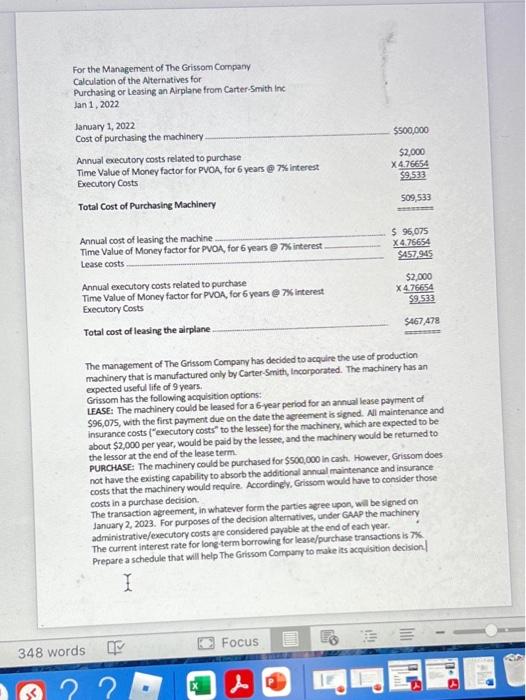

The management of The Grissom Company has decided to acquire the use of production machinery that is manufactured only by Carter-Smith, Incorporated. The machinery has an expected useful life of 9 years. Grissom has the following acquisition options: LFASE: The machinery could be leased for a 6 year period for an annual lease payment of $96,075, with the first payment due on the date the agreement is signed. Al maintenance and insurance costs ("executory costs" to the lessee) for the machinery, which are expected to be about $2,000 per year, would be paid by the lessee, and the machinery would be returned to the lessor at the end of the lease term. PURCHASE: The machinery could be purchased for $500,000 in cash., However, Grissom does not have the existing capability to absorb the additional anncal maintenance and insurance costs that the machinery would require. Accordingly. Grissom would have to consider those costs in a purchase decision. The transaction agreement, in whatever form the parties agree upon, will be signed on January 2, 2023. For purposes of the decision alternatives, under GAAP the machinery administrative/executory costs are considered papable at the end of each year. The current interest rate for long.term borrowing for lease/purchase transactions is 7 . Prepare a schedule that will help The Grissom Compary to make its acquisibion decision| The management of The Grissom Company has decided to acquire the use of production machinery that is manufactured only by Carter-Smith, Incorporated. The machinery has an expected useful life of 9 years. Grissom has the following acquisition options: LFASE: The machinery could be leased for a 6 year period for an annual lease payment of $96,075, with the first payment due on the date the agreement is signed. Al maintenance and insurance costs ("executory costs" to the lessee) for the machinery, which are expected to be about $2,000 per year, would be paid by the lessee, and the machinery would be returned to the lessor at the end of the lease term. PURCHASE: The machinery could be purchased for $500,000 in cash., However, Grissom does not have the existing capability to absorb the additional anncal maintenance and insurance costs that the machinery would require. Accordingly. Grissom would have to consider those costs in a purchase decision. The transaction agreement, in whatever form the parties agree upon, will be signed on January 2, 2023. For purposes of the decision alternatives, under GAAP the machinery administrative/executory costs are considered papable at the end of each year. The current interest rate for long.term borrowing for lease/purchase transactions is 7 . Prepare a schedule that will help The Grissom Compary to make its acquisibion decision|