Question

The management team at Taylor, Inc. is working on the companys 2019 pro-forma balance sheet and income statement, and wishes to find out the amount

The management team at Taylor, Inc. is working on the companys 2019 pro-forma balance sheet and income statement, and wishes to find out the amount of additional external funds it will need in 2019, based on the following assumptions:

- Sales are expected to double in 2019.

- The company is operating at full capacity.

- All operating assets (cash included) and spontaneous liabilities are expected to remain at their same proportion of sales as in 2018. Misc. assets (which are non-operating assets) will remain unchanged at $7,500.

- Cost of Goods Sold and Operating Expenses are also expected to remain equal in proportion of sales.

- Management expects Interest rates to fall in 2019 so that interest expenses will remain constant as a percentage of sales, even if the level of bank debt increases in 2019. In addition, assume that interest rates are the same for short-term and long- term debt.

- The companys tax rate is 40% and the firm does not pay dividends.

-

What are the Additional Funds Needed (AFN) for the year 2019, using both the AFN formula and a pro-forma balance sheet using the pct. of sales method? Both methods should give you the same result.

-

Now assume that, in 2019, while doubling its level of sales, the company wishes to improve its Days Payable to a more acceptable level of 60 days. What will then be the level of AFN?

-

In addition to reducing its Days Payable, the firm also wants to bring its Debt/Equity ratio as close as possible to, but not to exceed 2/1, and its current ratio as close as possible to, but not to fall below 2/1. How would this newly calculated level of AFN (from Question 2) be allocated among additional sources of funds, i.e., notes payable (N/P), long-term debt, and/or newly issued common stock?

Assume that additional long-term debt and common stock can only be obtained in multiples of $50,000 (i.e., $50,000, $100,000, $250,000, etc., and not $75,000 or $125,000, etc.) Additional Notes Payable can be obtained in any amount.

4. Prepare your pro-forma Income Statement and Balance Sheet accordingly. For your ratios, assume a 365 day and use the following formulas: = /

()

=

Note: The term Debt includes all forms of liabilities, not just bank debt.

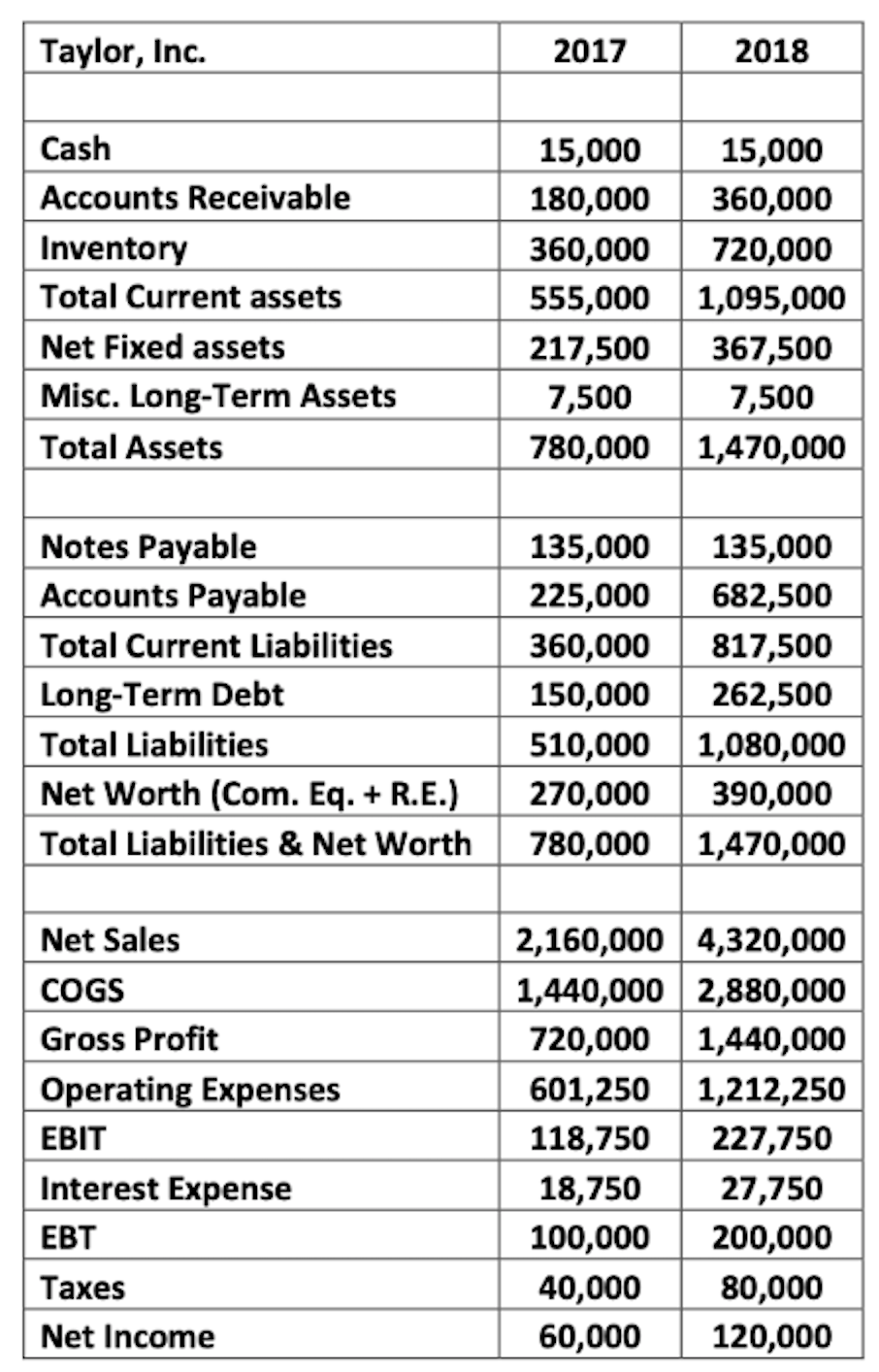

Please find below Taylor, Inc.s financial statements for the past two years:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started