Answered step by step

Verified Expert Solution

Question

1 Approved Answer

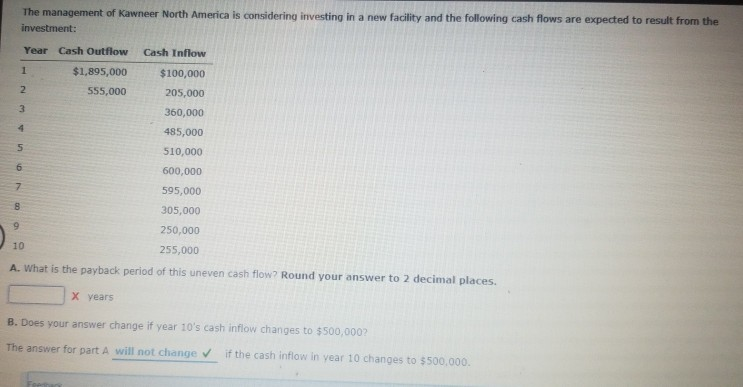

The management of Kawneer North America is considering investing in a new facility and the following cash flows are expected to result from the investment:

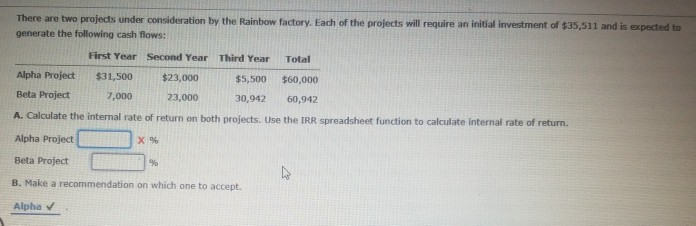

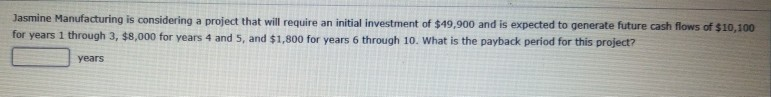

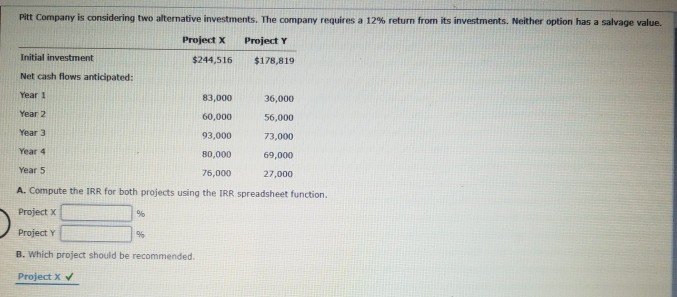

The management of Kawneer North America is considering investing in a new facility and the following cash flows are expected to result from the investment: Cash Inflow Year Cash Outflow $1,895,000 555,000 $100,000 205,000 360,000 485,000 510,000 600,000 595,000 305,000 250,000 255,000 A. What is the payback period of this uneven cash flow? Round your answer to 2 decimal places. X Years B. Does your answer change if year 10's cash inflow changes to $500,0002 The answer for part A will not change if the cash inflow in year 10 changes to $500.000 There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,511 and is expected to generate the following cash flows: First Year Second Year Third Year Total Alpha Project $31,500 $23,000 $5,500 $60,000 Beta Project 7,000 23,000 30,942 60,942 A. Calculate the internal rate of return on both projects. Use the IRR spreadsheet function to calculate internal rate of return. Alpha Project Beta Project B. Make a recommendation on which one to accept. Alpha Jasmine Manufacturing is considering a project that will require an initial investment of $49,900 and is expected to generate future cash flows of $10,100 for years 1 through 3, $8,000 for years 4 and 5, and $1,800 for years 6 through 10. What is the payback period for this project? years Pitt Company is considering two alternative investments. The company requires a 12% return from its investments. Neither option has a salvage value. Project X Project Y $244,516 $178,819 Initial investment Net cash flows anticipated: Year 1 83,000 60,000 Year 3 93,000 36,000 56,000 73,000 69,000 27,000 Year 80,000 76,000 Year 5 A. Compute the IRR for both projects using the IRR spreadsheet function. Project Project Y B. Which project should be recommended. Project X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started