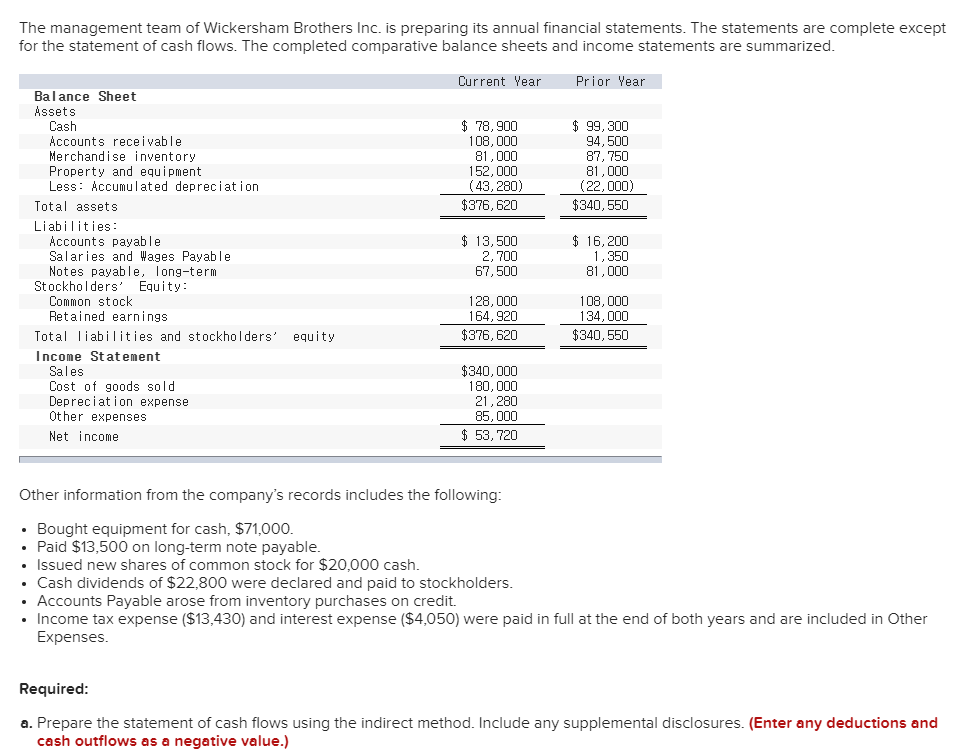

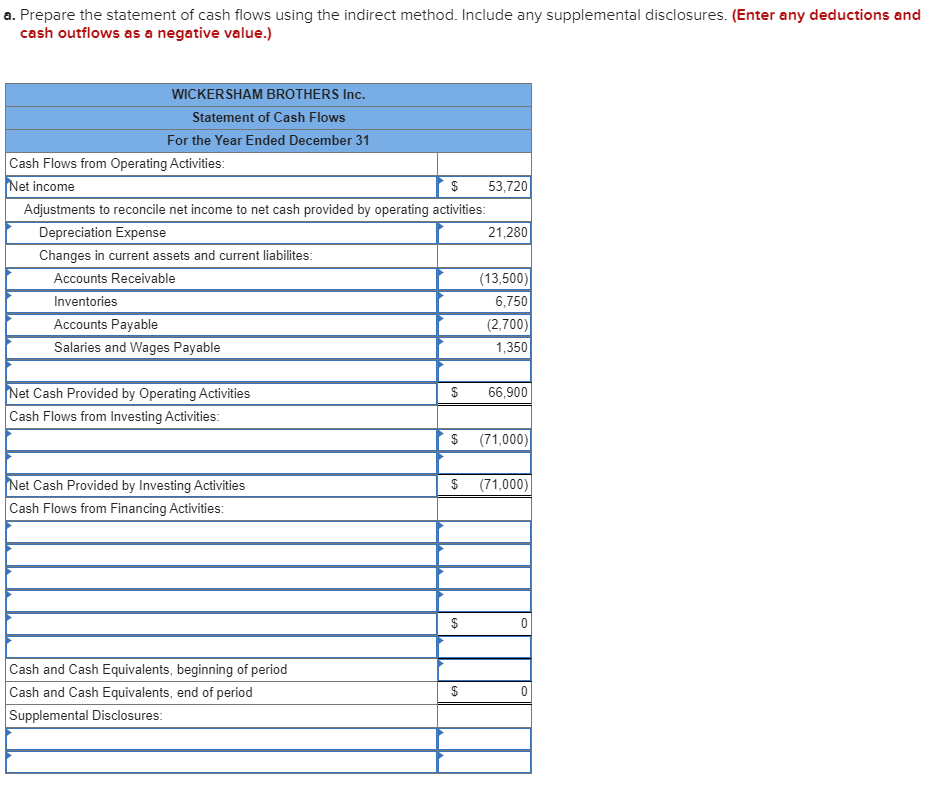

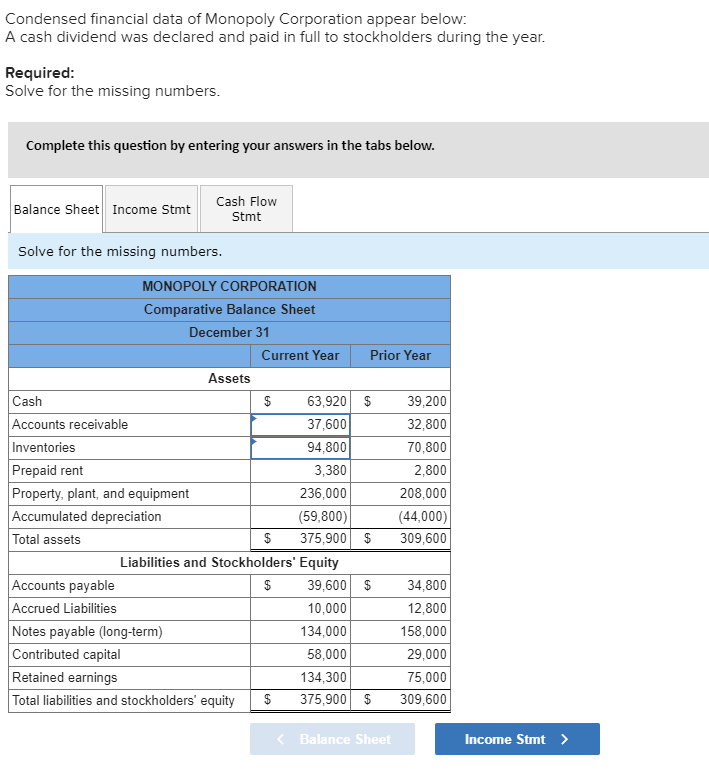

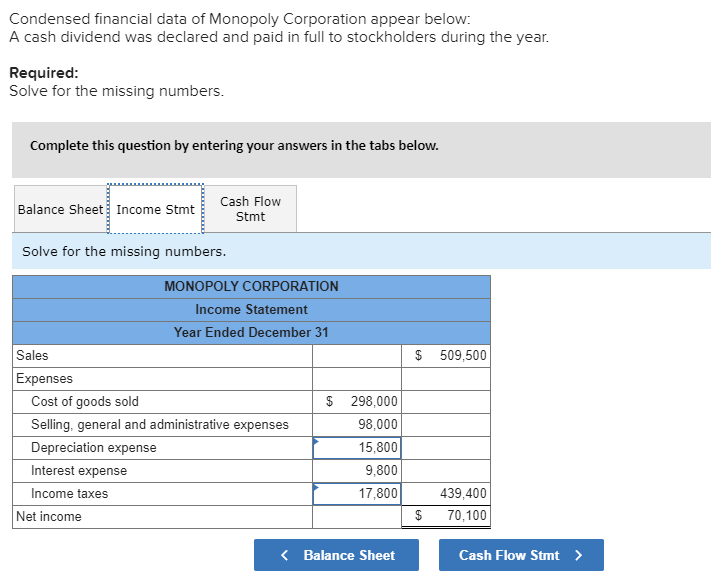

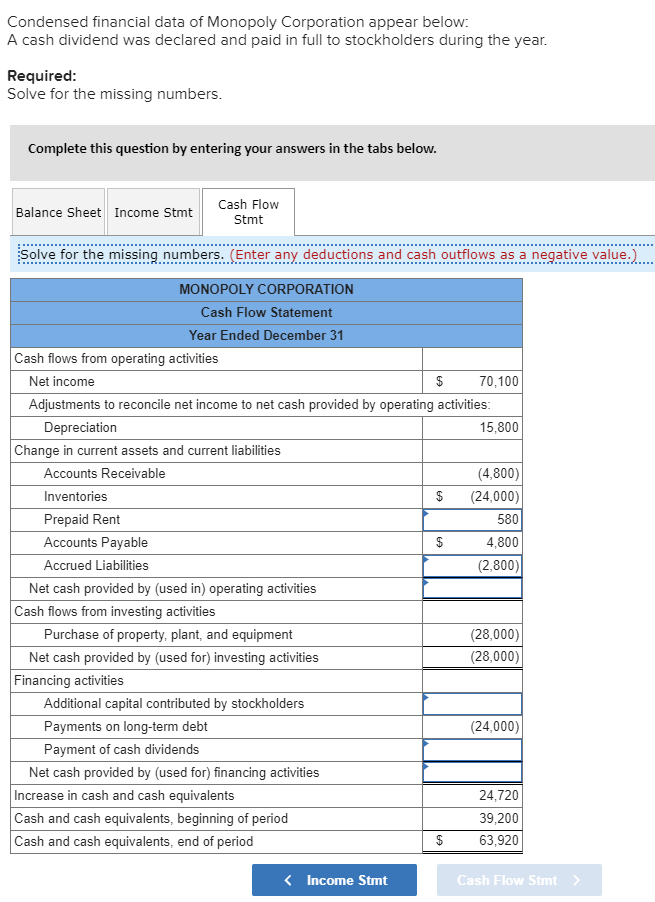

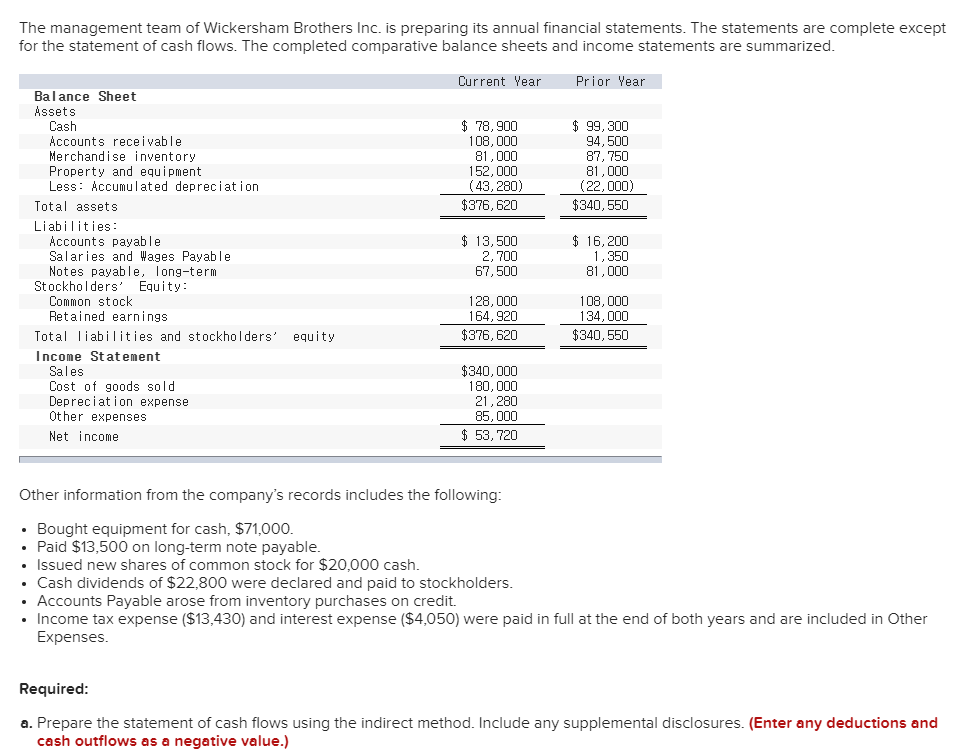

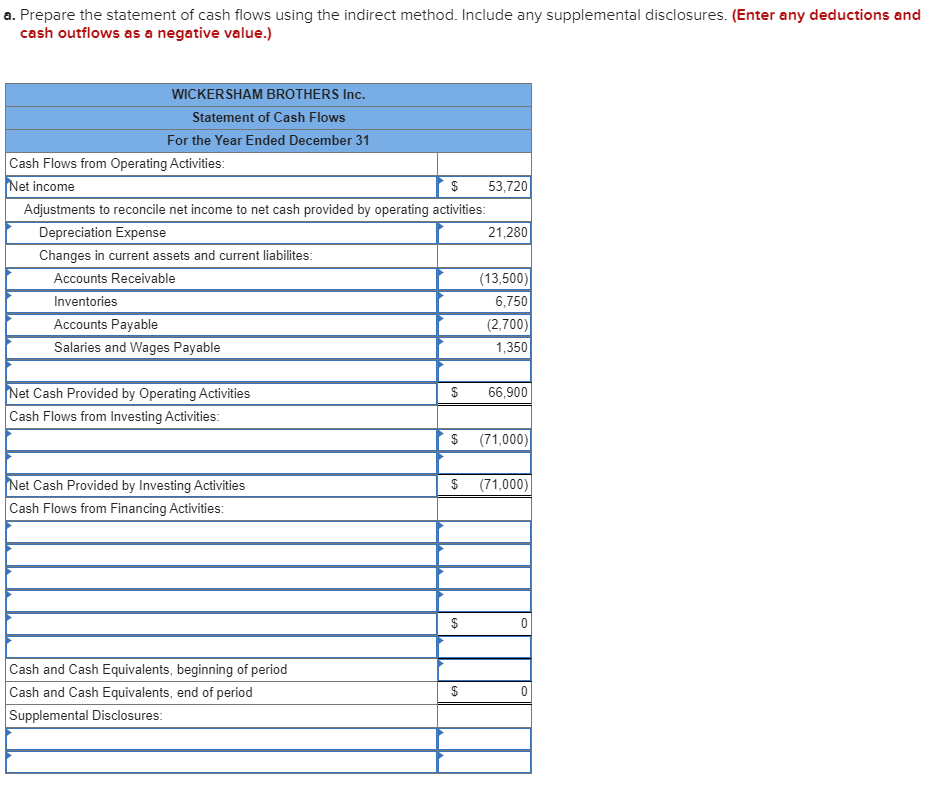

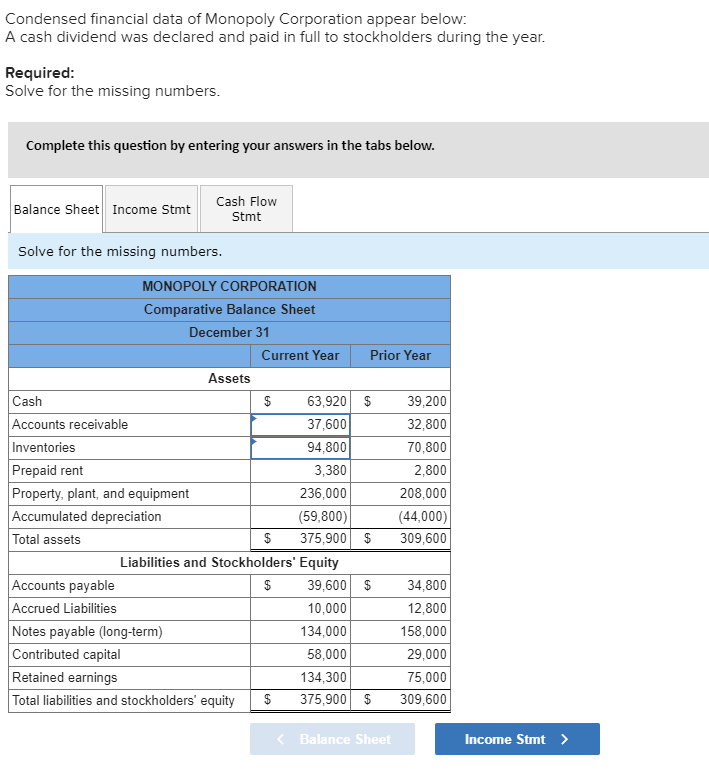

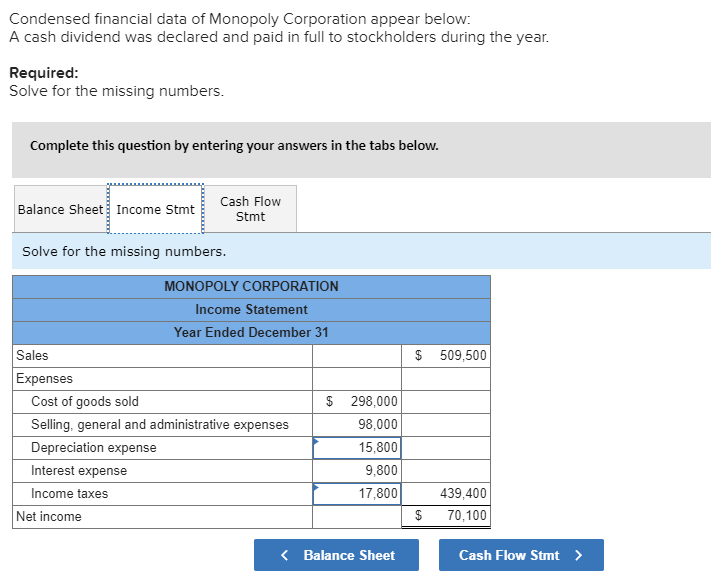

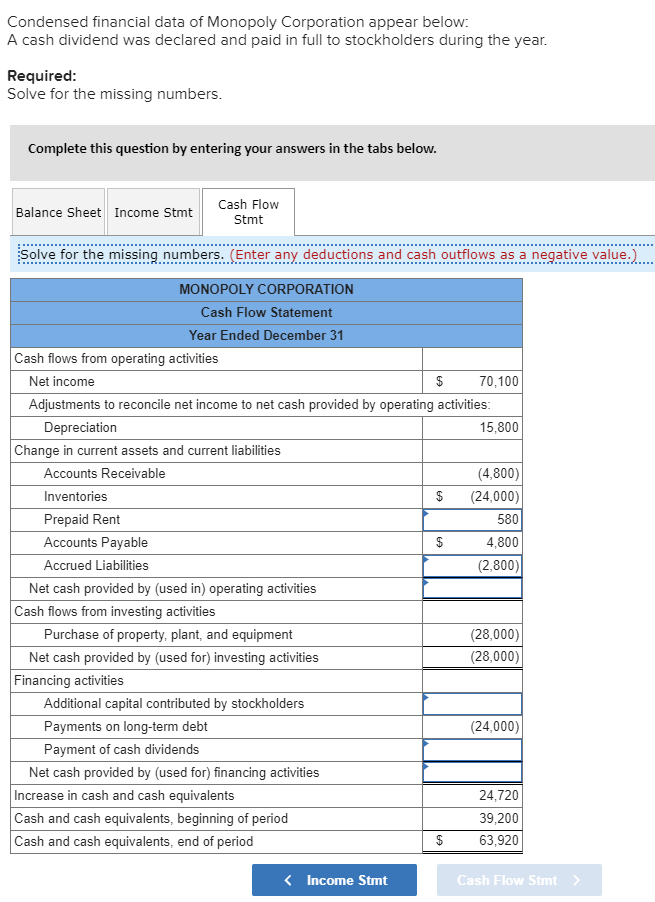

The management team of Wickersham Brothers Inc. is preparing its annual financial statements. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income statements are summarized. Current Year Prior Year $ 78,900 108,000 81,000 152,000 (43,280) $376,620 $ 99, 300 94,500 87.750 81,000 (22,000) $340,550 Balance Sheet Assets Cash Accounts receivable Merchandise inventory Property and equipment Less: Accumulated depreciation Total assets Liabilities: Accounts payable Salaries and Wages Payable Notes payable, long-term Stockholders' Equity: Common stock Retained earnings Total liabilities and stockholders' Income Statement Sales Cost of goods sold Depreciation expense Other expenses Net income $ 13,500 2,700 67,500 $ 16,200 1.350 81,000 128,000 164,920 $376,620 108,000 134,000 $340,550 equity $340,000 180,000 21,280 85,000 $ 53, 720 Other information from the company's records includes the following: Bought equipment for cash, $71,000. Paid $13,500 on long-term note payable. Issued new shares of common stock for $20,000 cash. Cash dividends of $22,800 were declared and paid to stockholders Accounts Payable arose from inventory purchases on credit. Income tax expense ($13,430) and interest expense ($4,050) were paid in full at the end of both years and are included in Other Expenses. Required: a. Prepare the statement of cash flows using the indirect method. Include any supplemental disclosures. (Enter any deductions and cash outflows as a negative value.) a. Prepare the statement of cash flows using the indirect method. Include any supplemental disclosures. (Enter any deductions and cash outflows as a negative value.) WICKERSHAM BROTHERS Inc. Statement of Cash Flows For the Year Ended December 31 Cash Flows from Operating Activities: Net income $ 53,720 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation Expense 21,280 Changes in current assets and current liabilites: Accounts Receivable (13,500) Inventories 6,750 Accounts Payable (2,700) Salaries and Wages Payable 1,350 $ 66,900 Net Cash Provided by Operating Activities Cash Flows from Investing Activities: | $ (71,000) $ (71,000) Net Cash Provided by Investing Activities Cash Flows from Financing Activities: Cash and Cash Equivalents, beginning of period Cash and Cash Equivalents, end of period Supplemental Disclosures: Condensed financial data of Monopoly Corporation appear below: A cash dividend was declared and paid in full to stockholders during the year. Required: Solve for the missing numbers. Complete this question by entering your answers in the tabs below. Balance Sheet Income Stmt Cash Flow Stmt Solve for the missing numbers. Prior Year Cash $ MONOPOLY CORPORATION Comparative Balance Sheet December 31 Current Year Assets $ 63,920 Accounts receivable 37,600 Inventories 94,800 Prepaid rent 3,380 Property, plant, and equipment 236,000 Accumulated depreciation (59,800) Total assets $ 375,900 Liabilities and Stockholders' Equity Accounts payable $ 39,600 Accrued Liabilities 10,000 Notes payable (long-term) 134,000 Contributed capital 58,000 Retained earnings 134,300 Total liabilities and stockholders' equity | $ 375,900 39,200 32,800 70,800 2,800 208,000 (44,000) 309,600 $ $ 34,800 12,800 158,000 29,000 75,000 309,600 $ Condensed financial data of Monopoly Corporation appear below: A cash dividend was declared and paid in full to stockholders during the year. Required: Solve for the missing numbers. Complete this question by entering your answers in the tabs below. Balance Sheet Income Stmt Cash Flow Stmt Solve for the missing numbers. $ 509,500 MONOPOLY CORPORATION Income Statement Year Ended December 31 Sales Expenses Cost of goods sold $ Selling, general and administrative expenses Depreciation expense Interest expense Income taxes Net income 298,000 98,000 15,800 9,800 17,800 439,400 70,100 $ Condensed financial data of Monopoly Corporation appear below: A cash dividend was declared and paid in full to stockholders during the year. Required: Solve for the missing numbers. Complete this question by entering your answers in the tabs below. Balance Sheet Income Stmt Cash Flow Stmt Solve for the missing numbers. (Enter any deductions and cash outflows as a negative value.).... MONOPOLY CORPORATION Cash Flow Statement Year Ended December 31 Cash flows from operating activities Net income $ 70,100 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation 15,800 Change in current assets and current liabilities Accounts Receivable (4,800) Inventories $ (24,000) Prepaid Rent 580 Accounts Payable 4,800 Accrued Liabilities (2,800) Net cash provided by (used in) operating activities Cash flows from investing activities Purchase of property, plant, and equipment (28,000) Net cash provided by (used for) investing activities (28,000) Financing activities Additional capital contributed by stockholders Payments on long-term debt (24,000) Payment of cash dividends Net cash provided by used for) financing activities Increase in cash and cash equivalents 24,720 Cash and cash equivalents, beginning of period 39,200 Cash and cash equivalents, end of period $ 63,920