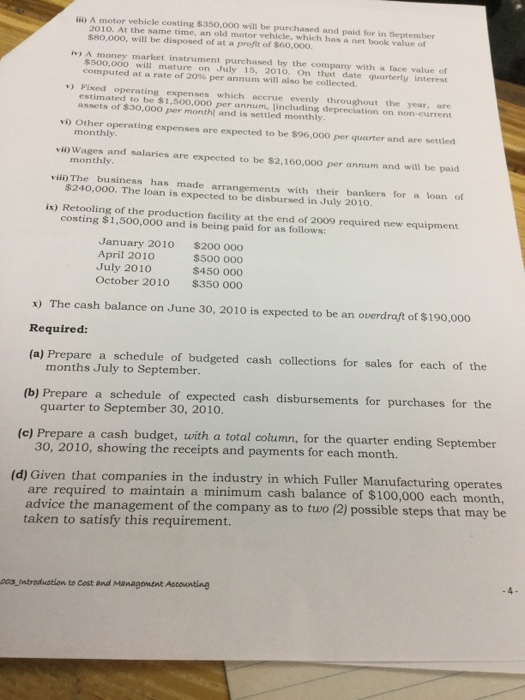

The management accountant at Fuller Manufacturing ce the process of preparing the cash budget for the business n accountant at Fuller Manufacturing Company, Dean Witter, is in September 30, 2010. Extracts from the sales and purcha ash budget for the business for the quarter ending om the sales and purchases budgets are as follows: September 30+ preparing the at Fuller Manufact Month May June July August September Cash Sales $45,000 $60,000 $38,000 $47,000 $51,000 Sales on Account $480,000 $600,000 $720,000 $640,000 $800,000 Purchases on Account $390,000 $360,000 $450,000 $400,000 $500,000 i) An analysis of the records shows that trade receivables (accounts receivable) ar settled according to the following credit pattern, in accordance with the cres terms 5/30, n90: 60% in the month of sale 20% in the first month following the sale 15% in the second month following the sale The remaining 5% is expected to be uncollectible. ) Accounts payable are settled as follows: 70% in the month in which the inventory is purchased 30% in the following month The credit terms of the suppliers - 10/30, n60. 003_Introduction to cost and Management Accounting A motor vehicle costing 350.000 will be purchased and d 2010. At the same time, an old motor vehicle, which has SHO,000, will be disposed of at a profit of 60.000 beek value A money market instrument purchased by the company with a face value of S500.000 will mature on July 15, 2010. On that date urtery interest computed at a rate of 2017 per annum will also be collected Pixed operating expenses which accrue evenly throughout the year, are estimated to be $1.500.000 per annum, including depreciation on non-current sets of $30.000 per month and is settled monthly Vi) Other operating expenses are expected to be 596.000 per quarter and are sted monthly vi) Wages and salaries are expected to be $2,160.000 per arm monthly and will be paid Wil The business has made arrangements with their bankers for a loan of $240,000. The loan is expected to be disbursed in July 2010 ix) Retooling of the production facility at the end of 2009 required new equipment costing $1.500.000 and is being paid for as follows: January 2010 April 2010 July 2010 October 2010 $200 000 $500 000 $450 000 $350 000 x) The cash balance on June 30, 2010 is expected to be an overdraft of $190,000 Required: (a) Prepare a schedule of budgeted cash collections for sales for each of the months July to September. (b) Prepare a schedule of expected cash disbursements for purchases for the quarter to September 30, 2010. (c) Prepare a cash budget, with a total column, for the quarter ending September 30, 2010, showing the receipts and payments for each month. (d) Given that companies in the industry in which Fuller Manufacturing operates are required to maintain a minimum cash balance of $100,000 each month, advice the management of the company as to two (2) possible steps that may be taken to satisfy this requirement. BOS_introduction to cost and Management Accounting