Answered step by step

Verified Expert Solution

Question

1 Approved Answer

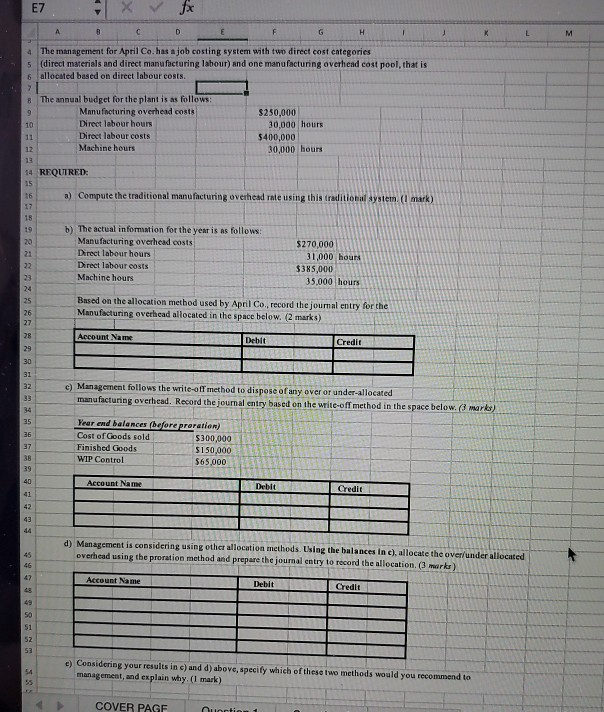

The management for April Co. has a job cesting system with two direct cost categories 5 (direct materials and direct manufacturing labour) and one manufacturing

The management for April Co. has a job cesting system with two direct cost categories 5 (direct materials and direct manufacturing labour) and one manufacturing averhead cost pool, that is 6 allocated based on direct labour costs. # The annual budget for the plant is as follows: Manufacturing overhead costs Direct labour hours Direct labour costs Machine hours $250,000 30,000 hours $400,000 30,000 hours 14 REQUIRED: a) Compute the traditional manufacturing overhead rate using this traditional systein (1 mar b) The actual information for the year is as follows: Manufacturing overhead costs Direct labour hours Direct labour costs Machine hours $270,000 31,000 hours $385,000 35,000 hours Based on the allocation method used by April Co, record the journal entry for the Manufacturing overhead allocated in the space below. (2 marks) ST Account Name D ebit Credit c) Management follows the write-off method to dispose of any over or under allocated manufacturing overhead. Record the journal entry based on the write-off method in the space below.marks) Year and balances (before praration) Cost of Goods sold $300,000 Finished Goods $150, 000 WIP Control $65.000 T Account Name Debit Credit d) Management is considering using other allocation methods. Using the balances in c), allocate the over/under allocated overhead using the proration method and prepare the journal entry to record the allocation. (3 marks Account Name D ebit Credit c) Considering your results in c) and d) above, specify which of these two methods would you recommend to management, and explain why. (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started