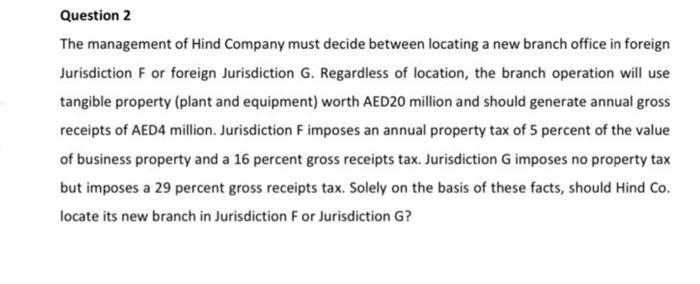

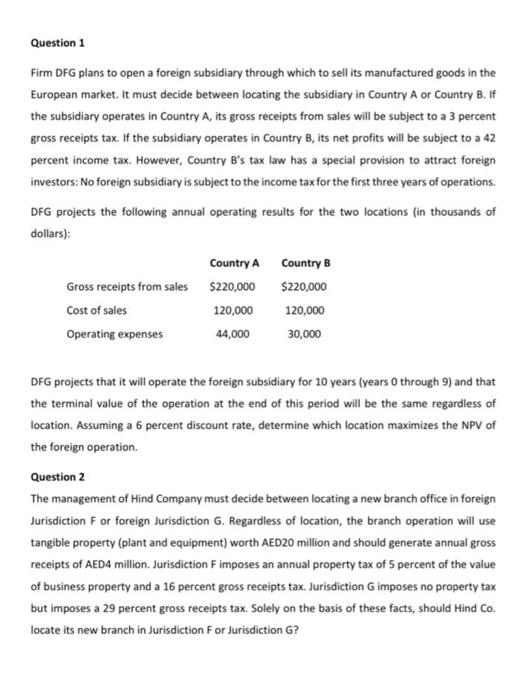

The management of Hind Company must decide between locating a new branch office in foreign Jurisdiction F or foreign Jurisdiction G. Regardless of location, the branch operation will use tangible property (plant and equipment) worth AED20 million and should generate annual gross receipts of AED4 million. Jurisdiction F imposes an annual property tax of 5 percent of the value of business property and a 16 percent gross receipts tax. Jurisdiction G imposes no property tax but imposes a 29 percent gross receipts tax. Solely on the basis of these facts, should Hind Co. locate its new branch in Jurisdiction F or Jurisdiction G? Question 1 Firm DFG plans to open a foreign subsidiary through which to sell its manufactured goods in the European market. It must decide between locating the subsidiary in Country A or Country B. If the subsidiary operates in Country A, its gross receipts from sales will be subject to a 3 percent gross receipts tax. If the subsidiary operates in Country B, its net profits will be subject to a 42 percent income tax. However, Country B's tax law has a special provision to attract foreign investors: No foreign subsidiary is subject to the income tax for the first three years of operations. DFG projects the following annual operating results for the two locations (in thousands of dollars): DFG projects that it will operate the foreign subsidiary for 10 years (years 0 through 9 ) and that the terminal value of the operation at the end of this period will be the same regardless of location. Assuming a 6 percent discount rate, determine which location maximizes the NPV of the foreign operation. Question 2 The management of Hind Company must decide between locating a new branch office in foreign Jurisdiction F or foreign Jurisdiction G. Regardless of location, the branch operation will use tangible property (plant and equipment) worth AED20 million and should generate annual gross receipts of AED4 million. Jurisdiction F imposes an annual property tax of 5 percent of the value of business property and a 16 percent gross receipts tax. Jurisdiction G imposes no property tax but imposes a 29 percent gross receipts tax. Solely on the basis of these facts, should Hind Co. locate its new branch in Jurisdiction F or Jurisdiction G