Question

The management of Rundle Modems, Inc. (RMI) is uncertain as to the volume of sales that will exist in Year 1. The president of the

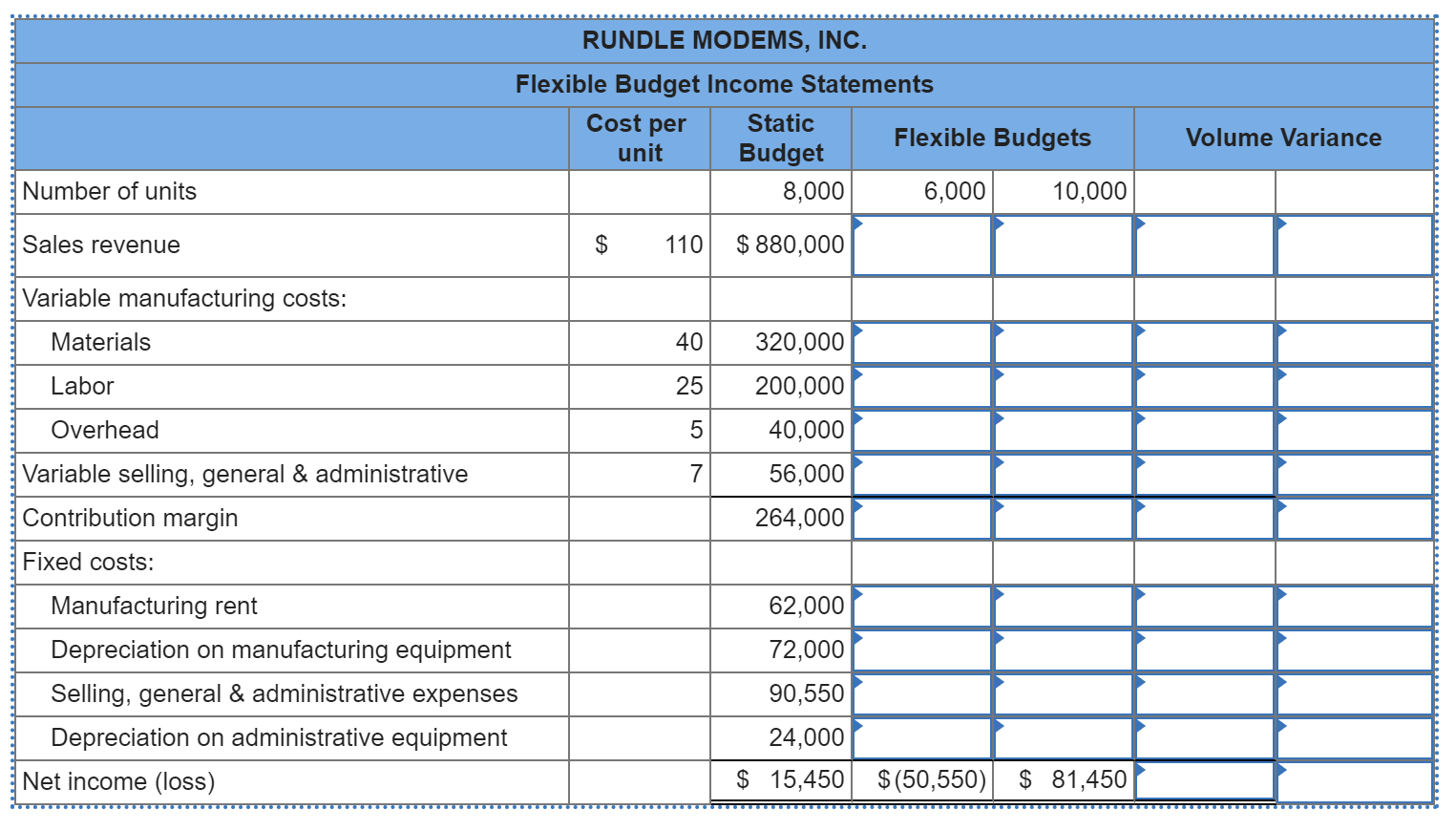

The management of Rundle Modems, Inc. (RMI) is uncertain as to the volume of sales that will exist in Year 1. The president of the company asked the chief accountant to prepare flexible budget income statements assuming that sales activity amounts to 6,000 and 10,000 units. The static budget is shown in the following form.

Required

-

Complete the following worksheet to prepare the appropriate flexible budgets.

-

Calculate and show the flexible budget variances for the static budget versus the flexible budget at 10,000 units.

-

Indicate whether each variance is favorable (F) or unfavorable (U). (Select "None" if there is no effect (i.e., zero variance).)

The management of Rundle Modems, Inc. (RMI) is uncertain as to the volume of sales that will exist in Year 1. The president of the company asked the chief accountant to prepare flexible budget income statements assuming that sales activity amounts to 6,000 and 10,000 units. The static budget is shown in the following form.

Required

-

Complete the following worksheet to prepare the appropriate flexible budgets.

-

Calculate and show the flexible budget variances for the static budget versus the flexible budget at 10,000 units.

-

Indicate whether each variance is favorable (F) or unfavorable (U). (Select "None" if there is no effect (i.e., zero variance).)

RUNDLE MODEMS, INC. Flexible Budget Income Statements Static Flexible Budgets unit Budget 8,000 6,000 10,000 Cost per Volume Variance Number of units Sales revenue $ 110 $ 880,000 Variable manufacturing costs: Materials 40 Labor 25 Overhead 5 320,000 200,000 40,000 56,000 264,000 7 Variable selling, general & administrative Contribution margin Fixed costs: 62,000 Manufacturing rent Depreciation on manufacturing equipment Selling, general & administrative expenses Depreciation on administrative equipment Net income (loss) 72,000 90,550 24,000 $ 15,450 $(50,550) $ 81,450

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started