Question

The management accounting division of Solar Limited wants to estimate the companys monthly operating costs for the next 6 months. The following cost and other

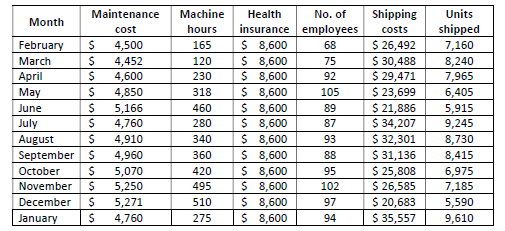

The management accounting division of Solar Limited wants to estimate the companys monthly operating costs for the next 6 months. The following cost and other data were gathered for the previous 12 months:

The maintenance cost is a mixed cost because the cost neither remains constant in total nor remains constant per unit. The health insurance cost is fixed per month because, although the number of employees change from month to month, the total cost remained constant. The shipping cost varies with the number of units shipped. Solar Ltd received a notification from its health insurance company in January. The notice from the insurance company advised that the insurance that the monthly health insurance premium will be increased by 2% commencing April 2021. Solar Ltd also received a notification from its shipping company in December. The notice from the shipping company advised that the shipping charges per shipment would increase by 3.13% from May 2021.

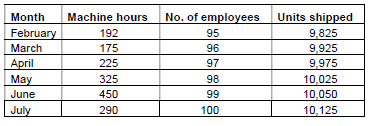

The budgeted data for Solar Limited for the next 6 months is presented below.

Required: (1) Using the highlow method, determine the fixed component of Maintenance cost and the variable component of maintenance cost per machine hour.

(2) Combine the answers from the calculation in requirement (1) with the information provided in the case study to estimate monthly maintenance, health insurance and shipping costs for Solar Limited for the period February to July 2021.

Month February March April May June July August September October November December January Maintenance cost $ 4,500 S 4,452 S 4,600 $ 4,850 $ 5,166 S 4,760 S 4,910 S 4,960 S 5,070 S 5,250 S 5,271 S 4,760 Machine hours 165 120 230 318 460 280 340 360 420 495 510 275 Health No. of insurance employees $ 8,600 68 $ 8,600 75 $ 8,600 92 $ 8,600 105 $ 8,600 89 $ 8,600 87 $ 8,600 93 $ 8,600 88 $ 8,600 95 S 8,600 102 $ 8,600 97 $ 8,600 94 Shipping costs $ 26,492 $ 30,488 $ 29,471 $ 23,699 $ 21,886 $ 34,207 $ 32,301 $ 31,136 $ 25,808 $ 26,585 $ 20,683 $ 35,557 Units shipped 7,160 8,240 7,965 6,405 5,915 9,245 8,730 8,415 6,975 7,185 5,590 9,610 Month February March April May June July Machine hours 192 175 225 325 450 290 No. of employees 95 96 97 98 99 100 Units shipped 9,825 9,925 9,975 10,025 10,050 10,125Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started