Question

The management of the Rolling Hills Golf Club (RHGC) is presently considering two potential projects to upgrade its facilities, namely: 1. A major upgrade to

The management of the Rolling Hills Golf Club (RHGC) is presently considering two potential projects to upgrade its facilities, namely:

1. A major upgrade to its Information Technology system, including the necessary hardware and software for the latest point‐of‐sale system and a significantly enhanced capacity for online sales. The estimated purchase cost is $75,000, with an estimated ongoing IT support expenditure of $5,000 required each year.

2. Build an undercover driving range with state‐of‐the‐art facilities including conference facilities and function rooms, and enhanced access for a broader demographic of golfers such as the physically challenged, the elderly and the indigenous.

While the first project is smaller, more defined and can be costed with relative precision, this is not the case for the second project. As such, the Board has approached your group for assistance on the following matters.

1. Should the Club pursue the IT upgrade? It is keen to pursue the project and clearly has financial resources to do so, but does not yet have a clear sense of the costs and benefits of doing so and requires greater clarity in this regard. Assume the estimated costs indicated above are relatively accurate.

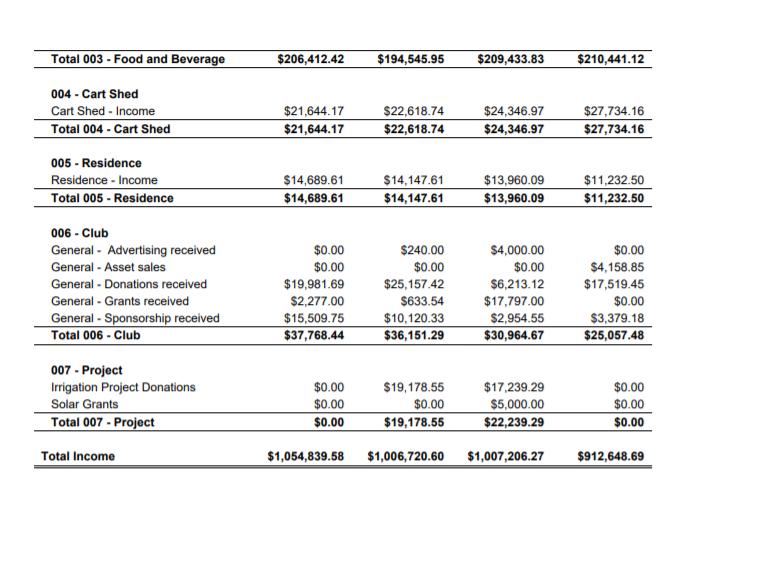

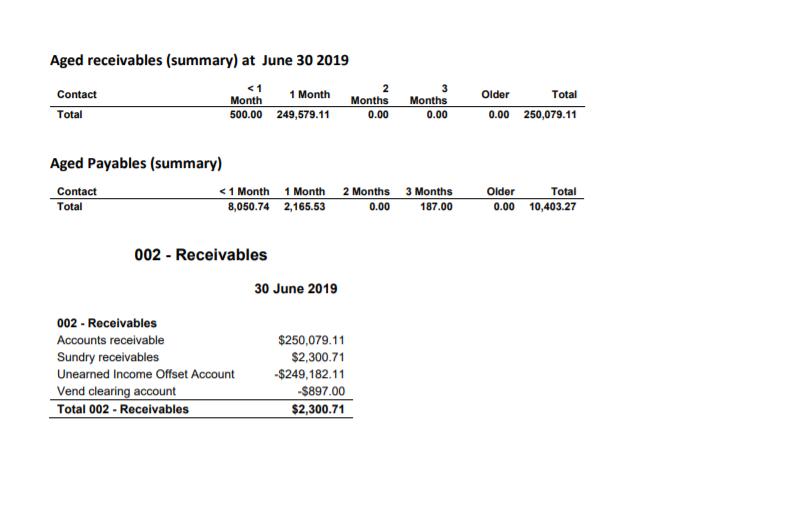

2. The Club is also keen to pursue the development of the driving range, but is uncertain as to: (i) how much it can/should spend on such a development; or (ii) how it should be financed. In providing the above advice, you should consider the costs, benefits and risks associated with each project, over both the short and medium term. In advising the club on the driving range project, your advice should be supported by a solid analysis of the Club’s financial position and recent financial performance. Your advice should also be provided based on what you believe to be the best ‘fit’ with the core values and key focus areas of the Club and should also consider any broader trends relevant to the industry. Note, in undertaking these tasks, discounted cash flow calculations are not required as we have not covered this technique in this subject.

Required:

Provide advice in the form of a business case. While you have considerable flexibility regarding the structure of the business case, your submission should include sections typically contained in such documents including: (i) Executive Summary; (ii) Background; (iii) Analysis; and (iv) Key Recommendations. In preparing your business case, where possible, support your views with reference to calculations and any other appropriate supporting evidence. If you feel that your advice is limited in any way, identify the limitations. The remainder of this document contains additional information to assist you in this task.

The mark allocation is as follows:

30%; Part 2: 60%. 10% of your result will be allocated to formatting and presentation.

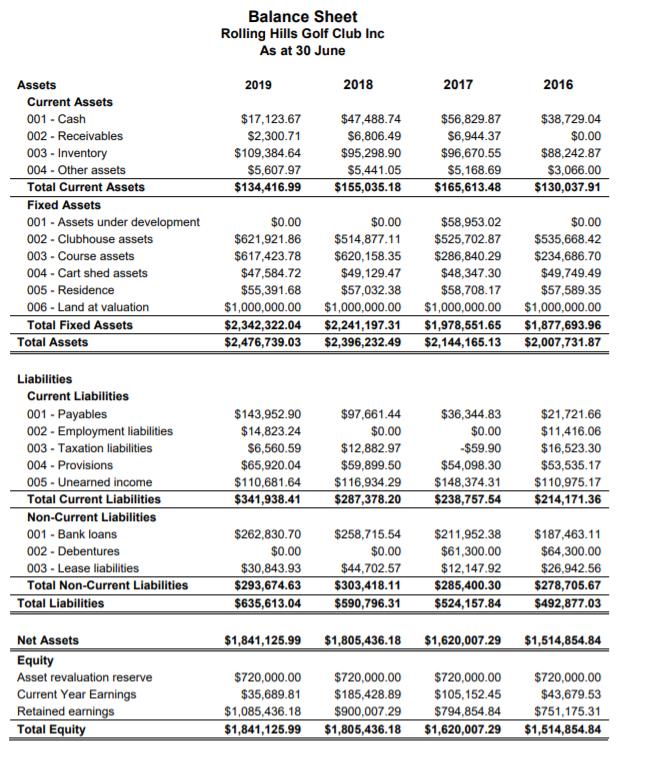

Assets Current Assets 001 - Cash 002 - Receivables 003 - Inventory 004 - Other assets Total Current Assets Fixed Assets 001- Assets under development 002 - Clubhouse assets 003 - Course assets 004 Cart shed assets 005 - Residence 006- Land at valuation Total Fixed Assets Total Assets Liabilities Current Liabilities 001 - Payables 002 - Employment liabilities 003- Taxation liabilities 004 - Provisions 005 - Unearned income Total Current Liabilities Non-Current Liabilities 001 - Bank loans 002 - Debentures 003- Lease liabilities Total Non-Current Liabilities Total Liabilities Net Assets Equity Asset revaluation reserve Current Year Earnings Retained earnings Total Equity Balance Sheet Rolling Hills Golf Club Inc As at 30 June 2019 2018 $17,123.67 $47,488.74 $2,300.71 $6,806.49 $109,384.64 $95,298.90 $5,607.97 $5,441.05 $134,416.99 $155,035.18 $143,952.90 $14,823.24 $6,560.59 $65,920.04 $110,681.64 $341,938.41 $0.00 $0.00 $621,921.86 $514,877.11 $617,423.78 $620,158.35 $286,840.29 $47,584.72 $55,391.68 $49,129.47 $57,032.38 2017 $56,829.87 $6,944.37 $96,670.55 $5,168.69 $165,613.48 $262,830.70 $0.00 $0.00 $30,843.93 $44,702.57 $293,674.63 $303,418.11 $635,613.04 $590,796.31 $58,953.02 $525,702.87 $1,841,125.99 $1,805,436.18 $48,347.30 $58,708.17 $97,661.44 $0.00 $12,882.97 $59,899.50 $54,098.30 $116,934.29 $148,374.31 $287,378.20 $238,757.54 $1,000,000.00 $1,000,000.00 $1,000,000.00 $1,000,000.00 $2,342,322.04 $2,241,197.31 $1,978,551.65 $1,877,693.96 $2,476,739.03 $2,396,232.49 $2,144,165.13 $2,007,731.87 $36,344.83 $0.00 -$59.90 $258,715.54 $211,952.38 $61,300.00 $12,147.92 $285,400.30 $524,157.84 2016 $38,729.04 $0.00 $88,242.87 $3,066.00 $130,037.91 $0.00 $535,668.42 $234,686.70 $49,749.49 $57,589.35 $21,721.66 $11,416.06 $16,523.30 $53,535.17 $110,975.17 $214,171.36 $187,463.11 $64,300.00 $26,942.56 $278,705.67 $492,877.03 $1,620,007.29 $1,514,854.84 $720,000.00 $720,000.00 $720,000.00 $35,689.81 $185,428.89 $105,152.45 $1,085,436.18 $900,007.29 $794,854.84 $1,841,125.99 $1,805,436.18 $1,620,007.29 $1,514,854.84 $720,000.00 $43,679.53 $751,175.31 Assets Current Assets 001 - Cash 002 - Receivables 003 - Inventory 004 - Other assets Total Current Assets Fixed Assets 001- Assets under development 002 - Clubhouse assets 003 - Course assets 004 Cart shed assets 005 - Residence 006- Land at valuation Total Fixed Assets Total Assets Liabilities Current Liabilities 001 - Payables 002 - Employment liabilities 003- Taxation liabilities 004 - Provisions 005 - Unearned income Total Current Liabilities Non-Current Liabilities 001 - Bank loans 002 - Debentures 003- Lease liabilities Total Non-Current Liabilities Total Liabilities Net Assets Equity Asset revaluation reserve Current Year Earnings Retained earnings Total Equity Balance Sheet Rolling Hills Golf Club Inc As at 30 June 2019 2018 $17,123.67 $47,488.74 $2,300.71 $6,806.49 $109,384.64 $95,298.90 $5,607.97 $5,441.05 $134,416.99 $155,035.18 $143,952.90 $14,823.24 $6,560.59 $65,920.04 $110,681.64 $341,938.41 $0.00 $0.00 $621,921.86 $514,877.11 $617,423.78 $620,158.35 $286,840.29 $47,584.72 $55,391.68 $49,129.47 $57,032.38 2017 $56,829.87 $6,944.37 $96,670.55 $5,168.69 $165,613.48 $262,830.70 $0.00 $0.00 $30,843.93 $44,702.57 $293,674.63 $303,418.11 $635,613.04 $590,796.31 $58,953.02 $525,702.87 $1,841,125.99 $1,805,436.18 $48,347.30 $58,708.17 $97,661.44 $0.00 $12,882.97 $59,899.50 $54,098.30 $116,934.29 $148,374.31 $287,378.20 $238,757.54 $1,000,000.00 $1,000,000.00 $1,000,000.00 $1,000,000.00 $2,342,322.04 $2,241,197.31 $1,978,551.65 $1,877,693.96 $2,476,739.03 $2,396,232.49 $2,144,165.13 $2,007,731.87 $36,344.83 $0.00 -$59.90 $258,715.54 $211,952.38 $61,300.00 $12,147.92 $285,400.30 $524,157.84 2016 $38,729.04 $0.00 $88,242.87 $3,066.00 $130,037.91 $0.00 $535,668.42 $234,686.70 $49,749.49 $57,589.35 $21,721.66 $11,416.06 $16,523.30 $53,535.17 $110,975.17 $214,171.36 $187,463.11 $64,300.00 $26,942.56 $278,705.67 $492,877.03 $1,620,007.29 $1,514,854.84 $720,000.00 $720,000.00 $720,000.00 $35,689.81 $185,428.89 $105,152.45 $1,085,436.18 $900,007.29 $794,854.84 $1,841,125.99 $1,805,436.18 $1,620,007.29 $1,514,854.84 $720,000.00 $43,679.53 $751,175.31 Assets Current Assets 001 - Cash 002 - Receivables 003 - Inventory 004 - Other assets Total Current Assets Fixed Assets 001- Assets under development 002 - Clubhouse assets 003 - Course assets 004 Cart shed assets 005 - Residence 006- Land at valuation Total Fixed Assets Total Assets Liabilities Current Liabilities 001 - Payables 002 - Employment liabilities 003- Taxation liabilities 004 - Provisions 005 - Unearned income Total Current Liabilities Non-Current Liabilities 001 - Bank loans 002 - Debentures 003- Lease liabilities Total Non-Current Liabilities Total Liabilities Net Assets Equity Asset revaluation reserve Current Year Earnings Retained earnings Total Equity Balance Sheet Rolling Hills Golf Club Inc As at 30 June 2019 2018 $17,123.67 $47,488.74 $2,300.71 $6,806.49 $109,384.64 $95,298.90 $5,607.97 $5,441.05 $134,416.99 $155,035.18 $143,952.90 $14,823.24 $6,560.59 $65,920.04 $110,681.64 $341,938.41 $0.00 $0.00 $621,921.86 $514,877.11 $617,423.78 $620,158.35 $286,840.29 $47,584.72 $55,391.68 $49,129.47 $57,032.38 2017 $56,829.87 $6,944.37 $96,670.55 $5,168.69 $165,613.48 $262,830.70 $0.00 $0.00 $30,843.93 $44,702.57 $293,674.63 $303,418.11 $635,613.04 $590,796.31 $58,953.02 $525,702.87 $1,841,125.99 $1,805,436.18 $48,347.30 $58,708.17 $97,661.44 $0.00 $12,882.97 $59,899.50 $54,098.30 $116,934.29 $148,374.31 $287,378.20 $238,757.54 $1,000,000.00 $1,000,000.00 $1,000,000.00 $1,000,000.00 $2,342,322.04 $2,241,197.31 $1,978,551.65 $1,877,693.96 $2,476,739.03 $2,396,232.49 $2,144,165.13 $2,007,731.87 $36,344.83 $0.00 -$59.90 $258,715.54 $211,952.38 $61,300.00 $12,147.92 $285,400.30 $524,157.84 2016 $38,729.04 $0.00 $88,242.87 $3,066.00 $130,037.91 $0.00 $535,668.42 $234,686.70 $49,749.49 $57,589.35 $21,721.66 $11,416.06 $16,523.30 $53,535.17 $110,975.17 $214,171.36 $187,463.11 $64,300.00 $26,942.56 $278,705.67 $492,877.03 $1,620,007.29 $1,514,854.84 $720,000.00 $720,000.00 $720,000.00 $35,689.81 $185,428.89 $105,152.45 $1,085,436.18 $900,007.29 $794,854.84 $1,841,125.99 $1,805,436.18 $1,620,007.29 $1,514,854.84 $720,000.00 $43,679.53 $751,175.31

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

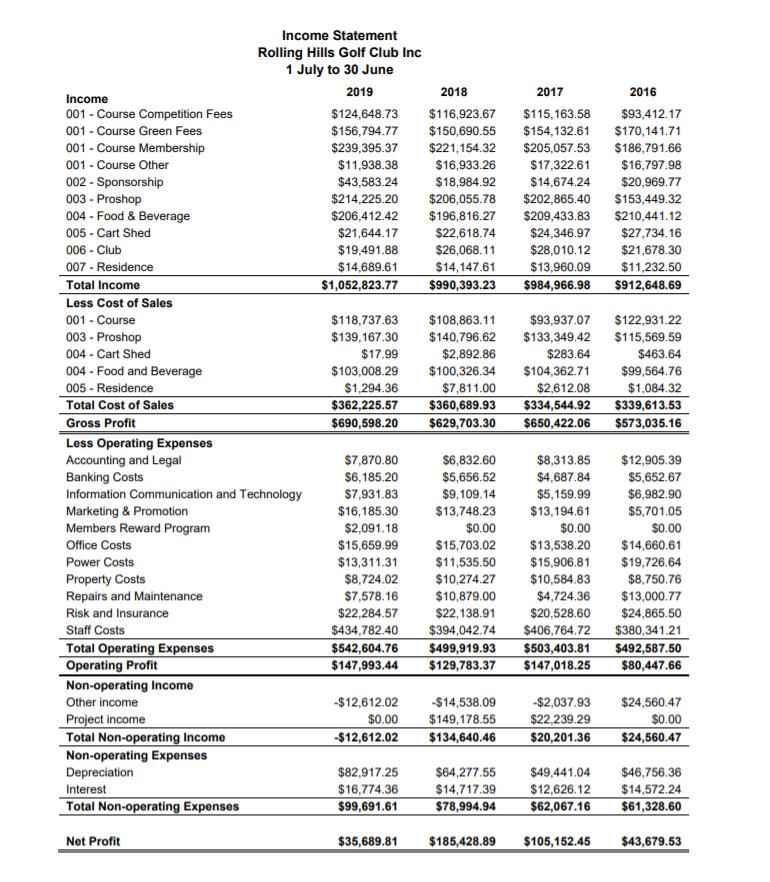

Executive Summary This business case provides advice to the Rolling Hills Golf Club RHGC on two potential projects to upgrade its facilities namely an ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started