Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The management of Eades Logistics Corp. controls 58% of the company's stock. The firm did not meet any of its quarterly sales projections for

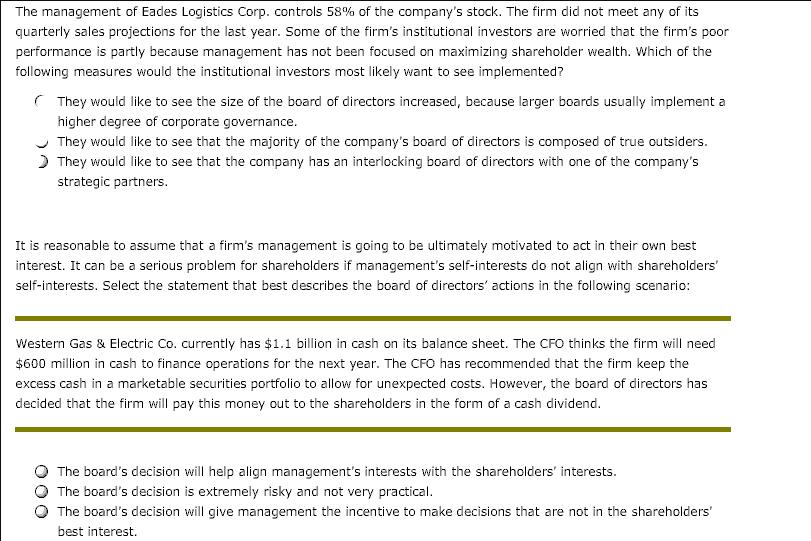

The management of Eades Logistics Corp. controls 58% of the company's stock. The firm did not meet any of its quarterly sales projections for the last year. Some of the firm's institutional investors are worried that the firm's poor performance is partly because management has not been focused on maximizing shareholder wealth. Which of the following measures would the institutional investors most likely want to see implemented? They would like to see the size of the board of directors increased, because larger boards usually implement a higher degree of corporate governance. They would like to see that the majority of the company's board of directors is composed of true outsiders. > They would like to see that the company has an interlocking board of directors with one of the company's strategic partners. It is reasonable to assume that a firm's management is going to be ultimately motivated to act in their own best interest. It can be a serious problem for shareholders if management's self-interests do not align with shareholders' self-interests. Select the statement that best describes the board of directors' actions in the following scenario: Western Gas & Electric Co. currently has $1.1 billion in cash on its balance sheet. The CFO thinks the firm will need $600 million in cash to finance operations for the next year. The CFO has recommended that the firm keep the excess cash in a marketable securities portfolio to allow for unexpected costs. However, the board of directors has decided that the firm will pay this money out to the shareholders in the form of a cash dividend. The board's decision will help align management's interests with the shareholders' interests. The board's decision is extremely risky and not very practical. The board's decision will give management the incentive to make decisions that are not in the shareholders' best interest.

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The boards decision will give managemen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started